Press Release: Financial markets have reversed course in recent weeks, and after a long period of bleeding, green candles once again dominated the charts. But is it really the end of the bear market or just another false reversal that will be followed by a fall to new lows? In this article, we present the opinion of Štěpán Hájek, senior analyst at XTB, creator of the programs A week at the markets a Wall Street open and many other analytical and educational materials.

Stocks are slowly overestimating rates, not expecting a recession. The Fed is starting to fear her.

Last year was one of predictions about the shape of the landing of the American economy. At first it seemed inevitable that a hard landing and a fall into recession would be inevitable. After that, investors began to lean and the reopening of China and the better energy situation in Europe, which began to materialize the soft landing of the economy. This very quickly meant a reassessment of the further development of inflation, which should reach close to 2% sometime early next year. Because if we have a soft landing ahead of us, inflation won't drop like a rock. However, the markets are dominated by even greater optimists. This left us with the possibility of no landing. What is it built on?

Hard, soft and no landing

Instead of an outright recession or a mild economic slowdown, growth can remain strong—or even pick up again—and companies can achieve their projected profits. Proponents of this view cite recent data that point to continued momentum in consumption and a strong labor market.

Those who bet on a decline are not only betting on a recession

Here comes the subjective view of every investor, which in my case is based on data. Historically, a very resilient economy always comes with resilient inflation. The stronger the economy, labor market and market sentiment accompanying these factors, the more restrictive the Fed must be and keep rates higher for longer. This will ultimately limit economic growth and weigh on stock prices. The minutes of the last Fed meeting showed something interesting. Indeed, bankers agreed that they are beginning to fear a recession, although past statements have been dominated by the idea that a recession can be avoided. The Fed is simply starting to count on a recession, which by the way is the fastest possible way to reach the 2% inflation target. They can achieve this with even higher rates.

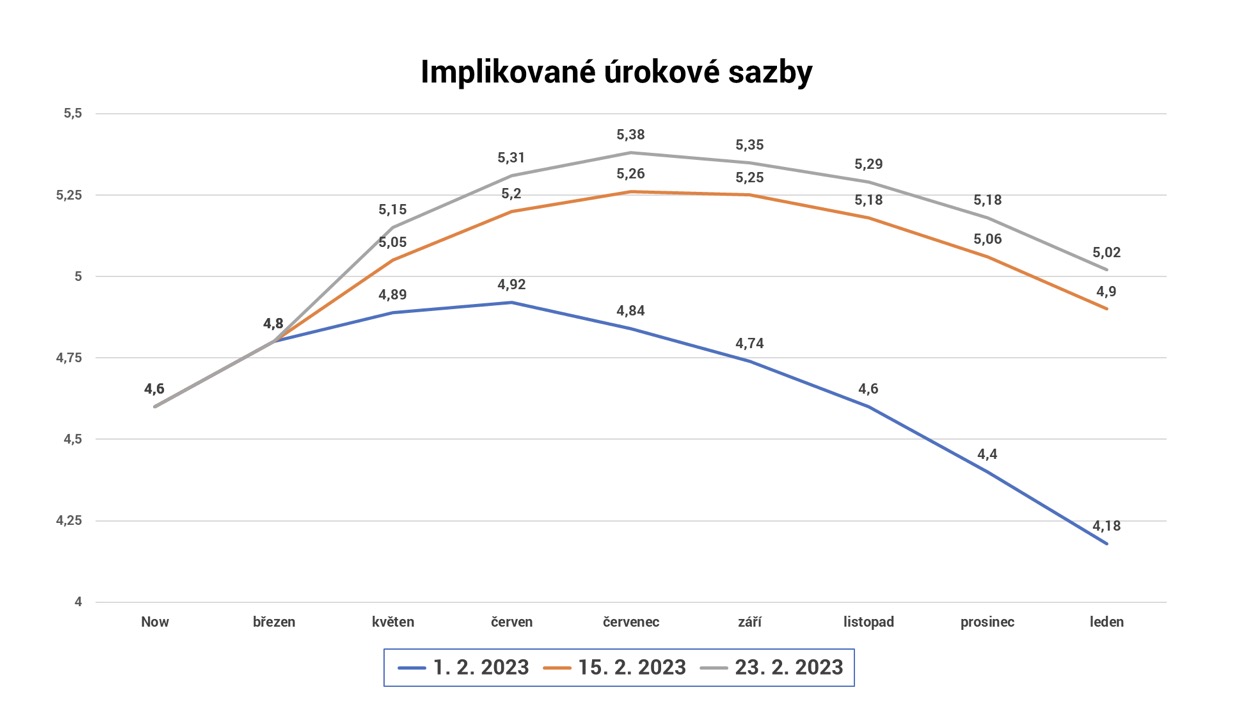

However, the bond market also believed in recession until the beginning of February. The implied curve priced rates to fall by 1% in the second half of the year. A 1% drop is no smooth landing. Today, the market already expects a cosmetic rate cut of 25 basis points, indicating that it has understood the Fed's determination not to give in to inflation. He also understood that inflation will not fall down in a straight line, which can also be seen in other inflation expectation curves that have been rising higher in recent weeks.

Chart: Implied US interest rate expectations curve (source: Bloomberg, XTB)

Stock markets do not expect any recession and did not expect it even at the beginning of the year. We've seen gains in speculative meme stocks, shorted stocks, loss-making tech or cyclical companies. Meanwhile, sectors with massive growth in profitability such as energy, healthcare or utilities remained in the background. Stocks have started to revalue rising bond yields and the outlook for rates in recent sessions, but they still remain dangerously high. This exposes them to further decline, which is supported by the dynamics of fundamental and technical factors.

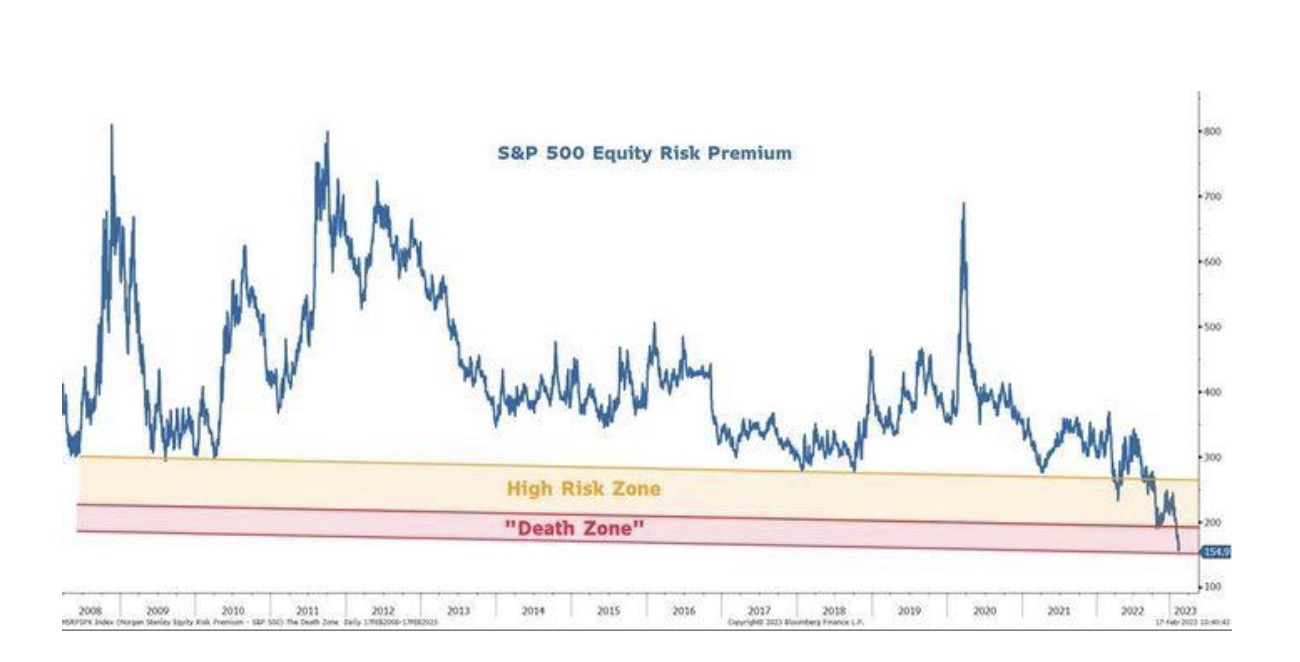

You need a lot of oxygen at dangerous altitudes

The S&P 500 climbed back above 15 after the P/E fell to 18 in the fall, while the risk premium fell significantly. This technical combination suggests that it is better to take the chips off the table and allocate capital to defensive assets. That is not happening for the time being, and loose financial conditions, a weaker dollar and better liquidity have been enough to maintain risk-on sentiment. No landing is suddenly the base scenario. However, liquidity has started to fall again in recent days, the markets are still dangerously high and the margin of safety has fallen significantly. Bulls are not as safe as they may think. Paradoxically, the increasingly better economic data is to blame for this, which is changing the situation especially for bonds, where yields are rising. Earnings and stocks are not 100% correlated, but bond investors are generally much smarter, and if stocks have reflected their decline, they must reflect their rise.

Chart: Equity risk premium (source: Morgan Stanley)

You should understand that you don't have to speculate on a recession when you speculate on falling markets. GDP growth over the last 10 quarters has shot up from normal thanks to the giant stimulus, and even if there was no recession, the return of growth momentum to the original values will put enough pressure on margins and profitability. Margins will also be pressured by a gradual decline in pricing power, as consumers no longer accept higher prices. Markets expect a decline in profits, but the surprise will be its depth. There is still room for surprises on both sides, but the underlying fundamentals for buying the stock are far from over. Liquidity and better financial conditions can help us overcome this gap (this happened at the beginning of the year), but we are watching the exact opposite.

The market situation is changing rapidly. The beginning of the year began with too much fanfare, and suddenly more and more red flags began to wave. Optimism will last as long as markets maintain luxury valuations. As soon as they further revalue higher rates, a downturn will come and with it a change in sentiment, downside bets will begin to accumulate and capital will begin to move from risky to defensive assets. This may open up room for the S&P 500 to test last year's lows -- investors will return to a hard landing, which is when you want to buy stocks and not wait for a recession because it will be too late to buy.