The spaceship, as Apple's campus is also nicknamed, was valued at $4 billion. The building is thus among the most expensive in the world, but Apple is not happy about it. In the past, he already wanted to avoid real estate tax.

According to an appraiser, Apple Park is worth $3,6 billion on its own. If we then include internal equipment such as computers, furniture and other equipment, the price goes up to $4,17 billion.

It could be interest you

Deputy Appraiser David Ginsborg said the valuation of Apple Park was particularly challenging. Everything is made to measure:

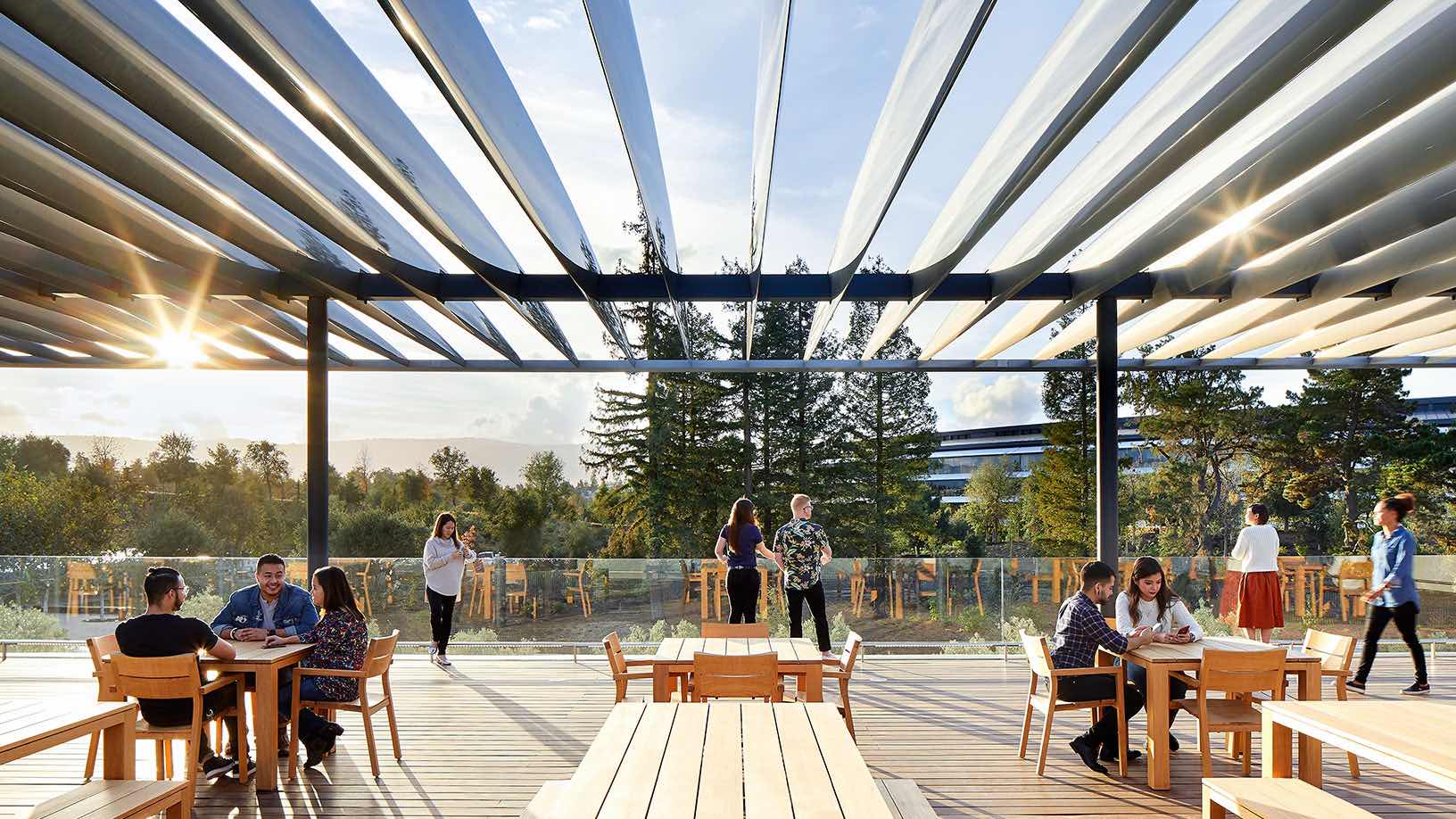

"What I mean by that is that every piece of the whole is custom," he said. The complexly designed ring of the building, which incorporates modified glass and specially designed tiles, is surrounded by pine trees from the Mojave Desert. "However, in the end it is an office building. So its value can be quantified," added Ginsborg.

The value of Apple Park makes it among the most expensive buildings in the world. Among them are, for example, the Open World Trade Center (World Trade Center), Abraj Al Bait Towers worth 15 billion dollars or the Great Mosque of Mecca (Great Mosque in Mecca) in Saudi Arabia for 100 billion dollars.

Real estate tax plays a leading role

Apple must pay one percent annually in property taxes. Converted, he regularly hands over 40 million dollars into the Cupertino coffers. But there are rumors that Apple could contribute more.

There has been a housing crisis in Silicon Valley for a long time. Respectively, rents have climbed to incredible heights and many residents do not have their own housing, which leads to an increase in homeless people. However, Apple is still among the largest tax payers in Santa Clara County.

Of the $40 million from Apple, 25% goes to subsidize the local elementary school, 15% goes to the fire department, and 5% goes to Cupertino for expenses.

Apple Lossless Audio CODEC (ALAC), even before Apple Park was built had to invest $5,85 million in affordable housing for residents and another $75 million in the city's infrastructure and transportation. The firm regularly appeals property tax rulings in Santa Clara County and is vocal in its opposition to such taxes.

It could be interest you

Source: 9to5Mac

In the headline you write that it is the most expensive building in the world for 4 billion USD, and right below that you mention two more for 15 and 100 billion USD. So how then?