Press Release: Current US consumer price statistics are understandably a closely watched indicator. Last week, investors' attention turned to the meeting of the US central bank, which, as expected, increased its key interest rate by 0,75 basis points. Many bullish investors were expecting any hint of dovish rhetoric in Jerome Powell's subsequent press conference. They were looking for anything to suggest that the peak of rate hikes was on the horizon and that markets would find an imaginary light at the end of the tunnel and a phase of rate cuts soon to follow. However, the reality was completely different. Governor Powell has already repeated several times that the FED intends to be very strong in the fight against inflation and does not intend to underestimate anything. In other words, he ruled out rate cuts unless the Fed is truly confident that inflation is coming under control.

Source: xStation

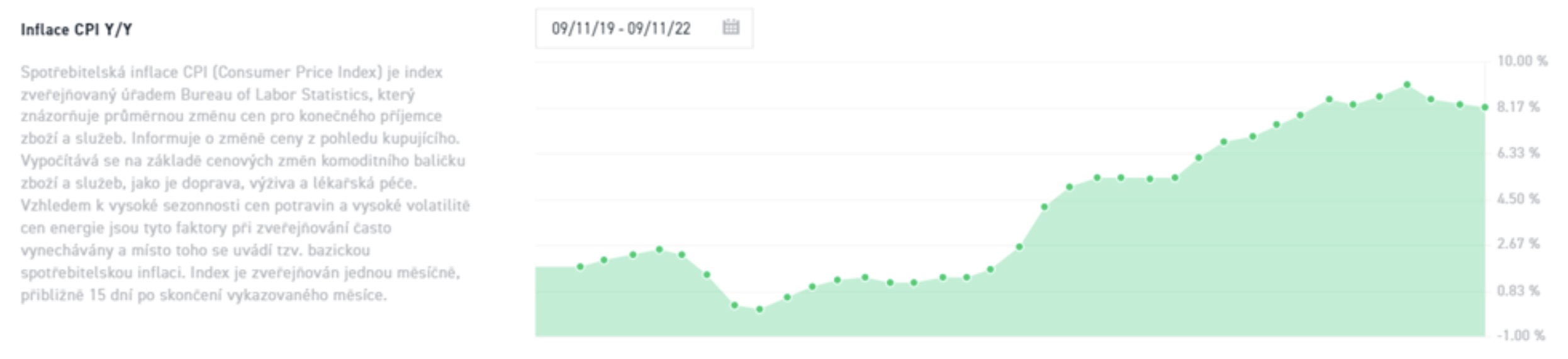

Central banks know they have lost the fight against current inflation

It is widely known that central banks are not so much interested in current inflation, but primarily in future inflation. The latest rhetoric of the head of the FED rather excludes that the American central bank is getting the impression that future inflation will fall somehow dramatically. According to the latest data, the American labor market remains relatively strong, so a significant drop in demand is not yet forthcoming. From the point of view of statistics from the last five months, the final result of the year-on-year consumer price index was always higher than the market expected in four cases. These are all factors that could weigh in favor of worse inflation data.

Expected market reactions

If today's inflation data were to come out significantly above market expectations, we can expect strong nervousness on the markets and probably a sell-off not only in stocks. On the contrary, a result below analysts' expectations could encourage markets, which are hungry for any positive news, and thus bring more stock purchases.

Live broadcasting

We will find out the new inflation data today at 14:30 p.m. our time. As is customary, XTB will broadcast and comment on this event live. Analysts Jiří Tyleček and Štěpán Hájek together with trader Martin Jakubec will discuss possible scenarios, implications for the FED's future decision-making and, last but not least, market reactions and possible investment opportunities.

You can join the broadcast for free using the following link: