On Wednesday, April 28, Apple announced the financial results for the first calendar quarter of this year, and it became clear that it did more than well. The Cupertino-based company managed to beat analysts' estimates when the company's sales were driven as usual by sales of new iPhones. However, Tim Cook also warned that a global shortage of semiconductor components would could jeopardize the supply of several billion dollars of iPads and Macs in the coming months.

The Chinese market played a significant role in the positive economic results. Here, sales of iPhones exceeded expectations by a factor of two, and sales of Macs exceeded estimates by a third.

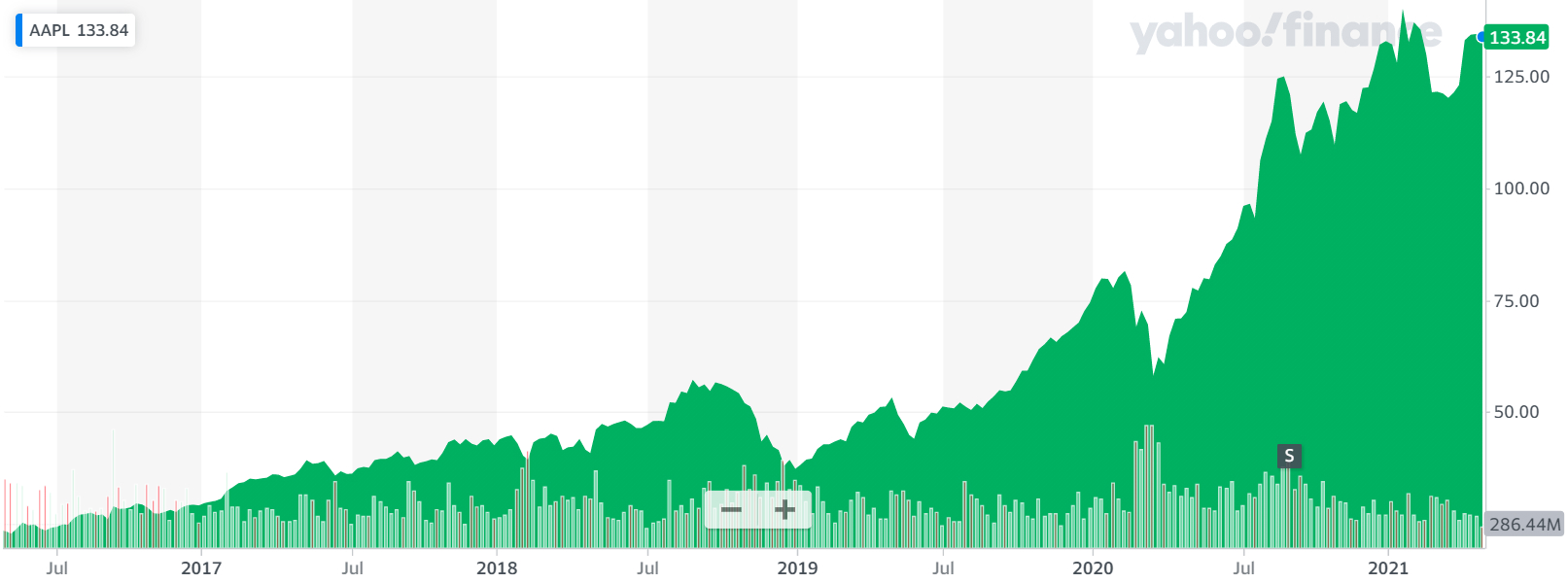

Apple also announced Wednesday that it will buy back $90 billion worth of its own stock, which is good news for investors. Because will reduce the volume of available shares in circulation, their price should rise with constant demand. The positive response of the investor community was immediately reflected in the stock market when Apple stock price grew by a few percent. However, this is nothing new for Apple shares, see below how their price chart looks over the last 5 years.

Will chip shortages become a problem for the company in the near future?

The company's CEO, Tim Cook, let it be heard during the announcement of financial results that he could face Apple in the next 3 months to a significant shortage of chips, which may endanger the production of new iPads and Macs in particular. This is a similar class of chips, the shortage of which is already threatening the production of Ford Motors cars, with the automaker having to cut production in half for the next three months.

Cook said Apple will have to compete with other industries for the manufacturing capacity of chip makers. At the same time, it is very difficult to predict when this deficiency will disappear. In the end, the lack of these necessary components will not lead to an increase in the price of Apple products?

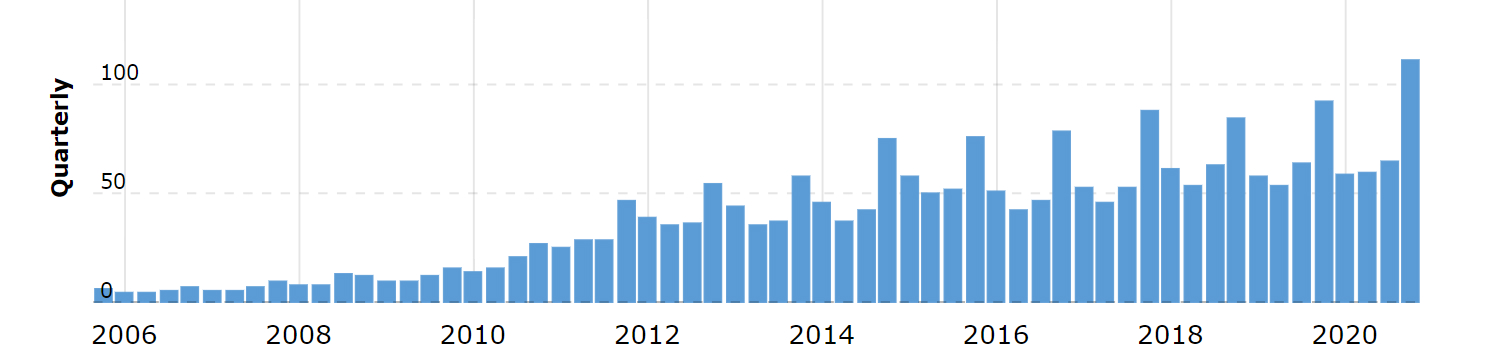

In any case, analysts expect that Apple should do well in the next quarter as well. Historically, the second calendar quarter has usually seen a significant decline in iPhone sales, but given the late launch of the iPhone 12, it is expected that this year will not repeat the usual scenario.

Apple's revenue by quarter, 2006-2020, in billions of dollars. Source: Macrotrends.net

Apple is thriving despite the coronavirus pandemic

There was a significant increase in the domestic market growth in wearable purchases, and Apple lovers have also subscribed far more to paid apps and services for fitness and music. However, there is little to be surprised about, both Apple Watch and AirPods are top products in their respective categories. As in China, however, it was also true worldwide that the company's main source of income was sales of the new iPhone 12.

Of the total $89,6 billion that Apple took in worldwide, $47,9 billion came from sales of iconic smartphones. The Cupertino-based company earned $9,1 billion from Mac sales, and iPads brought a total of $7,8 billion to the company's coffers. Investors then watched with interest as Apple's accessories and wearables business, which includes products such as headphones, fared AirPods, Watch or AirTag locator, as well as the services area, which includes, among others, the App Store and other new services such as paid podcasts.

Apple managed to get a comparable amount for wearable devices as in the case of Macs, and the technology giant even collected 15,5 billion dollars for services. It is certainly interesting that Apple services are already used by 660 million users worldwide, which is 40 million more people than at the end of 2021.

So it looks like Apple stock will continue to write its growth story, even though it has almost doubled in value over the past 12 months. It is thus still one of the most popular shares across a wide spectrum of investors who value the company unique and unrivaled products and loyal customers. As you probably know, once you fall into the net of the Apple ecosystem, you never want to get out.

How are you? Do you only actively use Apple products or did the Cupertina company appeal to you so much that you even bought its shares? If you are not kissed by the stock sector, you can learn more about investing in stocks here.