Not only the stock prices of big tech companies, but of course cryptocurrencies are also experiencing a rather steep fall right now. Although it may not be so drastic for the first mentioned, bitcoin, ethereum and other currencies are not worth selling right now. But what is actually behind this situation? It's a number of different factors that just add up.

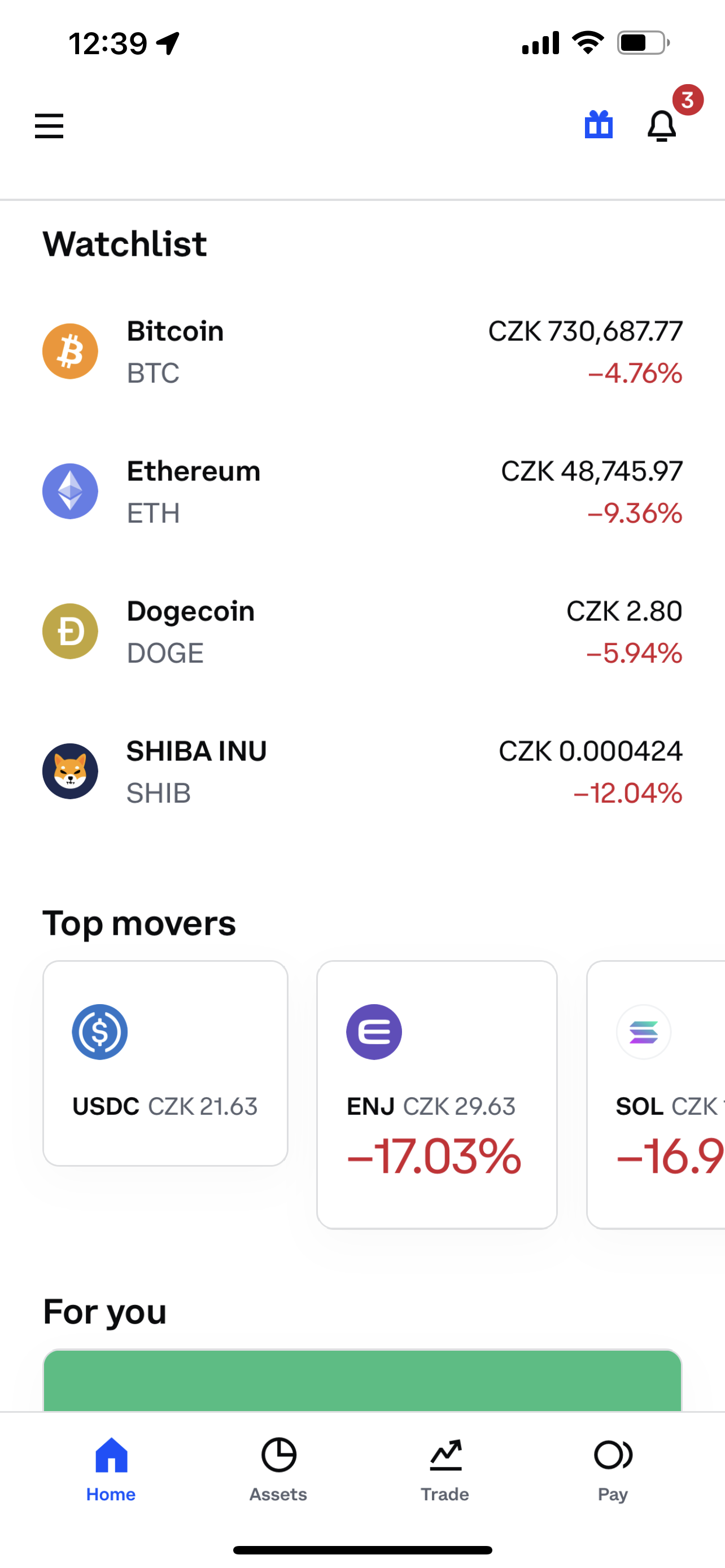

As of the date and time of writing the article, bitcoin is worth CZK 734. This is comparable to the one from last July. But in November, this cryptocurrency reached up to a million and a half. From the beginning of December, however, it more or less falls, and with the arrival of the new year, then relatively steeply. However, it cannot be said that this is something exceptional, because this behavior is quite common in the field of crypto-changers. Ethereum, Dogecoin, or the Shiba Inu, which skyrocketed in value in September of last year, are also falling, but have been steadily losing ever since.

It could be interest you

US Treasuries

The prices of technology companies and, subsequently, cryptocurrencies started to fall sharply last Thursday, January 20. The reason was a significant increase in the yields of US government bonds, due to which investors began to get rid of their positions in riskier assets, where cryptocurrencies are among the riskiest (the 10-year government bond yield traded above 1,9%). The US Federal Reserve is probably to blame. The latter plans to gradually increase interest rates, which may result in a continued decrease in the prices of stocks and cryptocurrencies.

Investing in Bitcoin and cryptocurrencies in general is usually resorted to by the general public as some sort of hedge against rising inflation. But as analysts mention, that would definitely not be the case this year. They are also influenced by regulatory authorities, which are trying to gradually clip the wings of cryptocurrencies. China has banned them completely, and Russia has proposed banning the use and mining of cryptocurrencies on its territory. Coincidentally, this was also just last Thursday, so these steps have a clear impact on the price. However, it cannot be said that the performance of crypto-assets must necessarily be related to the fall of the stock market.

It could be interest you

A clear factor cannot be determined

Many factors influence the price of stocks and cryptocurrencies. It also depends on which company succeeds with which product, which acquisitions it makes, and which financial results it publishes (we expect Apple's announcements covering the Christmas period already on January 27). Last but not least, of course, there is also the political situation. The result is a combination of everything, not only the main driver, but also the partial ones. Investments in stocks and cryptocurrencies are therefore very risky and no one can guarantee you a certain return. To do this, it is necessary to constantly monitor all events in the world and react accordingly in a timely manner.

In general, government bonds have a low level of risk, which is why they are popular among investors. States that are perceived as riskier must attract investors by paying higher interest because of the risk premium. The state most often invests borrowed money in infrastructure or to repay the national debt. In the Czech Republic, the state is the issuer. This is the Ministry of Finance, where the issue is ensured by the Czech National Bank through a so-called Dutch auction. The CNB also takes care of interest payments.

Flying around the world with Apple

Flying around the world with Apple