Not only if the world of finance seems to be entangled with complex terms and pitfalls, but also if you are just looking for a really suitable option for a current account, credit card or perhaps pension savings, they are here banks.cz. The scope of their offer, which includes practically all domestic financial institutions, is one of the largest in our country, and in combination with above-standard clear processing, they can represent an ideal signpost that will help you on your way to obtaining the necessary information or solving a specific matter, such as concluding a favorable mandatory guarantee, establishment of building savings or savings account and much more.

On the portal, it is possible to browse the continuously expanded dictionary of useful terms with more than 770 entries in alphabetical order, contact the online advice center with a question or view the answers to already answered questions. The website also includes a number of thematically classified articles prepared by experienced editors and experts, dealing with current events in the world of finance and banking products, for example the differences between home and property insurance, foreign exchange accounts or whether investing in bitcoin is worthwhile.

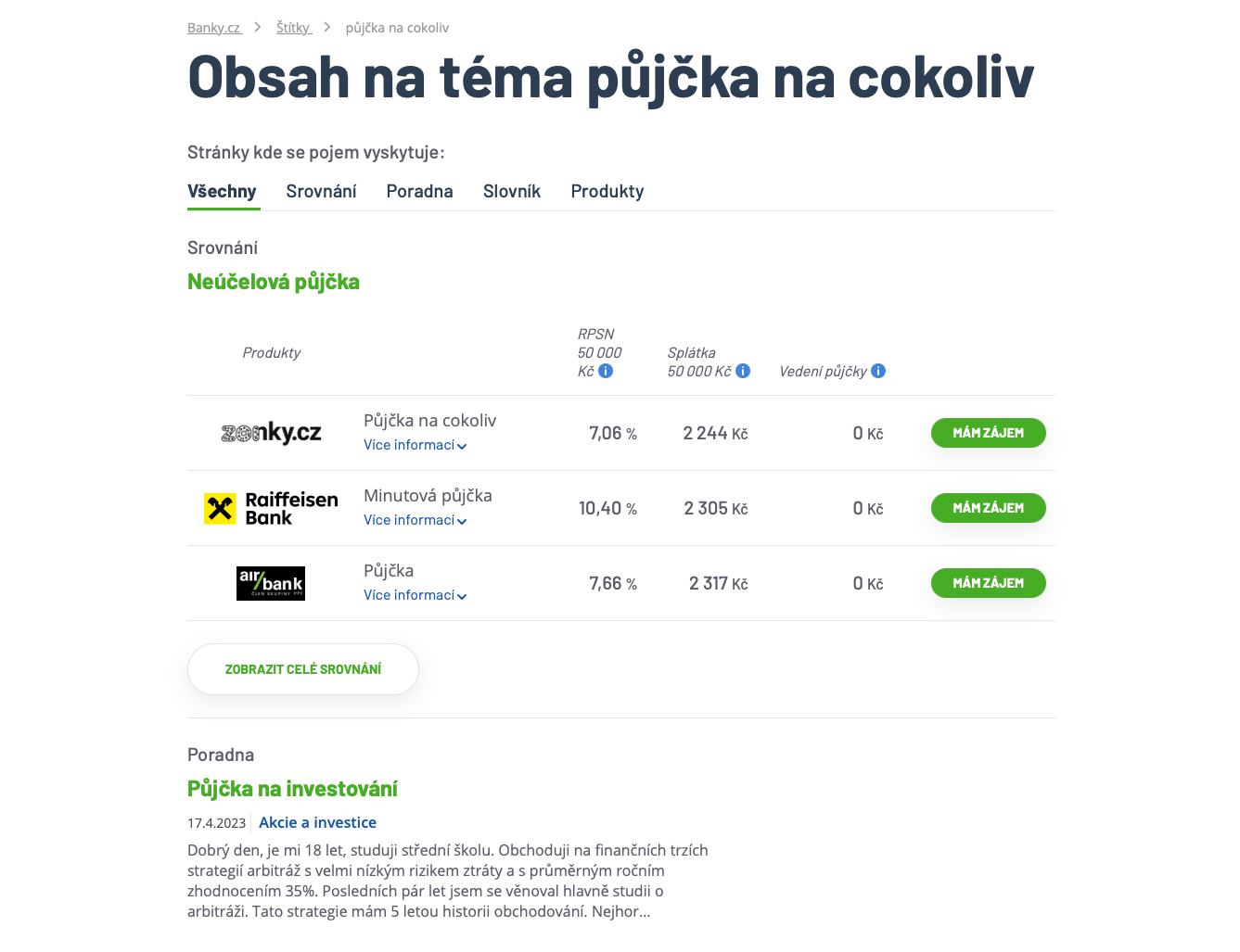

There is also a lot of advice and instructions for solving specific situations. In addition to access through the excellently structured menu, you can also use the search function, the results of which can be further sorted according to the type of query by selecting posts, individual comparisons, selected products or queries for advice. Therefore, if we enter the query "loan for anything", a preview of the comparison of non-purpose loans, a few selected questions of the advice center and the products themselves will immediately be displayed. So finding the content you want is very straightforward and simple.

Let's take a closer look at the individual sections and thus reveal the breadth of banka.cz's scope and what can be solved through them.

Mortgages

Regardless of whether we consider the acquisition of real estate as the realization of a dream home or a lucrative investment, it is no small matter, and when implementing such a plan, it is worth paying attention to details and avoiding potential pitfalls.

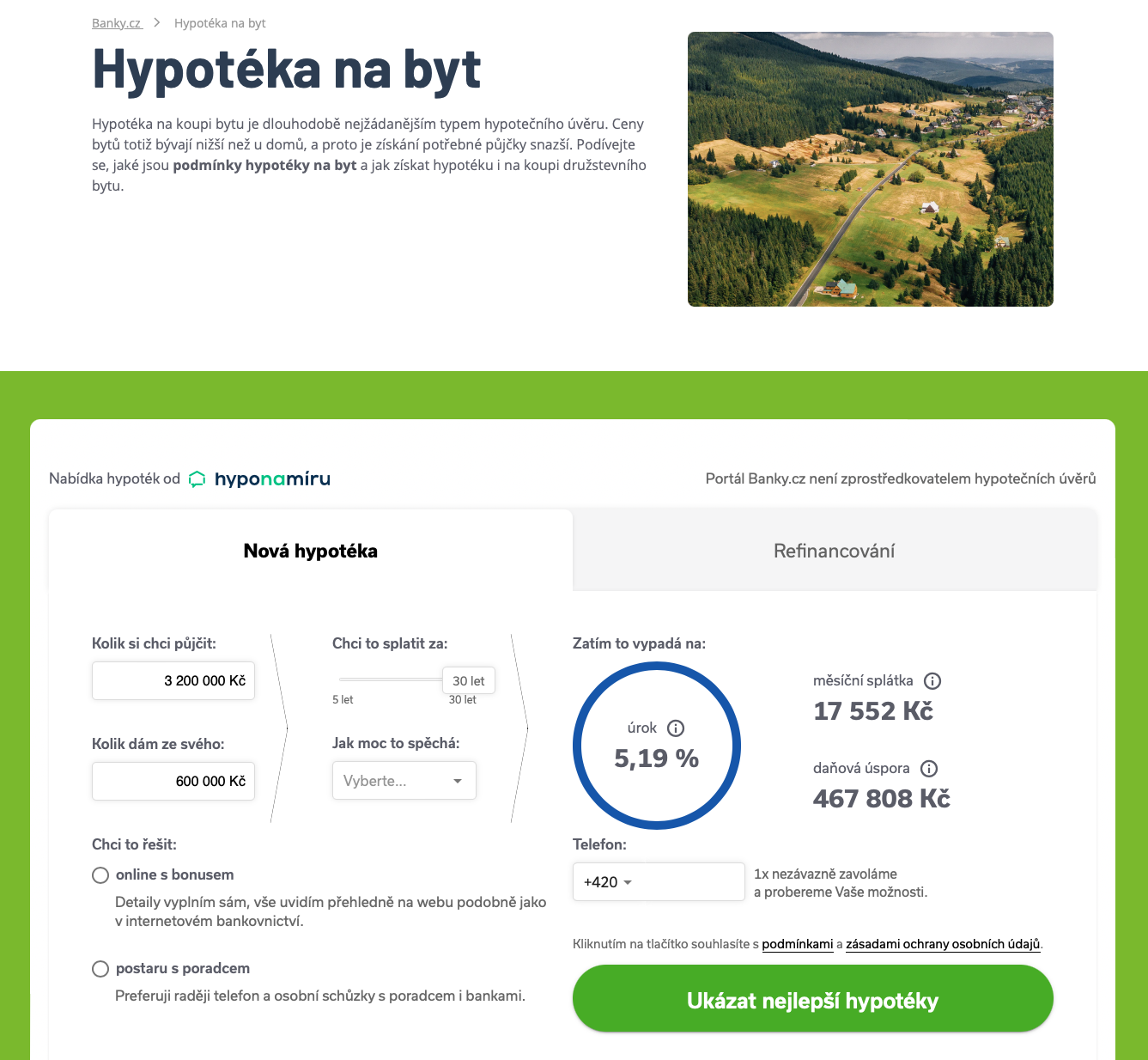

Banky.cz definitely has a lot to offer in this regard, and they cover the area of mortgage loans in detail. With this first item, various types of mortgages open up before us, including land, apartment, cottage, house construction, reconstruction or American mortgages. For this issue, the portal provides the services of a mortgage advisor, who can be contacted and with his help move the whole process forward, then a calculator, comparison and also mentions the updated conditions for obtaining a mortgage in 2023, all of which is supplemented with several useful terms and suggestions for related articles website.

At the beginning of any of the types, we come across a brief description followed by the mentioned calculator, in which it is possible to set the amount of the loan, the repayment period and the time horizon in which the person wants to implement his plans. The site does not neglect some risk factors such as easement, location in a flood zone and the like, which are good to focus on. At the same time, it connects the offer of individual mortgage variants to each other, compares relatives and thus increases the breadth of choice. In the case of a mortgage per apartment that is, information on a mortgage loan for a privately owned, cooperative or municipal apartment in a development project is connected to each other, along with an investment mortgage for an apartment for rent.

It is also worth noting the unique option of loan mediation in the form of online mortgage banking, which saves you the often lengthy visits to branches. As part of this service, users can monitor developments in the field of mortgages, thanks to which, if suitable conditions arise, the eventuality of refinancing can also become relevant.

The page closes with a list of the most frequently asked questions as well as links to related articles on the site, which is a very practical model that we encounter with basically all products.

Insurance

The purpose of insurance is to protect the policyholder for specific situations that he may encounter. While liability insurance and accident insurance are among the more widespread, another spectrum of risks is often neglected, even though their effects can be of fundamental importance. Banky.cz covers practically all possibilities, when in addition to the mentioned it offers travel and life insurance, insurance, property, household, liability or animals. At the same time, in the selection we find some important related terms such as bonus, loss event or policyholder, under which a preview with tips on useful articles related to the topic is displayed.

At the beginning of each of the pages dealing with insurance, the basic facts are stated - what the insurance is for and what it covers, which are accompanied by calculators and contact forms. Thanks to them, you can quickly get a free and non-binding overview of the most advantageous offers.

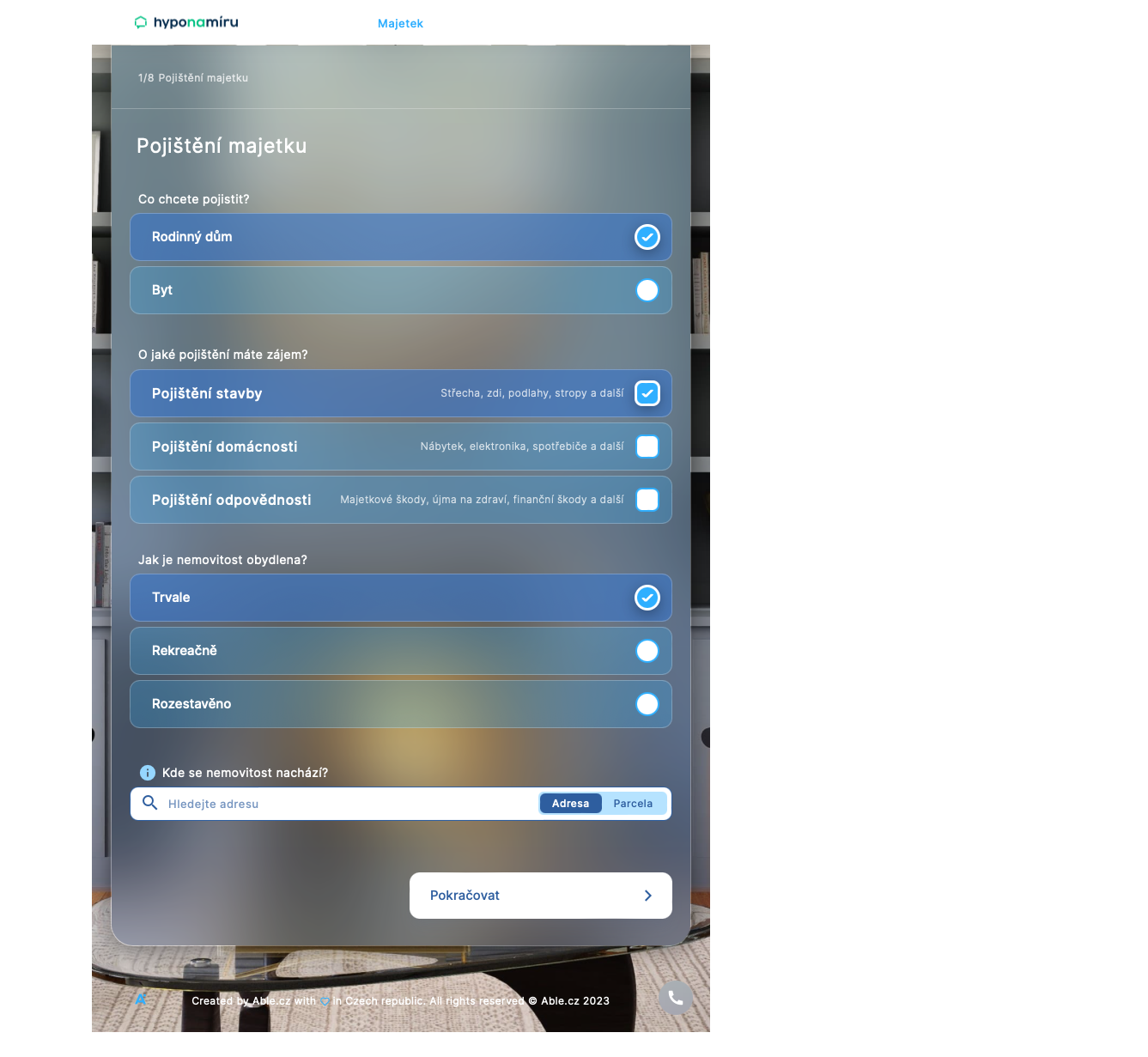

If we take real estate insurance as an example, the portal first sets the record straight about what it actually covers and draws attention to the frequent confusion with household insurance. Based on this information, the calculator in a few steps provides a choice of key data for comparison, where you need to enter, for example: whether it is an apartment or a family house, if the property is inhabited permanently, for recreation or is under construction, and also indicate the predominant material of the construction buildings, number of floors and several others. It is also possible to choose your own amount for which we want to insure the building, but based on the entered data, the calculator provides appropriate recommendations. Banky.cz then explains in more detail what damage property insurance covers, why you should be careful about undervaluing insurance, and at the same time advises how to get the most suitable option, what not to forget or how to take out insurance from the comfort of your home. In conclusion, the site sticks to the scheme when it prompts to look through the most frequently asked questions and complements it with a selection of articles.

Loans

Scenarios where funds are needed relatively quickly do not have to be limited to a washing machine, refrigerator, boiler or car that have unexpectedly reached the end of their life, it can be a planned purchase of furniture or even renovation of an apartment. For these and similar cases, it is enough to let the portal guide you to a loan that will be the ideal alternative and will correspond to our ideas. Loan models for 100, 150, 200 and 500 thousand are available, as well as non-purpose and purpose loans.

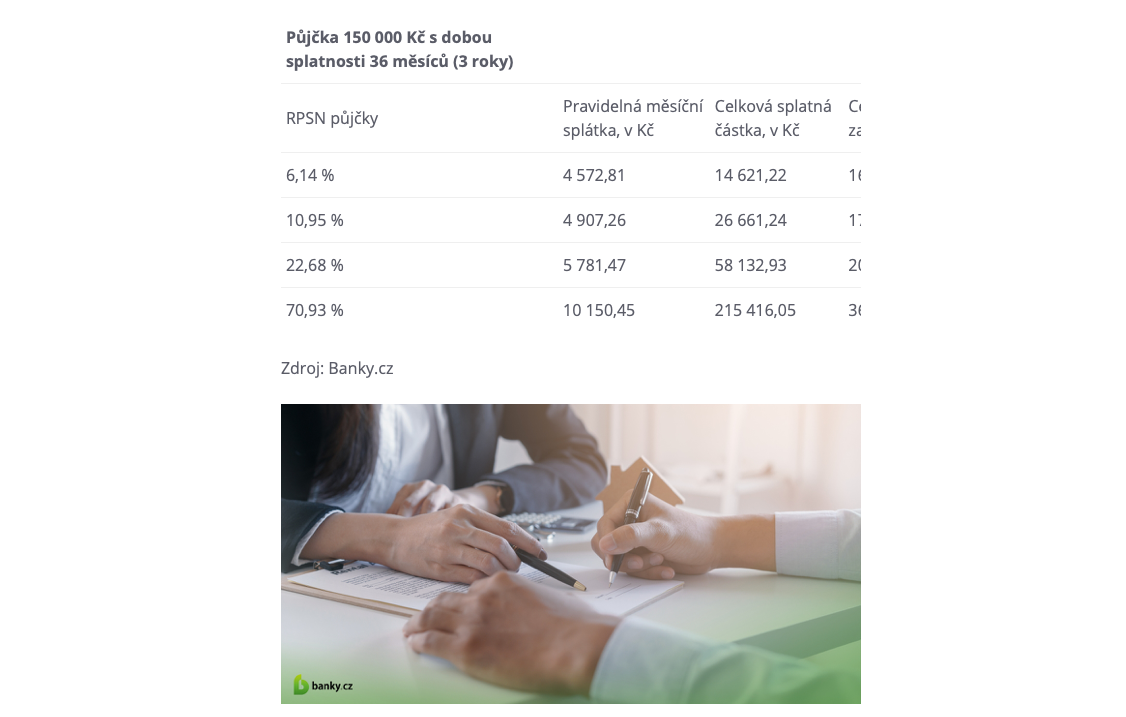

If we focus on the first in order, i.e. a loan for CZK 150, for an idea, we first have the opportunity to familiarize ourselves with the basic characteristics, then we can quickly get a picture by entering the amount and repayment period, to which we can then adapt the purchase of goods or the scope planned project. Furthermore, the guide leads us to loan options for 000 and points out immediately where it is advisable to pay attention and what to avoid. There is no shortage of instructions on how to choose the most favorable loan for CZK 150 in combination with key parameters on the basis of which it is ideal to assess individual offers. Aspects such as fees for early repayment, the possibility of deferring installments or late payment penalties are also not left behind.

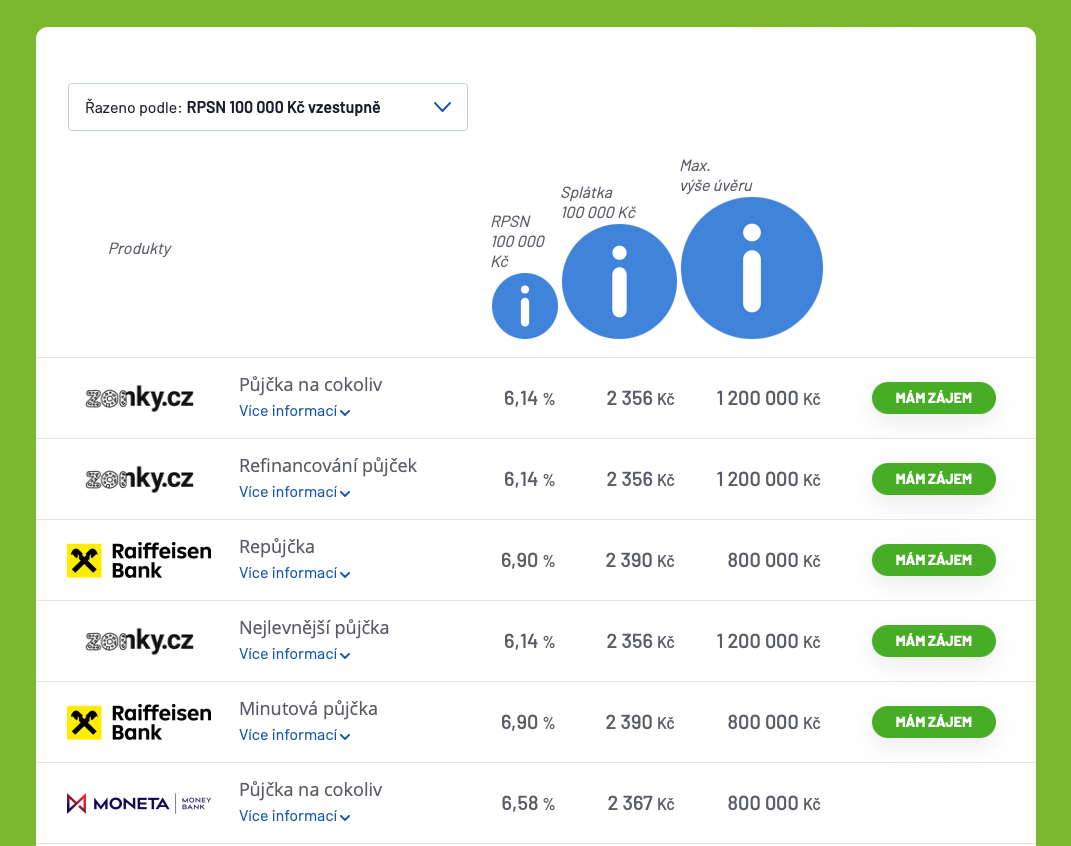

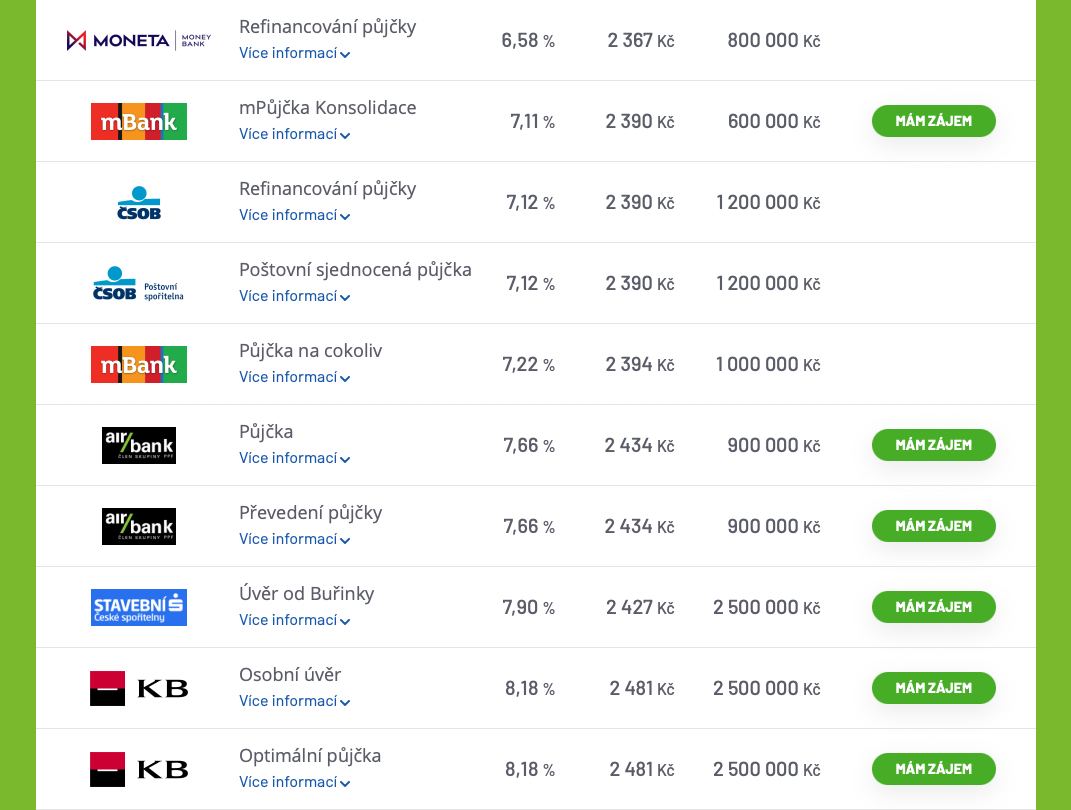

In addition, the portal provides, for example, what documents we will need for processing and what matters if the applicant gets the loan. All that remains is to choose the most suitable solution with the help of a regularly updated calculator that compares more than 30 products. It is possible to sort in ascending and descending order according to the APR, installment or maximum loan amount. An online solution is also offered through banka.cz, and this time too there are several links to inspiring articles dealing with the topic and some answered related questions.

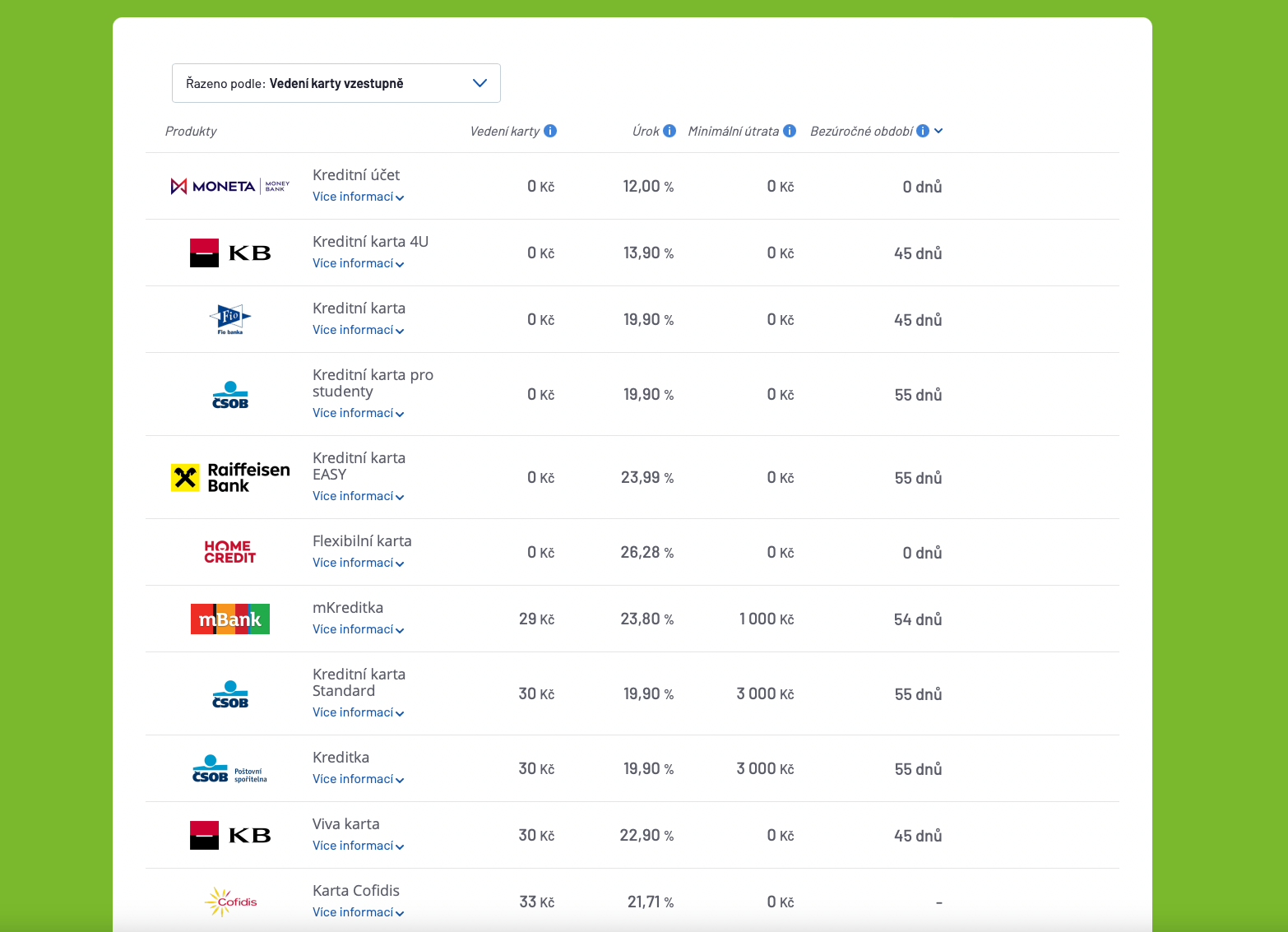

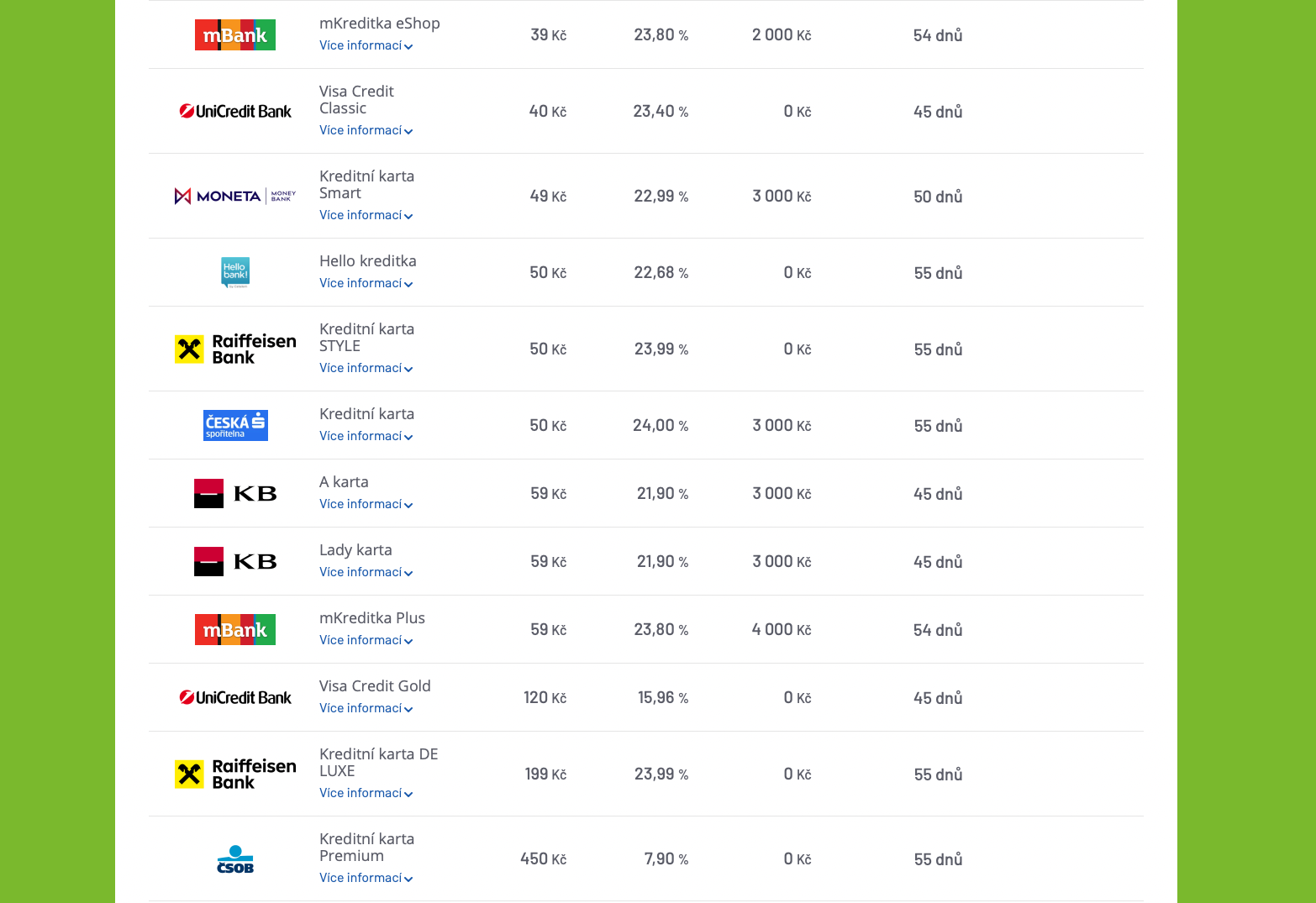

Cards

According to the portal, we can understand a credit card as an interest-free loan that we always have with us, which is provided that its owner can use it correctly, an appropriate label, and in practice its benefit will be appreciated not only by those who travel often. In the banka.cz comparison, there are 26 products of this type with the possibility of sorting upwards and downwards according to the cost of keeping the card, interest, minimum spending and interest-free period. In this way, it is very easy to get a clear overview and, based on it, to decide exactly on the offer that corresponds to specific requirements.

Here, the website dispels some prejudices and, within this section, devotes itself to a detailed illumination of the principle of operation as well as the positive aspects of the product. At the same time, however, it does not avoid its pitfalls, where all the pros and cons are listed on a separate page accessible from the menu called Advantages and pitfalls of a credit card.

Accounts

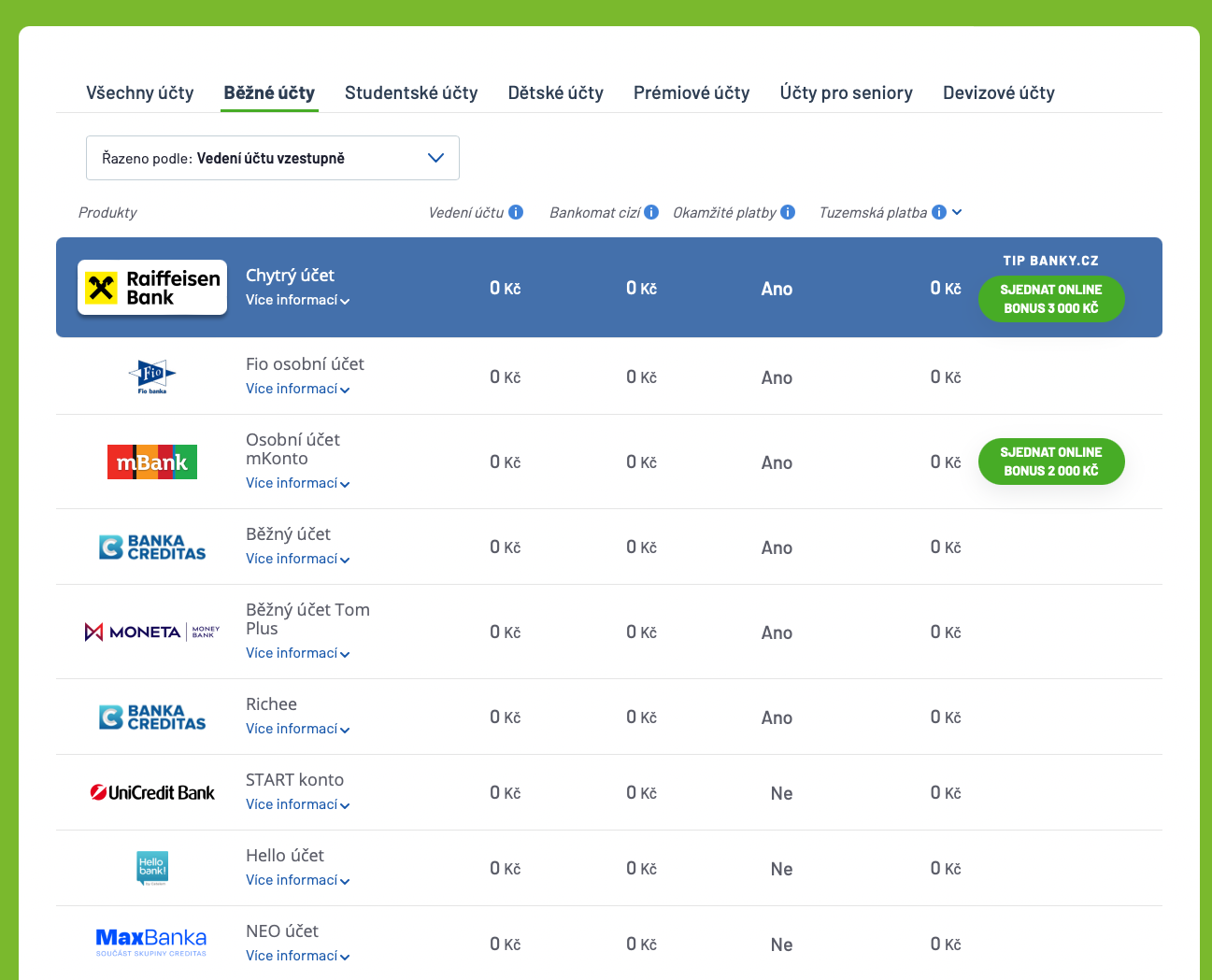

Transactions related to payments for purchases in brick-and-mortar stores, e-shops or for applications on phones, as well as for energy and other living expenses, take place through our bank accounts, which usually receive income from employers or institutions in the form of sick pay in the other direction. Nowadays, a regular bank account is almost a necessity. The banky.cz portal offers various types of accounts, including student, children's and senior accounts, as well as premium, foreign exchange, guaranteed and protected accounts.

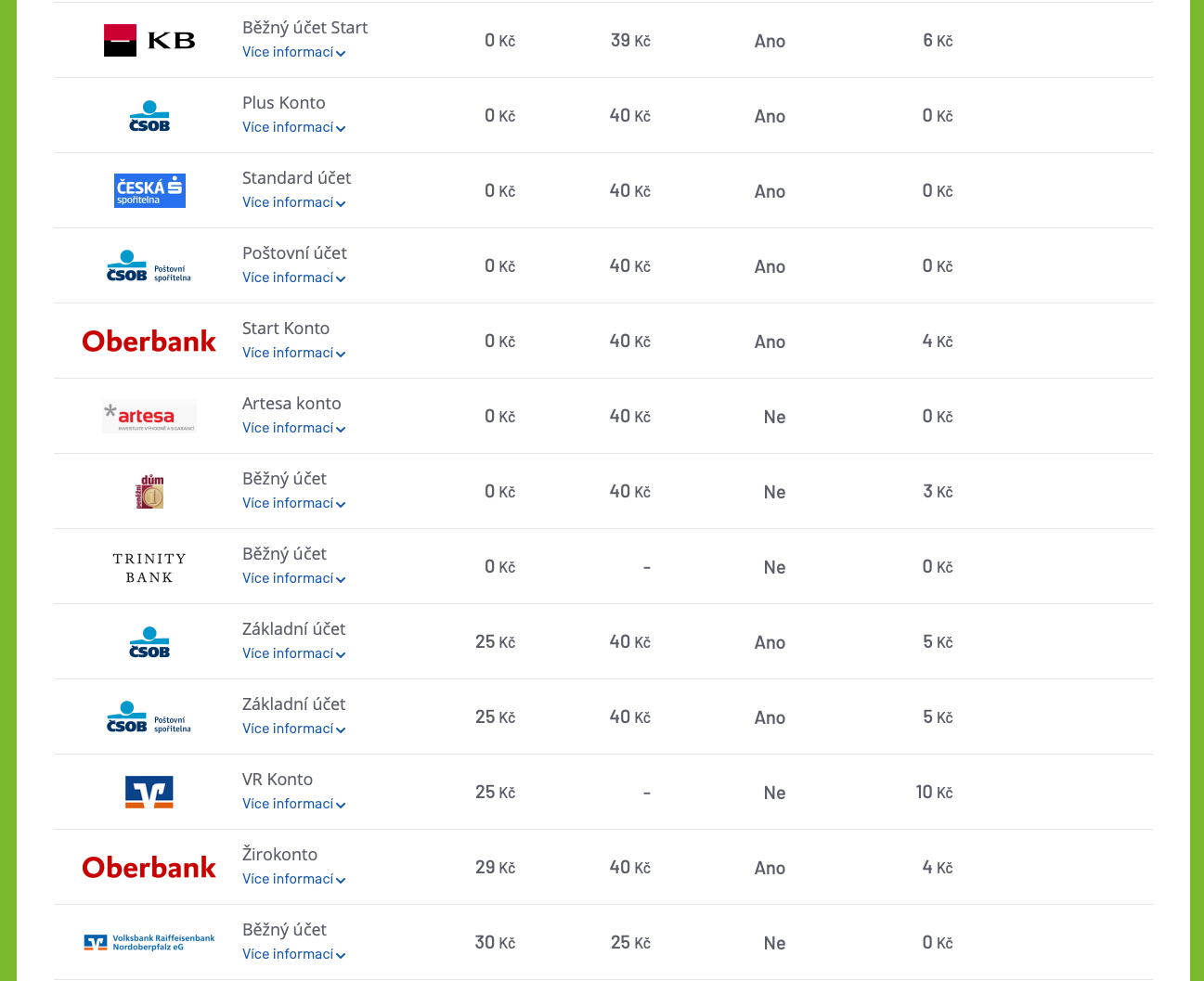

In the case of a current account, we can compare and sort 35 products in ascending and descending order according to several criteria, such as management costs, withdrawal from a foreign ATM, the possibility of immediate payment or a fee for outgoing payment to a foreign bank via internet banking. This calculator is accompanied by clearly structured information on the comparison of common crown accounts, including their specifications and a few tips for choosing the best one. Advice on how to proceed when you want to set up an account online, transfer to another bank or, conversely, need to cancel it can also be useful. Before asking questions about the counseling service, we come across a list of specific advantages and disadvantages of current accounts, where, for example, when mentioning zero interest in most cases, we immediately find a link to the offer of savings accounts with which free funds can be evaluated.

Saving

When saving, we create financial reserves and our funds are valued. The portal deals with this topic in a dedicated section, where it separately deals with pension and building savings, term deposits and savings accounts, including their overview and comparison.

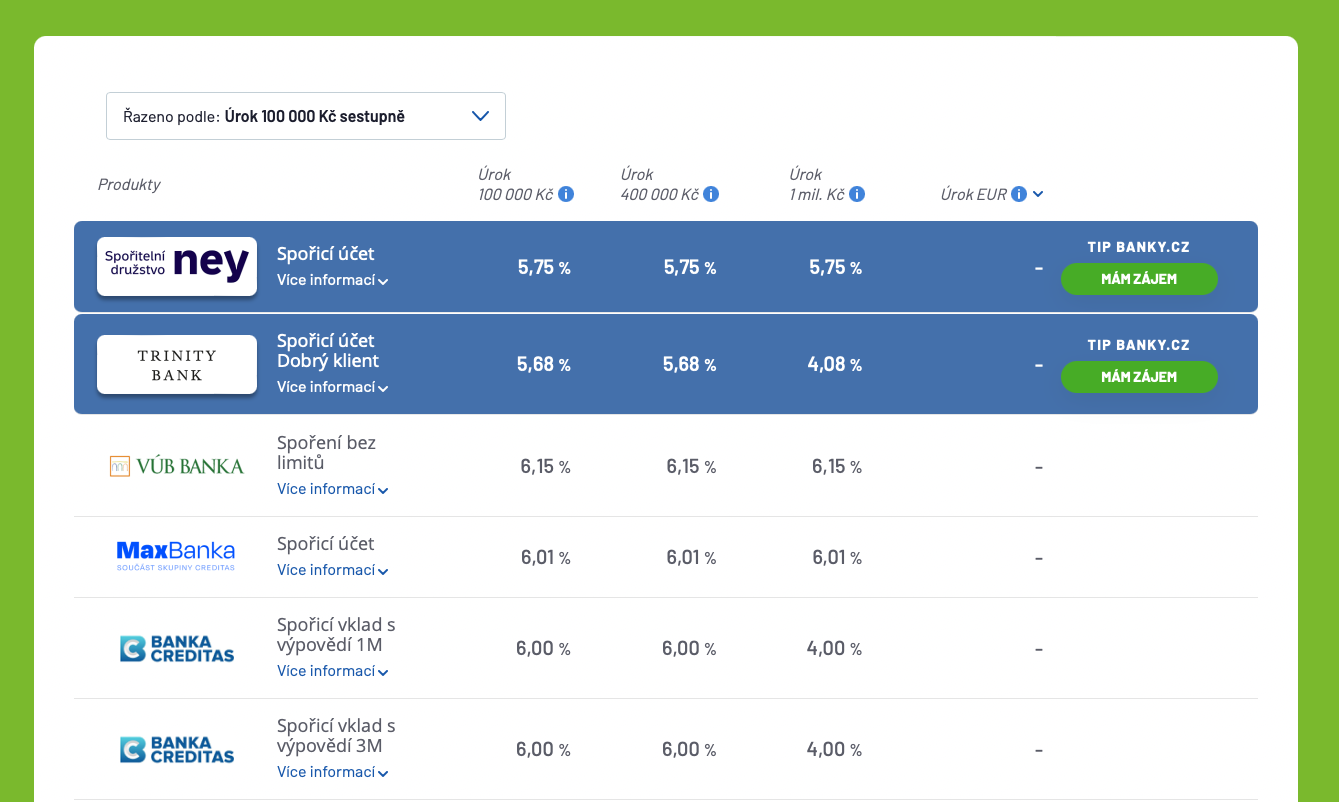

They can be a prime example savings accounts, with which we immediately get to the calculator with two-way sorting according to the interest rate at different levels of the balance in crowns and euros, which is accompanied by a concise discussion of the operation, types and conditions and possible fees for savings accounts. This is followed by some useful advice such as: how to choose the best offer at the moment or how to withdraw money from a savings account. This time too, we can learn from the experiences of those who turned to the advice center, and among the articles we will come across, for example, a guide to saving products for children.

Overviews of banks, insurance companies and other useful information

In addition to the content and functions mentioned above, the portal also provides an overview of banks that operate not only in the Czech Republic, but also in neighboring Slovakia, as well as credit unions and entities that offer non-bank loans, while clicking on any of the items will display a more detailed description.

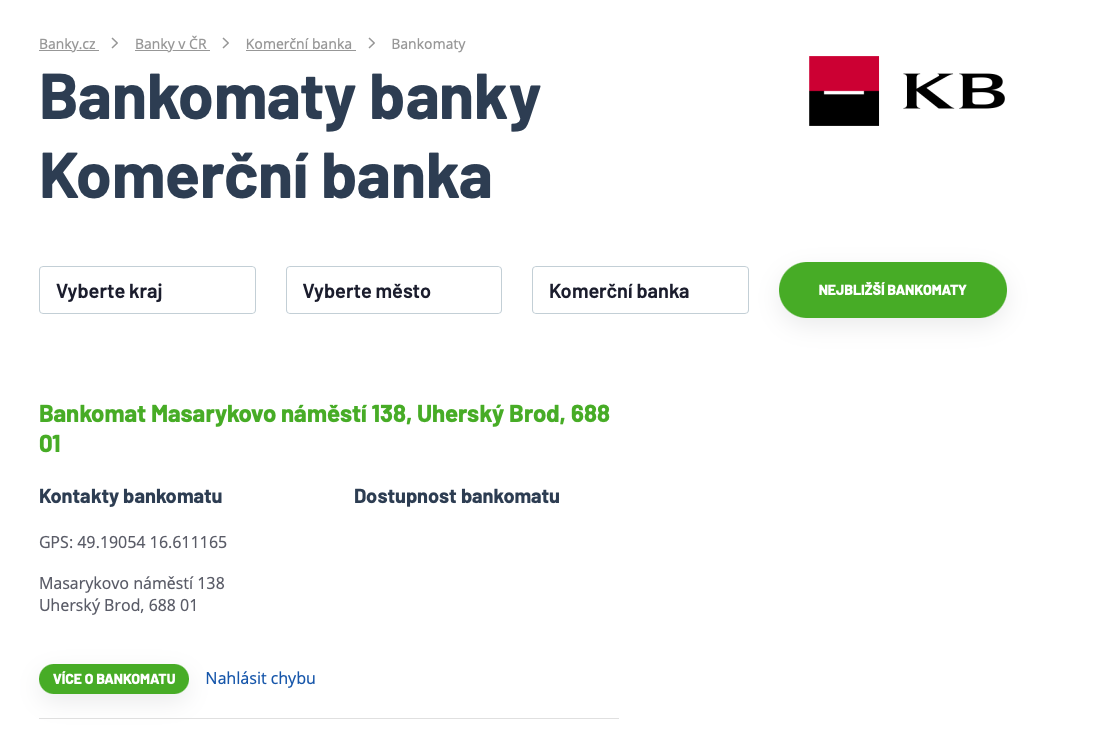

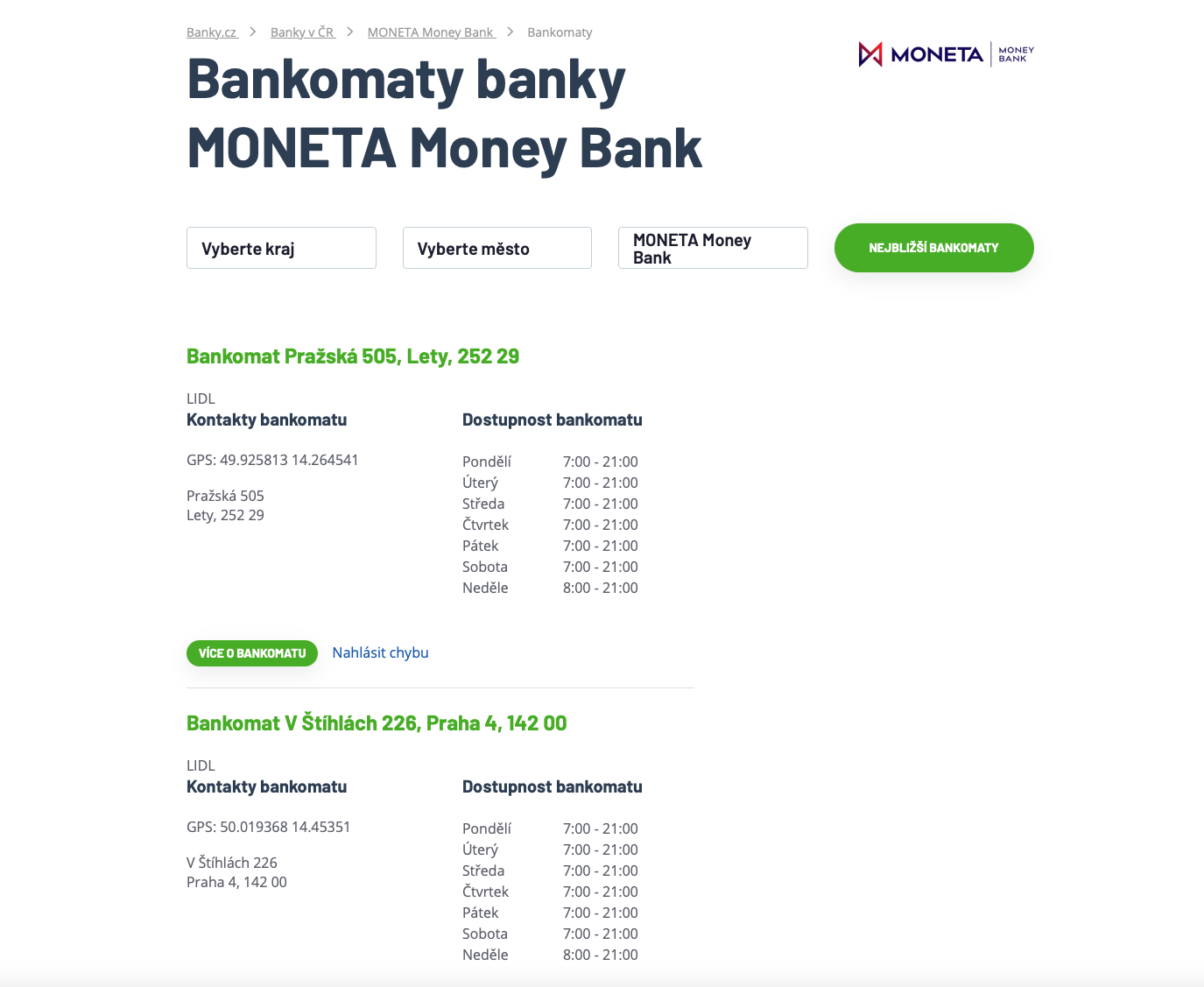

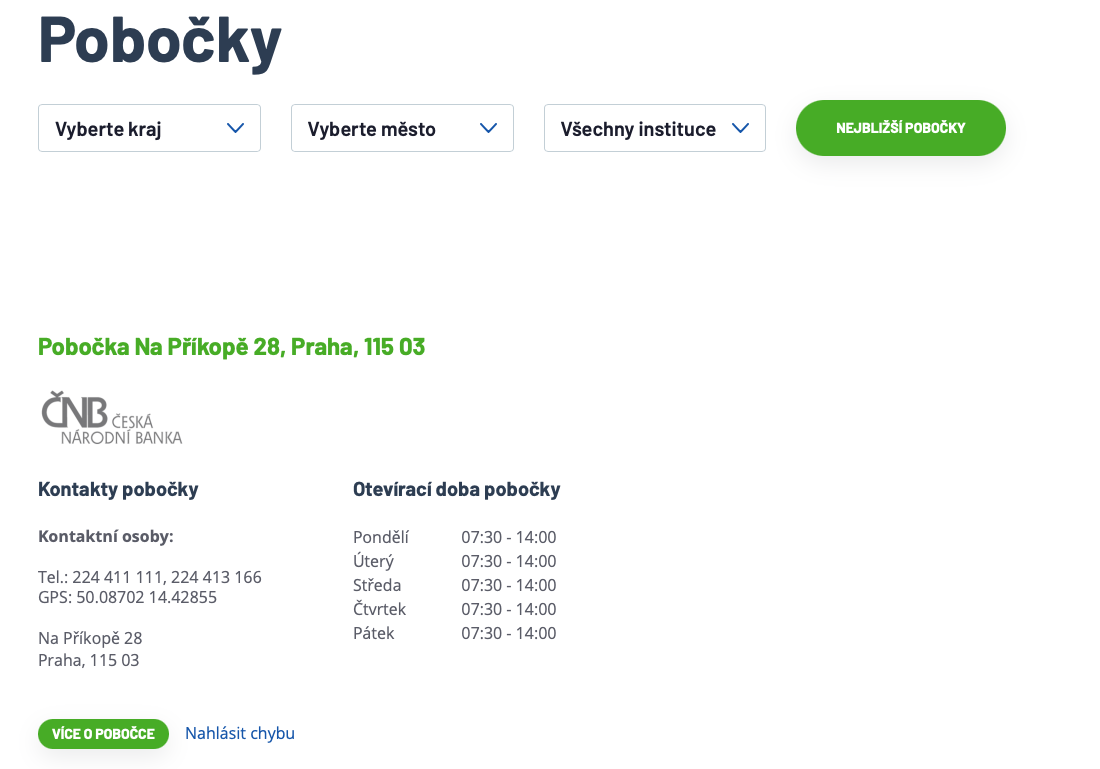

By choosing a region, city and institution or conveniently enabling access to location services, it is also possible to search for branches, ATMs and depository machines or view a list of pension funds together with key information about how they work or how they differ. The list of insurance companies on the Czech market is also processed in a similar way.

Summary

Banky.cz is a uniquely sophisticated web portal characterized by a high level of clarity, where a large amount of easily searchable information is combined with a comparison of financial products and an attractive range of services, including an online consultancy. If a person is faced with any question related to the world of finance, he can offer a helping hand and facilitate orientation in the given issue in an easily accessible and understandable way.