Commercial message: Investing has experienced a tremendous boom in recent years. Investment funds, brokerage houses and investment platforms reported a record increase in practically all indicators. But now comes the cleansing. A lot of hot money has come in and out of the market over the past few difficult months, and very often at a significant loss. Then there are the longer-term investors who have a horizon of several years and if they entered the market recently, they probably also face some ongoing loss. In the following text, we will look at how you can easily reduce your ongoing loss by up to 20%, or increase your potential ongoing profits by up to 20%.

Still significant most capital is invested through traditional mutual funds. The following points are characteristic of these traditional funds:

- Investment management is handled by a professional portfolio manager (or group), the investor does not have to be active in any way.

- Fund managers are usually more cautious, and mainly do not want to lose significantly more than the market average.

- According to all available statistics the vast majority of actively managed funds do not achieve greater yield, than the market average.

- For this one fund management is usually charged in the interval from 1% to 2,5%, on average 1,5% from the capital per year, including loss years, i.e. the market loss deepens by that.

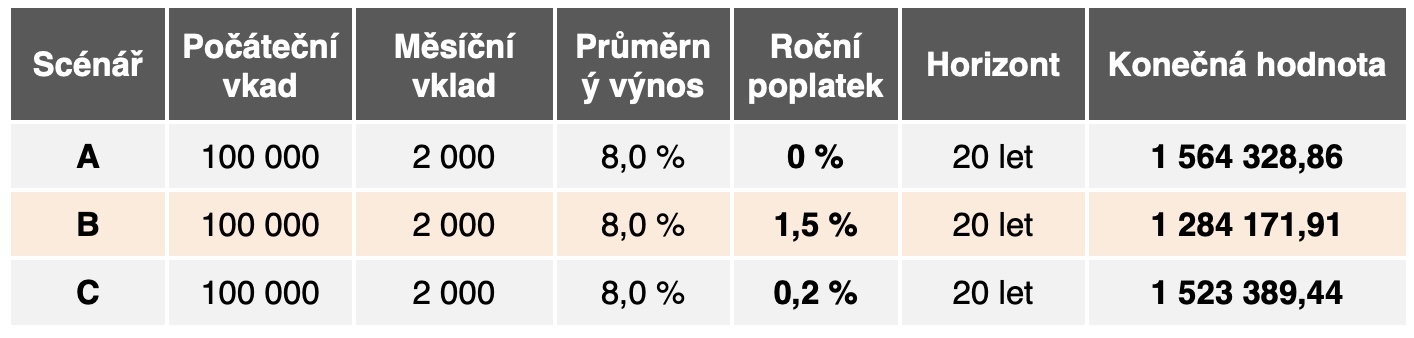

Let's dwell on the last point, which actually defines the cost of the investment itself. If in the long term the average stock return is between 6 to 9% and your investment value is reduced by 1,5% every year, then the table below shows that in the long term these are really huge differences.

Source: own calculations

The effect of compound interest, which actually reinvests the profits achieved, means that any increase in costs is dramatically prescribed in the final value of the investment. Scenario A simulates average returns over 20 years without any fees. Scenario B, on the other hand, simulates returns with an average fee of 1,5%. Here we see the difference to the previous scenario of 280 over a 000 year horizon. At this point, it is also worth reminding again that the overwhelming majority of actively managed funds do not achieve higher returns than the market average (they usually achieve significantly lower returns). Finally, scenario C shows a passive low-cost fund with a fee of 20% per year, which almost perfectly follows the development of the stock market represented by some stock index. These low-cost funds are called ETFs - Exchange Traded Funds.

Pro ETF funds is characterized by:

- They are not actively managed, just as a rule they copy the given stock index, or another defined group of equity securities.

- Extremely low fund management costs – usually up to 0,2%, but some even 0,07%.

- Revaluation of the value of the funds (and thus your investment) takes place every time the ETF is traded on the stock exchange.

- It requires a proactive approach by the investor

And here we pause again on the last point. Unlike classic investment or mutual funds, where you really don't have to worry about your investments, in the case of ETFs, you need to familiarize yourself with at least the important basics of how ETFs work. At the same time, if you plan to invest regularly with monthly or at least quarterly deposits, you should always actively purchase the given ETF. In modern investment applications of the type xStation or xMobile station the whole process takes a few minutes at most, but for more skilled users it can take a few tens of seconds. Then every investor has to answer for himself to what extent he wants to fulfill the traditional saying "no pain no gain” and thus how much return he is willing to hand over to an investment fund for what he can largely manage himself these days. As we saw in the scenarios above, this one the difference between a traditional fund and an ETF can be hundreds of thousands of crowns, if we are looking at a long investment horizon.

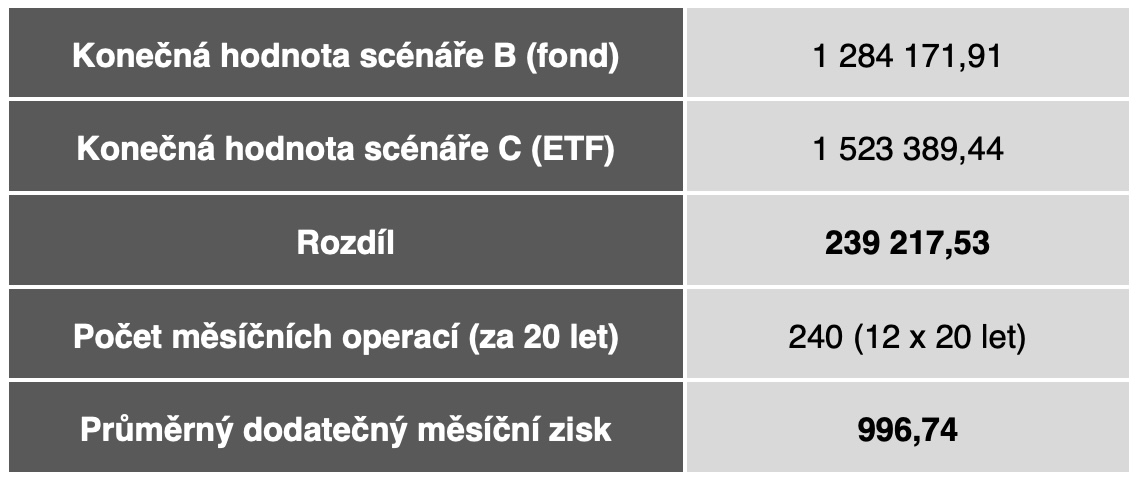

A final calculation to ponder:

Source: own calculations

The table above shows what can be expected in 20 years additional income in the case of low-cost ETFs also amounts to almost 240 CZK. However, this additional income requires an active purchase of the ETF in your investment account every month. The last row of the table shows how much more you will earn each month if you actively buy an ETF tracking the average performance of the stock market consistently every month for 20 years. In other words, if you take one minute of your time every month to enter an ETF purchase in your investment platform, in the long run you will an additional 1 CZK for one minute of your time and watch out for every month. So, in 20 years, almost 240 CZK. If, on the other hand, you transfer your investments to traditional funds, you hand over this additional profit to the fund managers and you have saved yourself a minute of work every month.

- More about how ETFs work Download for free - XTB's most popular ETF

Discussion of the article

Discussion is not open for this article.