If you want to buy your own home or embark on a challenging renovation, then a mortgage is a great tool for achieving your goals. Unfortunately, as you may know, arranging a mortgage is not exactly a walk in the park. In most cases, you may come across a number of unnecessary obstacles. Fortunately, there is already a solution for these cases today. Thanks to current possibilities and the Internet, the entire mortgage can be settled online from the comfort of your home, without wasting time.

That is exactly why in this review we will shed light on the groundbreaking solution of a Czech fintech startup hyponamíru.cz. This company has developed a great web application, with the help of which you can solve the mortgage arrangement literally from A to Z online. This is not just a mortgage calculator, but a real solution that will help you not only with an advantageous choice according to key parameters, but also with the entire negotiation process and subsequent administration.

Negotiating a mortgage online

As we already mentioned at the beginning, thanks to today's possibilities, there is no longer any obstacle to arrange a mortgage online, which brings with it a number of great advantages. The most important one is that everything can be solved from the comfort of your own home, without the need for face-to-face meetings, lengthy waiting or haggling over interest rates. Instead of having to go from bank to bank, the so-called will become the center of everything for you mortgage banking.

In mortgage banking, you can immediately see an overview of available offers, which everyone can also sort according to their own preferences (according to interest rates, maturity and other data). But for the inexperienced, such an arrangement can be a Spanish village. That is why hyponamíru.cz is based on a simple and clear user environment, where you have all the information and offers literally at your fingertips. At the same time, a mortgage specialist is assigned to each mortgage to facilitate the entire negotiation process and subsequent administration.

How to arrange a mortgage online via hyponamíru.cz

Therefore, let's show together how to arrange a mortgage online via hyponamíru.cz. The whole process is divided into several steps to keep it simple and clear. We must also definitely not forget to mention the overall transparency. Therefore, you don't have to worry that, for example, some fees and other important information will remain hidden from you, which are absolutely essential in such a case.

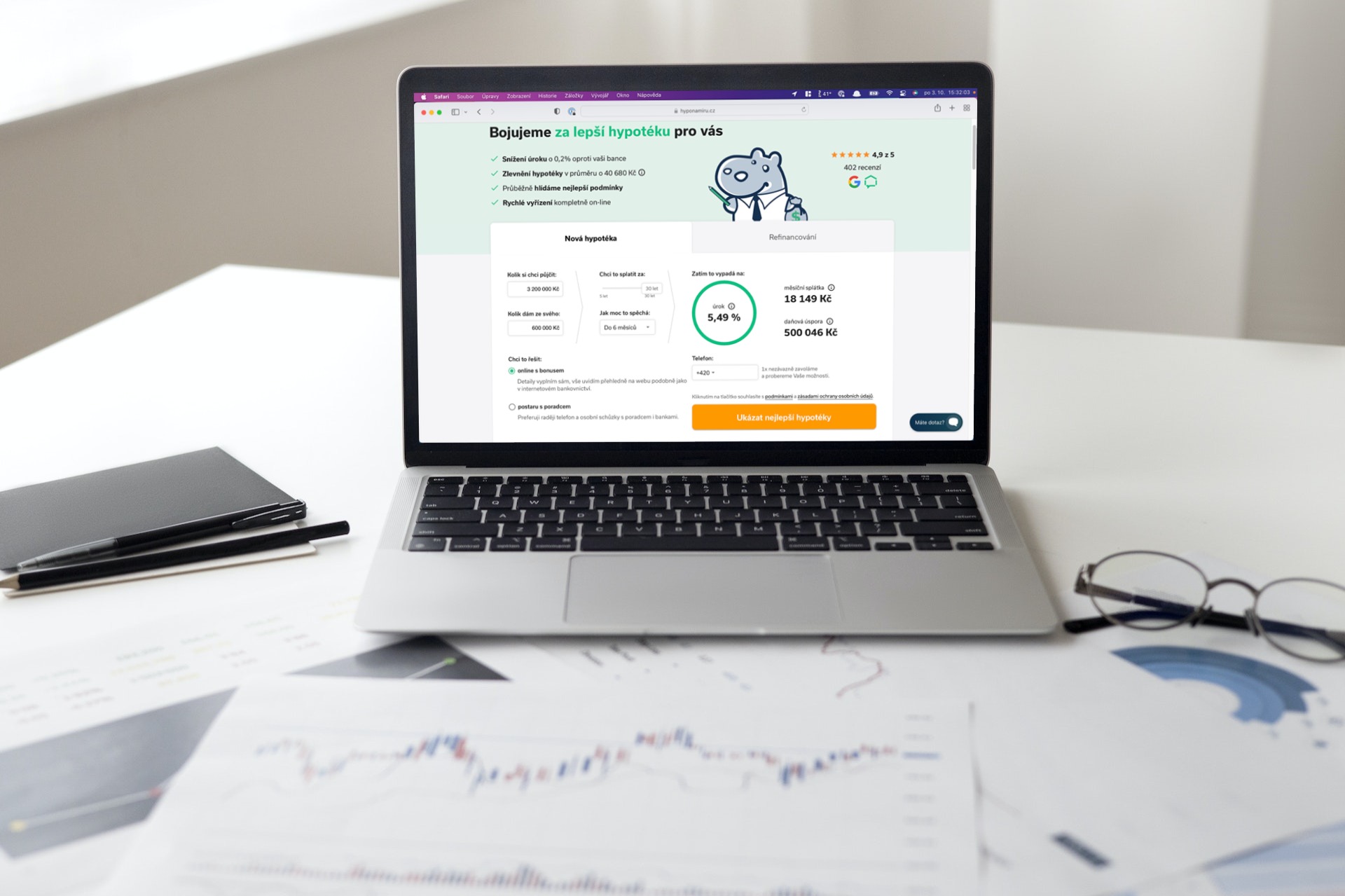

The journey itself begins with deciding whether you want to take out a new mortgage or refinance an existing one. If you are interested in negotiating, just go to the mortgage calculator, where you need to fill in the required ideas, i.e. how much you need to borrow, how much you will give from your own, what is your preferred repayment period and how fast you are getting the mortgage. However, at this point you should already know the value and type of property, the amount of mortgage you need, your preferred repayment term and your intended use. At the same time, it is necessary to enter basic information in the form of a telephone number and type of solution. The type of solution is extremely important in this regard. You can choose to solve the whole matter online with a bonus, or take care of it with an adviser in the form of phone calls and personal meetings.

Mortgage banking

Mortgage banking is at the center of everything. After filling in the aforementioned mortgage calculator, we move to this banking section, where a preview of offers from individual banks is immediately displayed. At the same time, all information regarding the interest rate, APR, length of fixation, amount of the monthly installment, the total amount for interest during the fixation period, the principal amount and the total amount for the entire mortgage are visible at a glance. We must not forget to mention another rather important piece of information. Here you will also find a detailed overview of all other fees – for processing a mortgage, taking out a loan, maintaining a credit account – or fees associated with the real estate cadastre and the estimate itself.

When choosing the most suitable mortgage, it is of course extremely important to find the one that best suits your needs. As we mentioned above, this is why it is possible to rank these offers differently. However, it should be noted that to view the best offers you have to do online personal account activation. Again, this can be resolved within banking within a few minutes.

Mortgage selection and application processing

Once you have chosen a mortgage that exactly meets your requirements, there is nothing stopping you from preparing your application. First, it is necessary to fill in some data and then upload personal documents (identity card), tax returns and other necessities that are needed to prepare the application using a secure transmission. After that, the already mentioned mortgage specialist takes over the application. He plays a very crucial role at this point, as he will help you complete the application successfully and ensure that you do not forget anything.

All you have to do is resolve the necessary formalities with a specialist by phone or e-mail. Once you have the application ready in mortgage banking, all you have to do is check it and sign it. The courier will deliver it directly to the agreed place for you to sign, so you don't have to worry about anything at all. In the case of some banks, the possibilities go one step further in the form of an SMS signature. It is a much faster and safer option.

Mortgage approval and drawdown

After signing the application, you have completed the next essential step. At this point, the bank enters the whole process, which has to check, evaluate and possibly approve the application. After that, it informs you about the so-called bank scoring in the form of an SMS, which means the transition to the next stage - the approval of the mortgage and its withdrawal. After the evaluation, a mortgage specialist will take care of you again, who will upload a list of the necessary documents to complete the process. Just upload the prepared documents here one by one and you're done. Again, there is no need to go round the necessary places unnecessarily - you can solve everything online from home.

A very important moment follows – as soon as the bank prepares the loan agreement for signing. This is the last step that separates you from getting a mortgage. In this case, the mortgage specialist will only inform you about the method, time and place for signing the contract. The signature can take place at the place of residence or at the nearest branch of the given bank. After signing the contract, a specific specialist for the given area takes over the drawing, who also informs you about the moment when the drawing can start. And you're done! You have successfully negotiated a mortgage completely online, without the unnecessary complications that we mentioned right at the beginning. When it runs out, you will still receive an informative SMS.

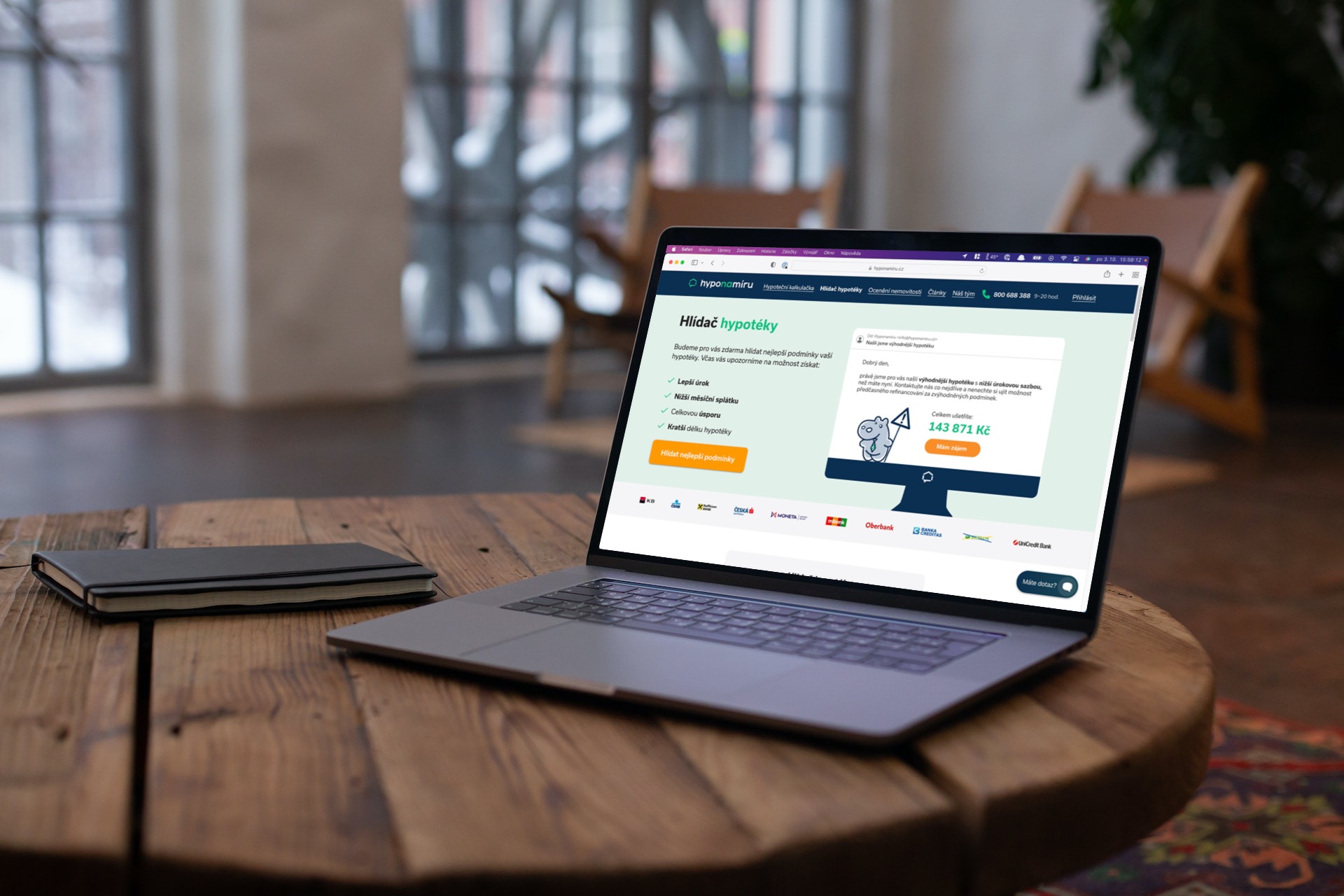

Mortgage watcher and property valuation

A mortgage is a long journey, and it certainly does not end with its agreement. This is exactly what the startup hyponamíru.cz is fully aware of, which offers its clients an elegant function called free of charge Mortgage Watcher. It is a web application for monitoring your mortgage, so you never miss any important information. At the right moment, you can have it refinanced and switch to a much more favorable offer. The mortgage watcher is directly focused on securing a better interest rate, lower monthly payments, overall savings and a shorter mortgage term. With its help, you can even save up to tens of thousands of crowns.

As we mentioned above, you won't miss anything important with the help of this feature. In addition to options for refinancing, the application monitors the anniversary of contracts for extraordinary installments and the approaching end of fixation. In the same way, if you already have a previous mortgage, nothing prevents you from "parking" it under the wings of hyponamíru.cz and benefiting from the same benefits.

A relatively new pro module is also gaining attention recently verification of real estate valuation. Hyponamírů.cz works with external Swiss technology for the most accurate estimate, thanks to which you can check the price of a given property completely free of charge during an auction, purchase or sale. It is thus a perfect option corresponding to the situation in today's market. You can check in an instant whether the price is adequate or not, on the contrary, excessive. Using the module is again extremely simple. To estimate the price, the system works with information from several sources - from current and historical offers on the largest real estate portals in the Czech Republic, which is supplemented by data from the real estate cadastre and sophisticated artificial intelligence capabilities.

Summary

Fintech startup hyponamíru.cz can clearly be described as a great full-service platform that can help you, for example, on your way to owning your own home. In addition to complete mortgage management, the company is also connected to developers and various real estates, thanks to which it can connect those interested in housing with owners or sellers of individual properties. This will be especially appreciated by those interested in a mortgage without real estate, when they can fix a specific rate, and only then look for, for example, their dream home. The platform can even manage compulsory property insurance and life insurance for you.

It is in this respect that a mortgage is a great tool. Hyponamíru.cz is in the position of a complete guide that can eliminate a number of unpleasant obstacles for you that you would normally have to deal with during traditional handling. It is therefore quite understandable that this Czech startup has been a huge success since its inception. Hyponamíru.cz bases its success on convenience, maximum transparency and speed, which the online world brings with it.

Discussion of the article

Discussion is not open for this article.