Press Release: Consumer inflation is the enemy of money, causing it to lose value. Last year, due to rising energy prices and the war in Ukraine, we faced the second highest inflation since the independent Czech Republic was established, when this indicator rose to 15,1%. Although inflation is expected to slow down this year, estimates are still around 10%. According to the Czech National Bank, we should not return to single-digit inflation until 2024. So what should you do if you received bonuses at work and would like to keep their value or, ideally, gradually increase it? Thoughtful and long-term investments can be the solution.

A recent survey by the Capital Markets Association of the Czech Republic (AKAT) showed that our population is divided into three basic groups according to how we approach investments. We are either Savers, Savers or Investors. In the Šetřílk group, people don't bother to invest, and they don't save the money they have left over every month in any savings account, nor do they invest it. They simply use them for household operations and leisure activities. Savers, on the other hand, are fans of savings accounts and deposits, where half of them deposit more than CZK 3 per month. And then there are Investors. Unlike the two previous groups, they usually do not spend their savings or leave them in the account, but either already actively use investment instruments such as mutual funds and shares, or they are interested in this type of investment and are ready to try it.

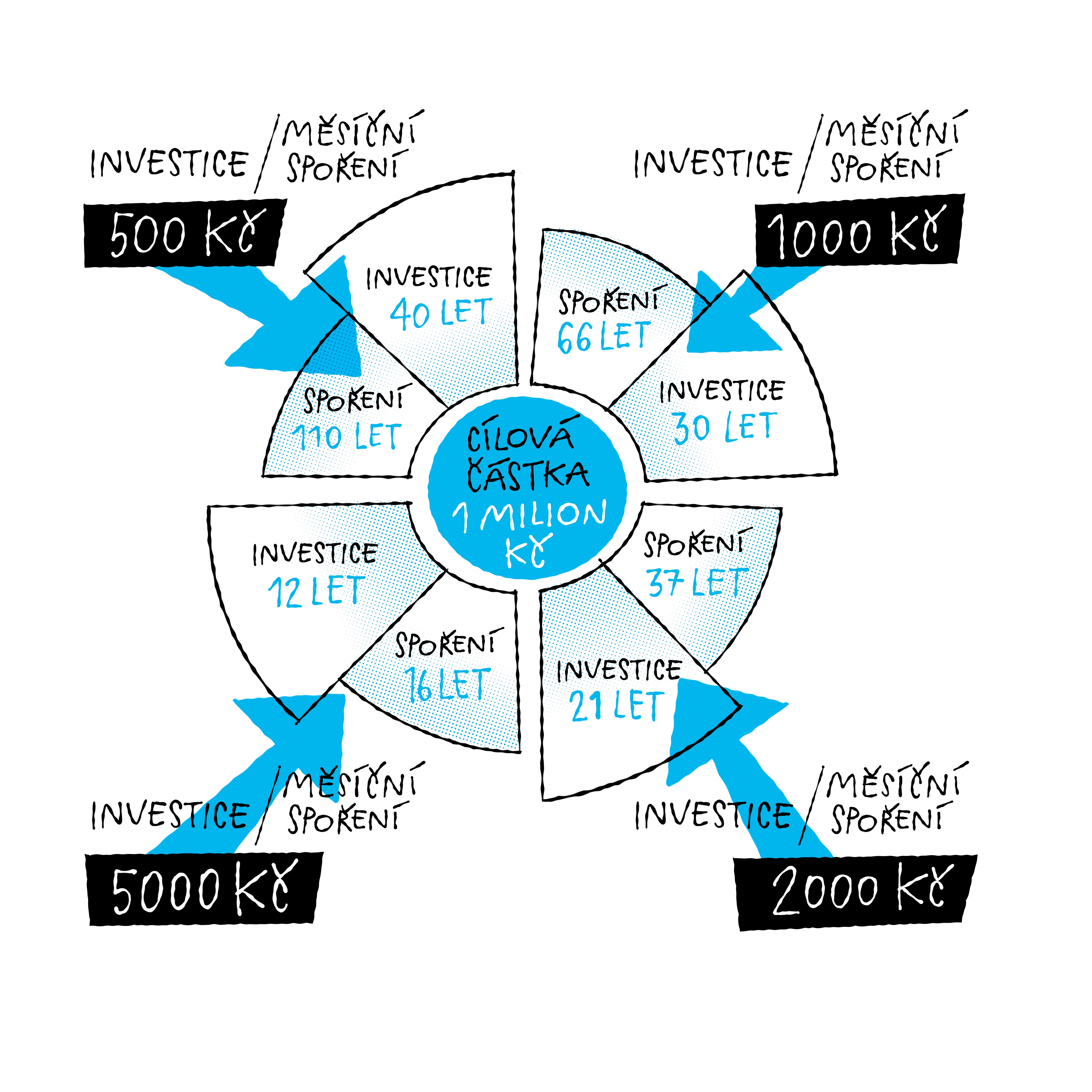

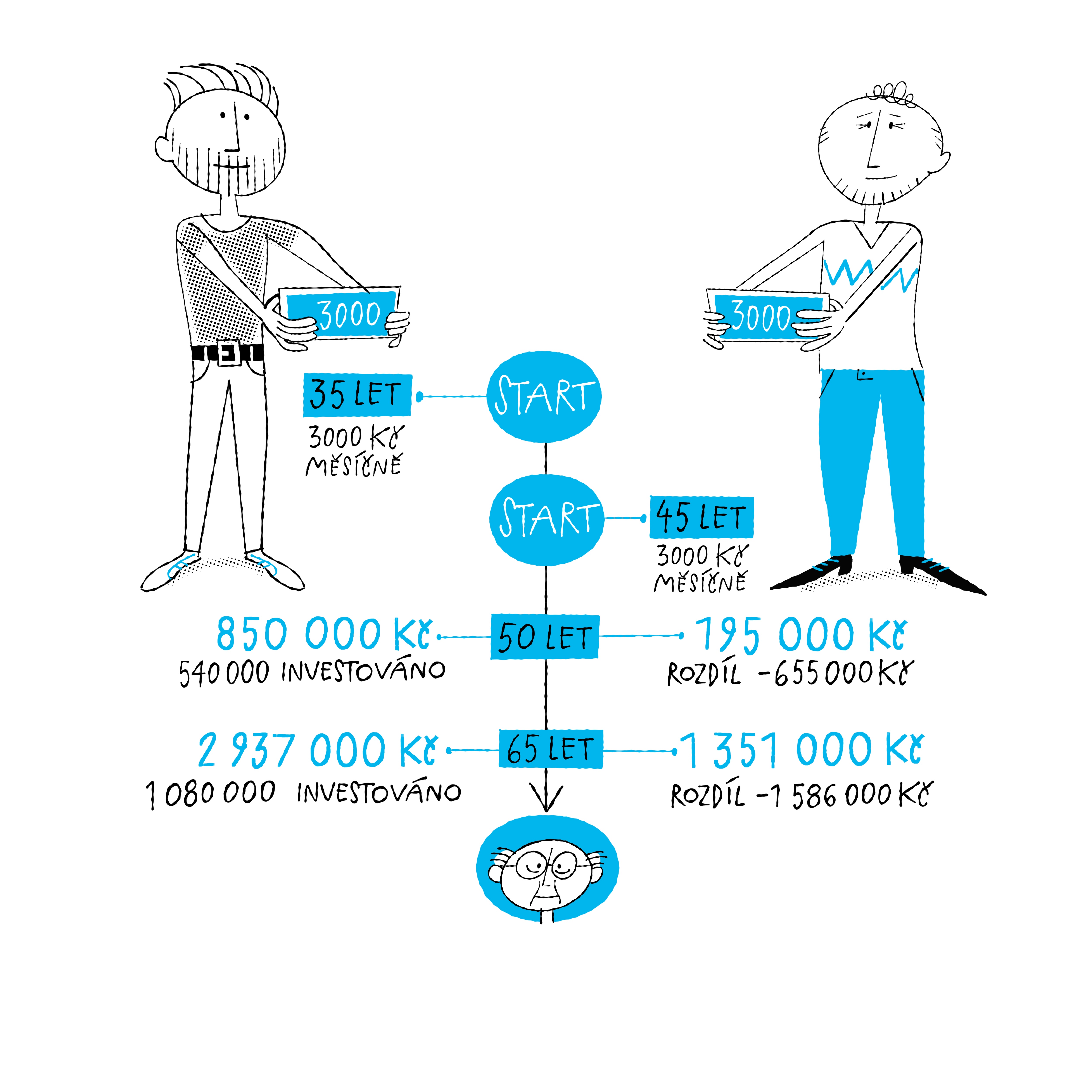

As can be seen from the picture above, reasonable and long-term investing makes sense for everyone. Limiting or postponing current consumption allows you to build up financial reserves that you can invest and ensure that their value will gradually increase.

The type of investment that is right for you depends on your individual situation. If you don't want to gamble unnecessarily, it makes sense to invest your money for the long term - the longer the better. "That way, you will have more time for real appreciation, gradual acquisition of income and compensation for possible fluctuations or declines in the stock markets. That is also why I would recommend starting to invest at a young age," says Markéta Jelínková, portfolio manager of the investment company Amundi. "For beginners and young people, mutual funds are definitely the best choice. It is enough to start investing even in small amounts, but regularly," he adds. It is definitely not recommended for beginners to invest in specific stocks, because without a thorough knowledge of how stock markets work, there is a relatively high risk of losing your money. With mutual funds, you don't have to worry about individual shares or securities, the fund is managed by its manager, who is an experienced expert and thus ensures the appreciation of your funds.

What do I actually need the money for?

Before you start investing, it's definitely a good idea to ask yourself a few questions. What are your investment goals? Do you have a specific thing that you want to buy, do you want to secure yourself for old age or build up equity? The key is to clarify what the time period of your investment is, i.e. how long you plan to save the money for investments and not withdraw it for other needs. Time plays for you and the longer the investment lasts, the more it earns.

If you are not sure what this would mean specifically for you, experts at banks or specialized investment companies can help you with all the unknowns. They will also help you find out what type of investor you are. Some prefer safety, while others, on the contrary, aim for the highest possible profitability.

To keep your money as safe as possible, a combination of safer and more profitable investments is recommended. In addition to the already mentioned mutual funds, there are of course other investment options, such as savings accounts, which currently offer a certain degree of protection for your money thanks to high interest rates or, for example, private pension insurance. Investments in real estate, precious metals or art are not very suitable for beginners, they both require a high initial investment and also often face large price fluctuations.

Experts from Amundi recommend that you always keep a reserve for unexpected expenses in your current account, usually at least two to three net incomes are recommended, and to diversify your money as much as possible, i.e. spread it among several instruments and protect yourself against possible fluctuations. What to do with the money you have left over or with the savings lying in your current account or even under your mattress at home, you will be advised by professional investment advisors, which you can find in your bank or in specialized companies. However, sensible and long-term investing is definitely a way to preserve and gradually increase the value of your money.

Illustrator: Lukáš Fibrich