Commercial message: Are you fed up with savings accounts and term deposits that won't even cover several months of inflation? At the same time, are you looking for a platform through which you could invest money in stocks, cryptocurrencies, commodities or indices? We tested the broker for you eToro, which offers all of the above and much more. The free mobile application will help you to successfully navigate the financial markets.

What can eToro do?

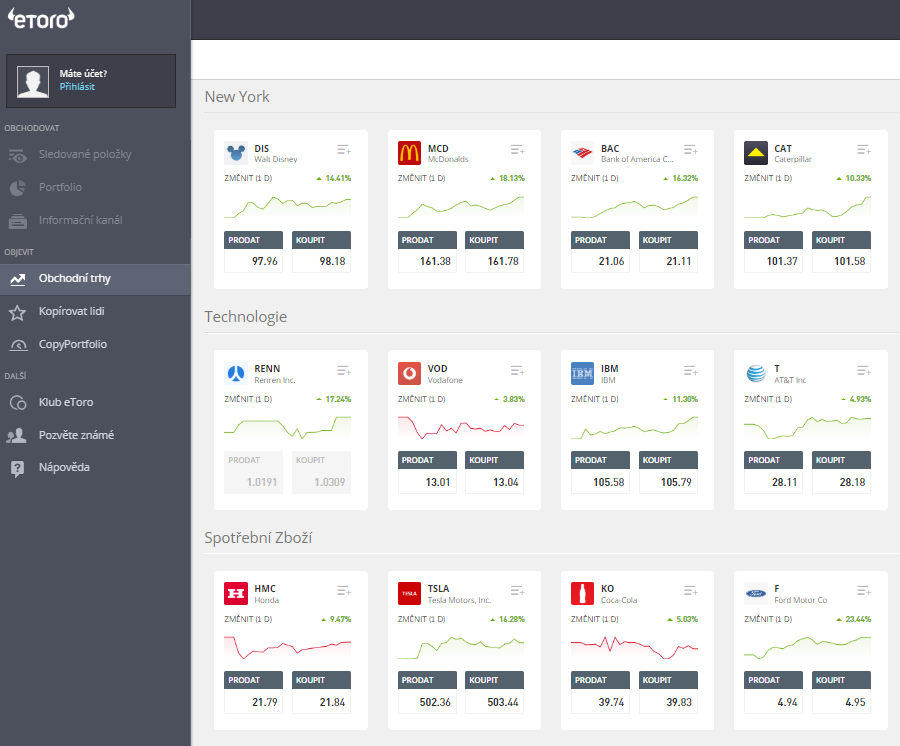

After free registration, just log in and familiarize yourself with the user interface. Many users will be pleased that all the administration is translated into Czech, so you don't have to worry about not understanding something. There is no need to upload money to your account immediately. Any purchase can be made in real time with so-called "paper money" on the demo profile. When you are more sure, it is possible to make the first deposit as a minimum 200 USD, which is a little over 5 000 $. Yes, even with such a small amount it is possible to start, you don't need hundreds of thousands.

What can I do? eToro invest? You can choose between foreign shares, commodities such as oil, gold, silver or cotton, as well as forex, stock indices and cryptocurrencies. Individual purchases of positions can be made from 50 USD.

All this sounds nice, but is your experience not high enough to be able to manage your own portfolio without financial loss? We understand, not everyone is a financial guru, but this platform has thought of that too. There are several million users trading on eTor and you can start copying any of them at any time and for free. Of course, you have access to all the data such as the average annual appreciation, the amount of risk, etc. An interesting strategy is to choose several traders at once and thereby reduce the resulting risk of loss.

There are many other functions available such as watchlist, maximum loss setting or financial leverage, but you will become familiar with this after using the application for a long time.

Registration

If you decide that you would like to invest real money, you need to fill out a registration form with personal data. Some might find it too detailed, but it is almost the same for all brokers.

After submitting the application, identity verification follows. Don't worry, you don't have to go anywhere. Just upload copies of two IDs. The first document can be a passport or an identity card. The second document must prove that your permanent address is real, so prepare a bank statement or mobile service bill. Attention, it must not be older than 6 months. If you are not familiar with board registration, read on detailed instructions on how to open an account.

eToro mobile app

The application is available for free as a pro Android so for iOS. It has been downloaded more than on Google Play 1 000 000 people. It is clear from the user ratings that this is a very popular app, try it yourself!

Deposits and withdrawals

You can deposit money into the trading account using a bank transfer (the slowest option), credit or debit card, or use internet wallets such as PayPal, Skrill, Neteller, GiroPay and Webmoney.

- minimum deposit 200 USD (via bank transfer 500 USD)

- the maximum limit is not limited

The downside is that withdrawals are charged an amount 5 USD, you can use the same options as when making a deposit.

An alternative for the more experienced

Definitely Plus500, which is one of the largest CFD brokers in the world, where you can also find Czech shares. It also works in the local language.

Finally

Etoro is a great tool for anyone new to investing in more than just stocks. Diversify your portfolio with cryptocurrencies or commodities with a few mouse clicks or directly on your mobile device.

*Investing in the financial markets is associated with many risks, always invest only as much as you are willing to lose. This article is for educational purposes only and is in no way intended to serve as a recommendation to buy or sell stocks, indices, ETFs, options, cfds, futures or other investment products. 62% of retail investors at the eToro broker experienced a loss when trading CFDs. 76,4% of retail investors at the Plus500 broker experienced a loss when trading CFDs.

Jablíčkář magazine bears no responsibility for the text above. This is a commercial article supplied (in full with links) by the advertiser.

Discussion of the article

Discussion is not open for this article.