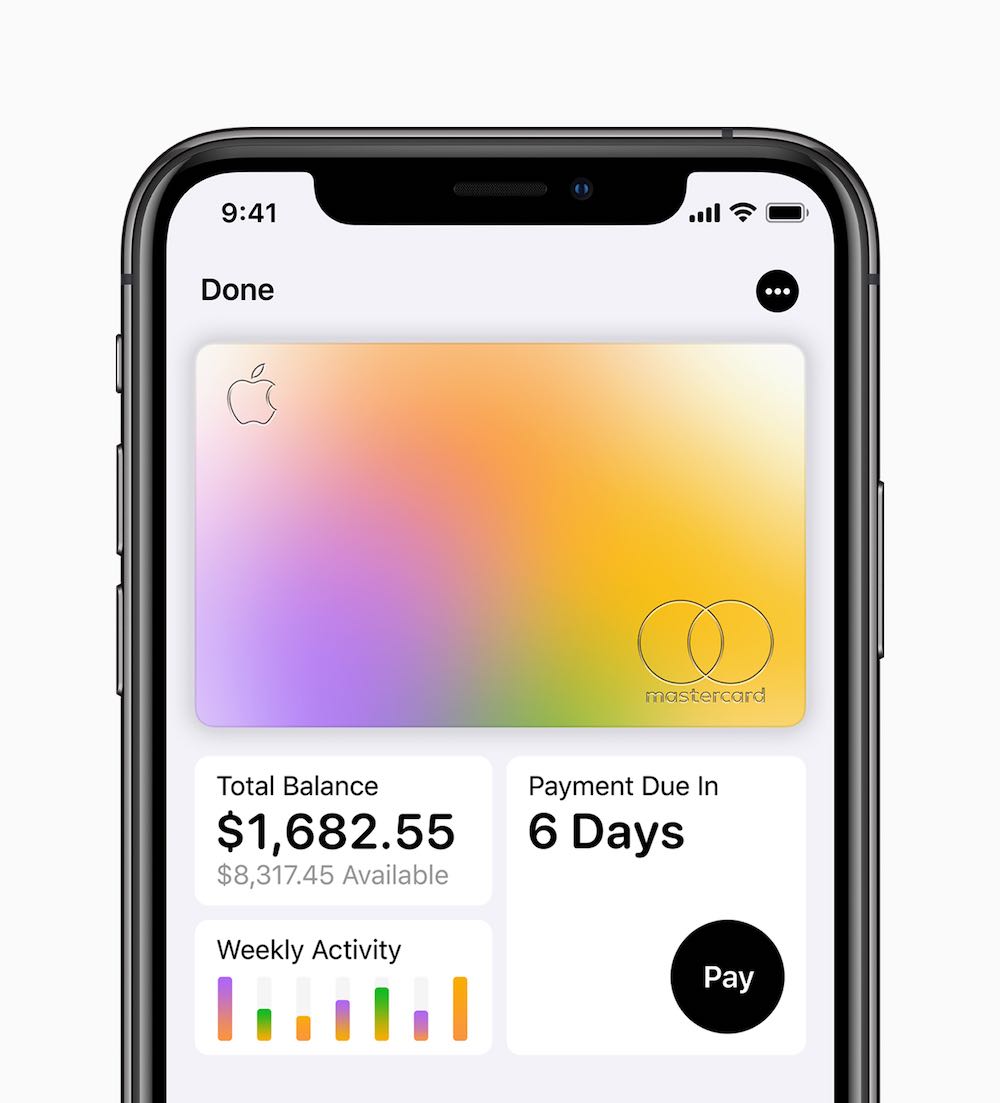

When Apple yesterday introduced its new Apple Card service, it was clear from the start that it would have a very limited scope. Even during the presentation, it was confirmed that Apple will only focus on customers in the US with its digital and physical credit card, among other things, because this is where the Apple Pay superstructure works in the form of Apple Pay Cash - which is the basic building block for the Apple Card. However, shortly after the introduction of the service, representatives of Goldman Sachs were heard to be exploring the possibility of expanding the service outside of the United States.

It is the banking institution Goldman Sachs that cooperates with Apple within the framework of the Apple Card. The CEO of Goldman Sachs confirmed in an interview that at the moment the targeting of the service is purely on the territory of the United States, but in the future they would like to see it spread to other parts of the world.

If that really happens, the logical choice falls on Canada and other English-speaking markets around the world, i.e. especially Great Britain, Australia and New Zealand. How the situation will develop will largely be determined by how well Apple succeeds in expanding the Apple Pay Cash service to other countries. At the moment, after almost a year and a half of operation, it doesn't look too glorious.

The very focus of the product also hints at the difficulties of expanding the Apple Card to other parts of the world. From the point of view of the American market, this is a completely logical step, as credit cards are extremely popular here and are used much more than in other parts of the world. Credit cards in the US bring several supposed advantages to their owners, whether it is different types of cash-backs, travel insurance, loyalty point programs or events/discounts on selected products and services. In Europe, the credit card system does not work to such an extent (which does not mean that credit cards are not used here).

So if expansion outside of the US ever happens, the resulting product will most likely be a lot more stripped down, especially with regards to the different types of bonuses. In the case of cash-backs, this is due to the fact that European laws require payment card operators to virtually eliminate fees for transactions at merchants. In the US, card and credit service operators can more easily "return" funds to customers in the form of cash-backs, as they have sufficient room for this due to the amount of fees collected from sellers. In Europe, purchase fees are more or less prohibited, and this makes any major cash-backs poorly generated.

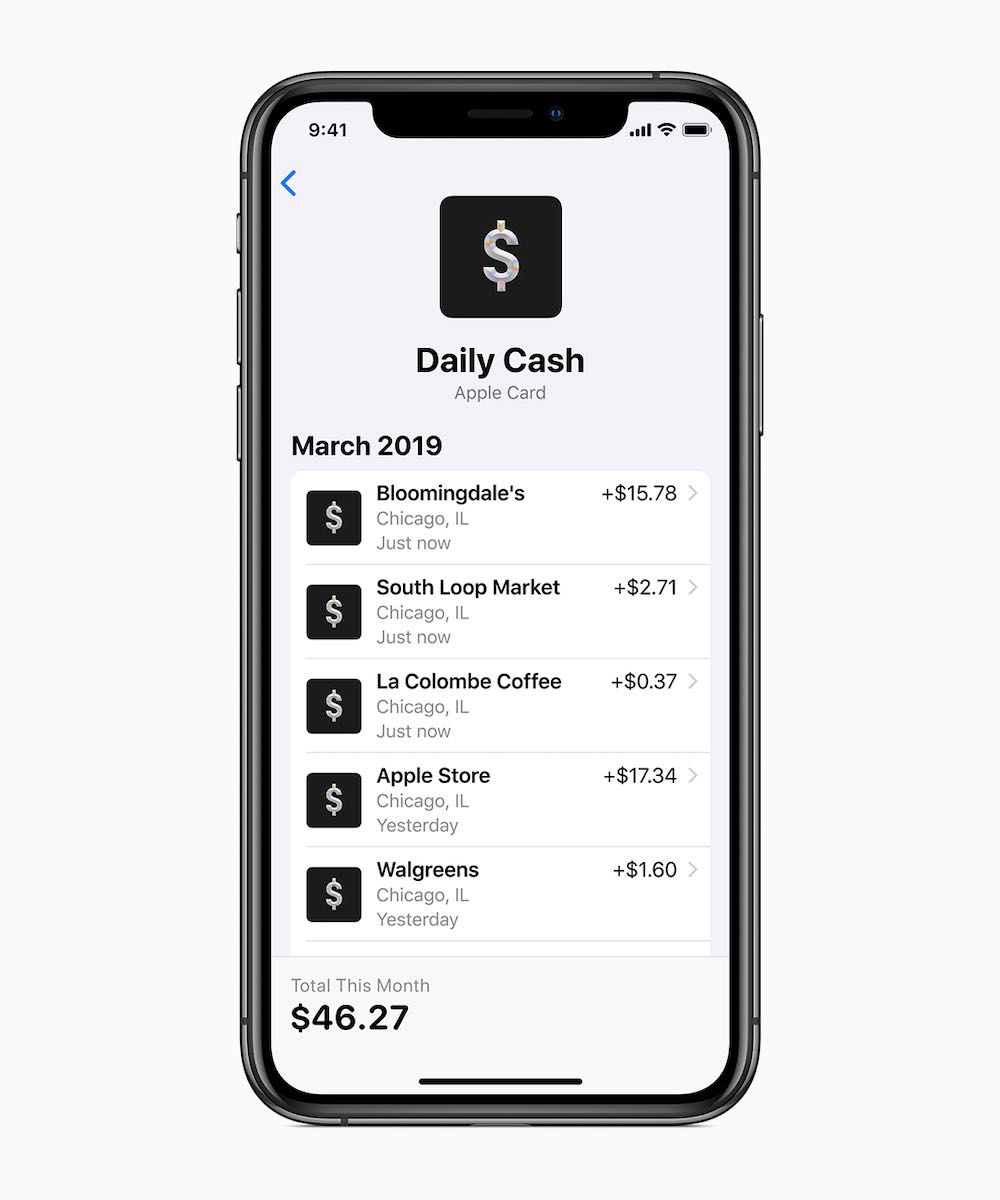

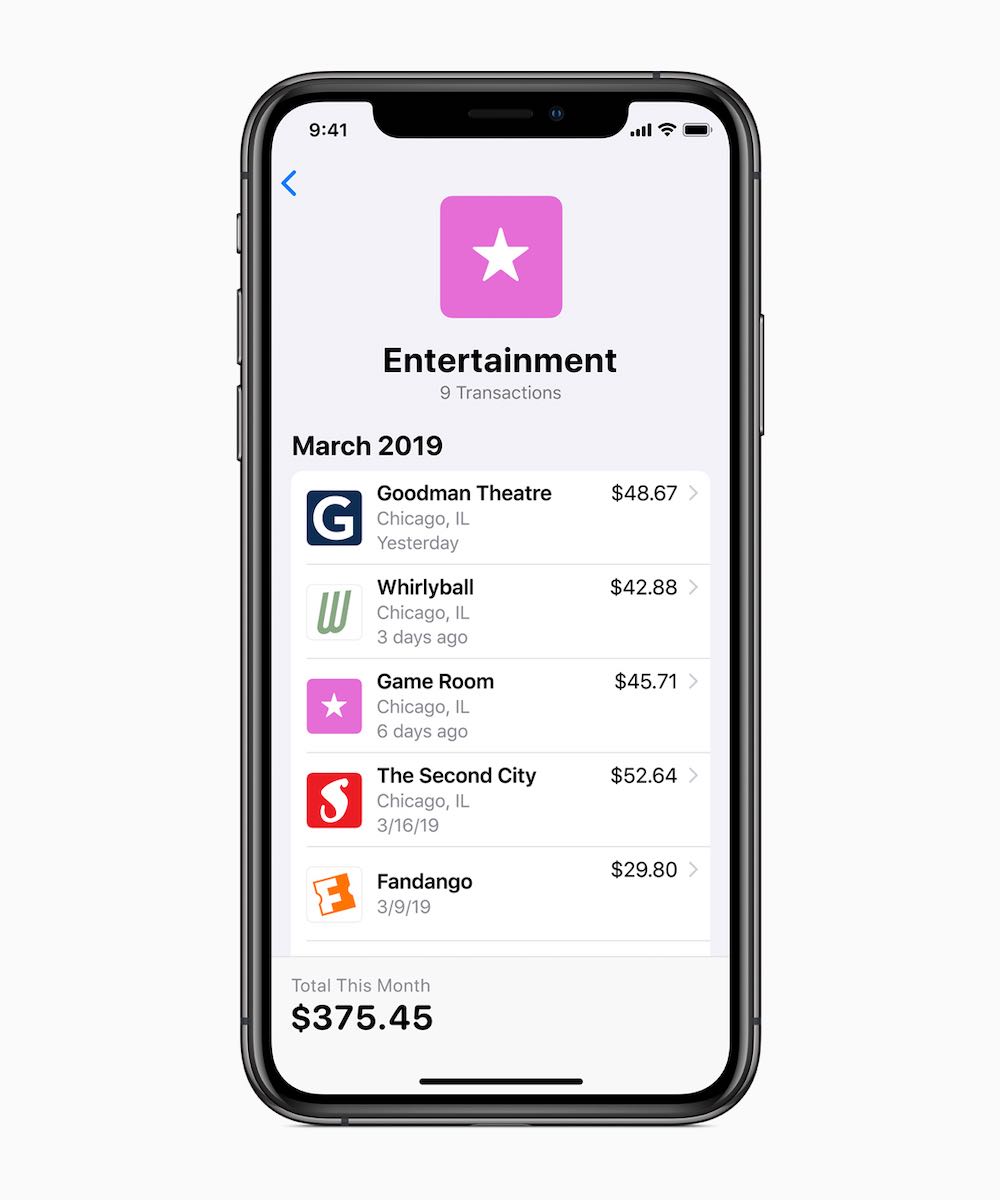

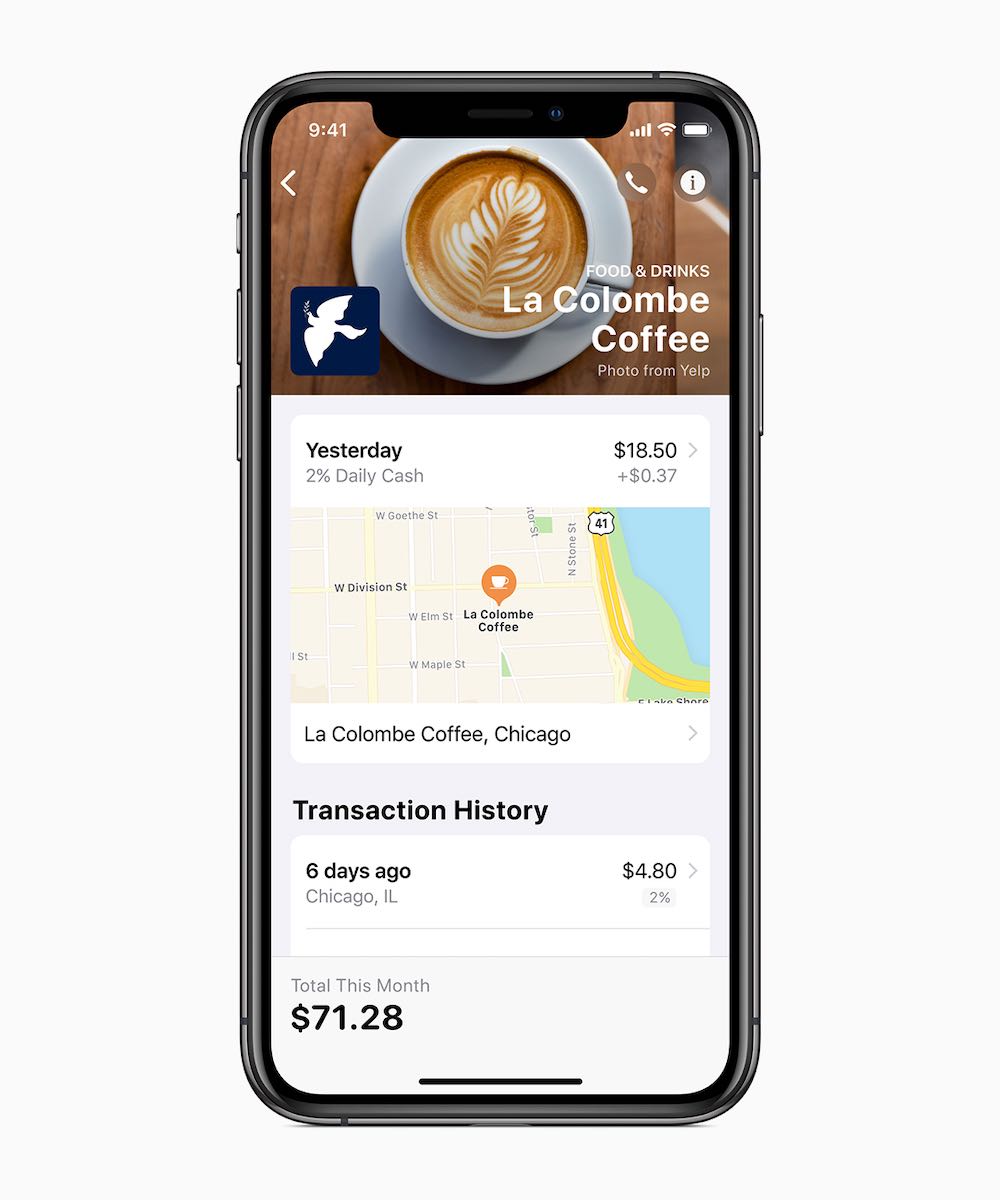

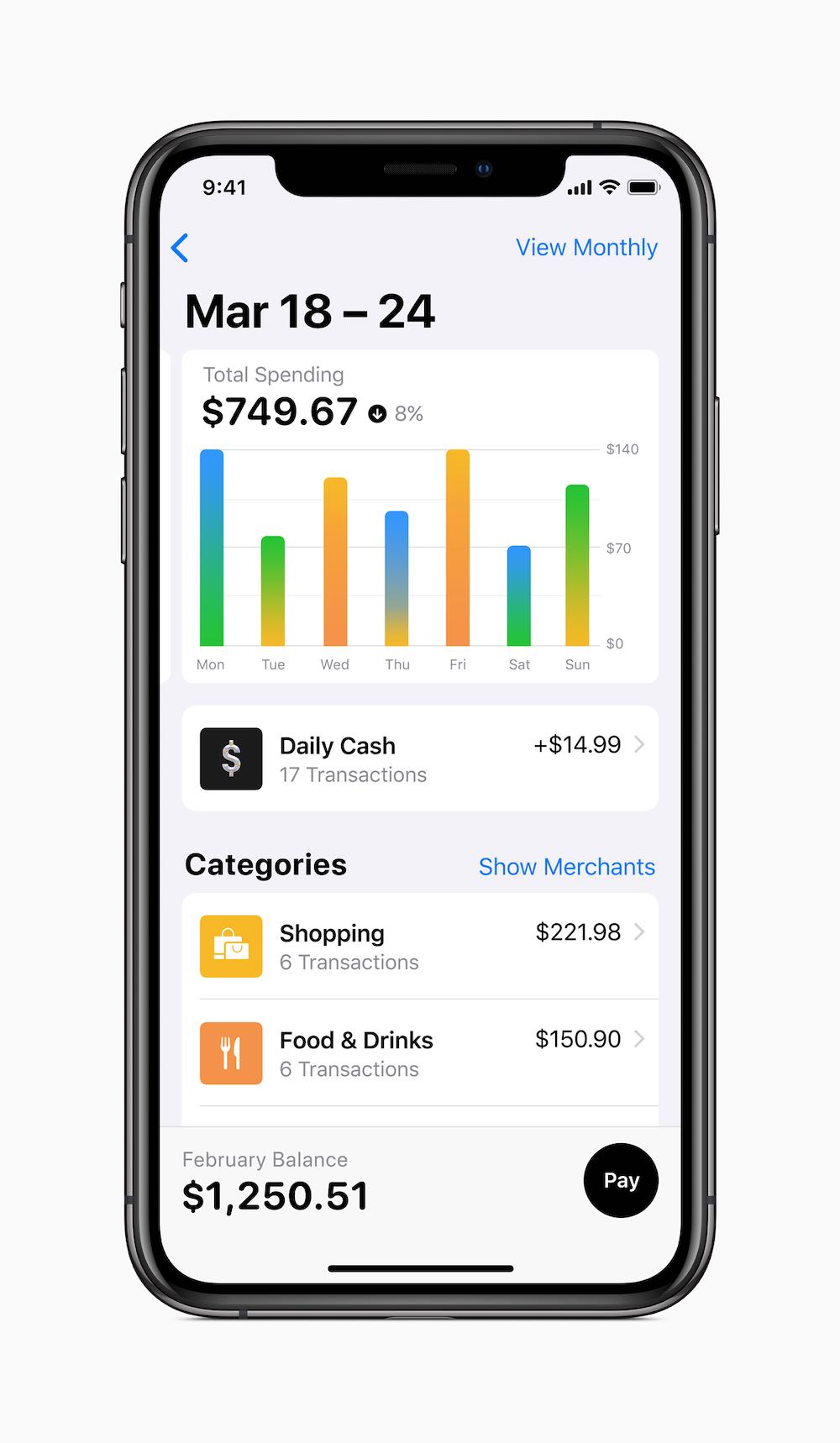

But the Apple Card isn't just about usage bonuses. For many users, the analytical tools that the credit card from Apple has in conjunction with Apple Wallet are of particular interest. The possibility of controlling the movement of funds, setting savings or various limits is very attractive for many potential users. That alone makes it worthwhile for Apple to expand this service to other parts of the world as soon as possible. However, how it will actually turn out, today, few people know.

It could be interest you

Source: 9to5mac