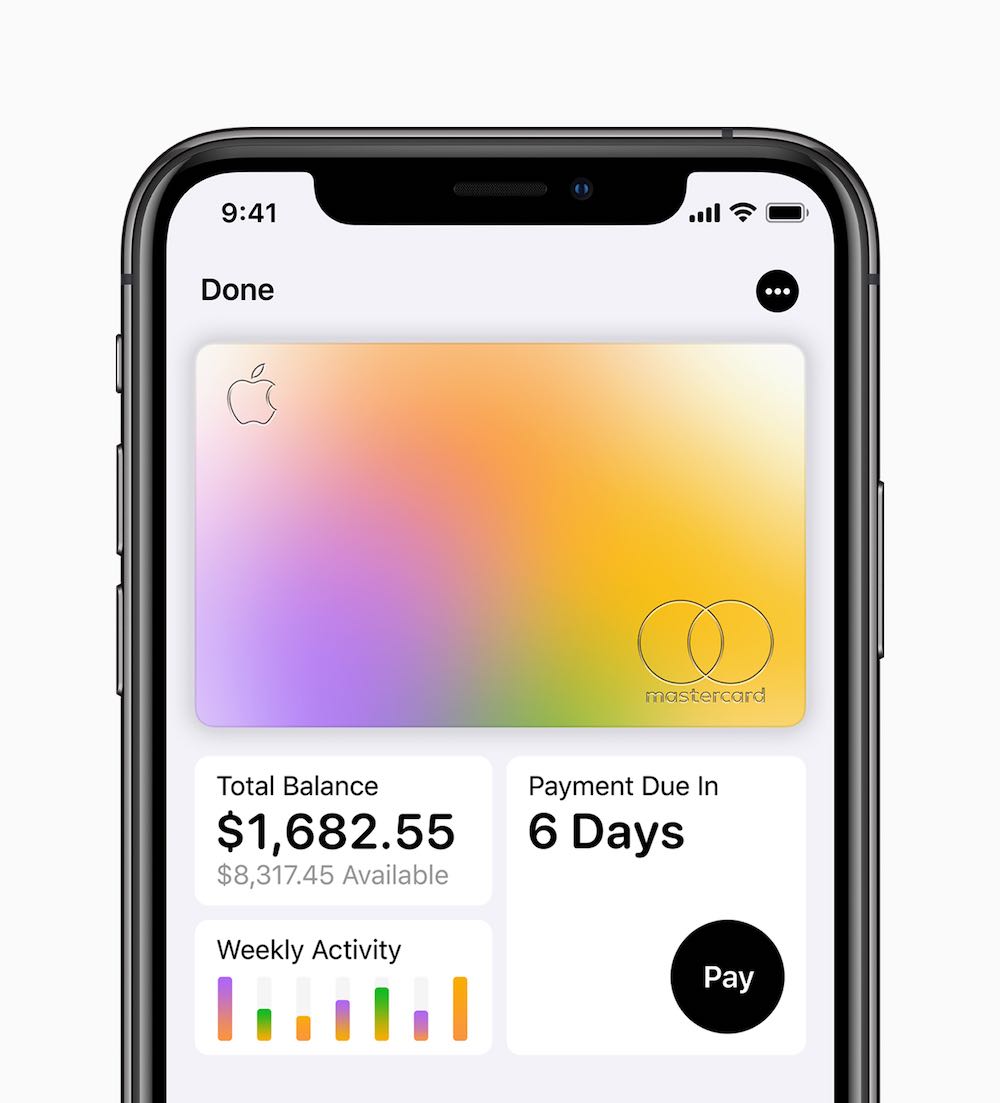

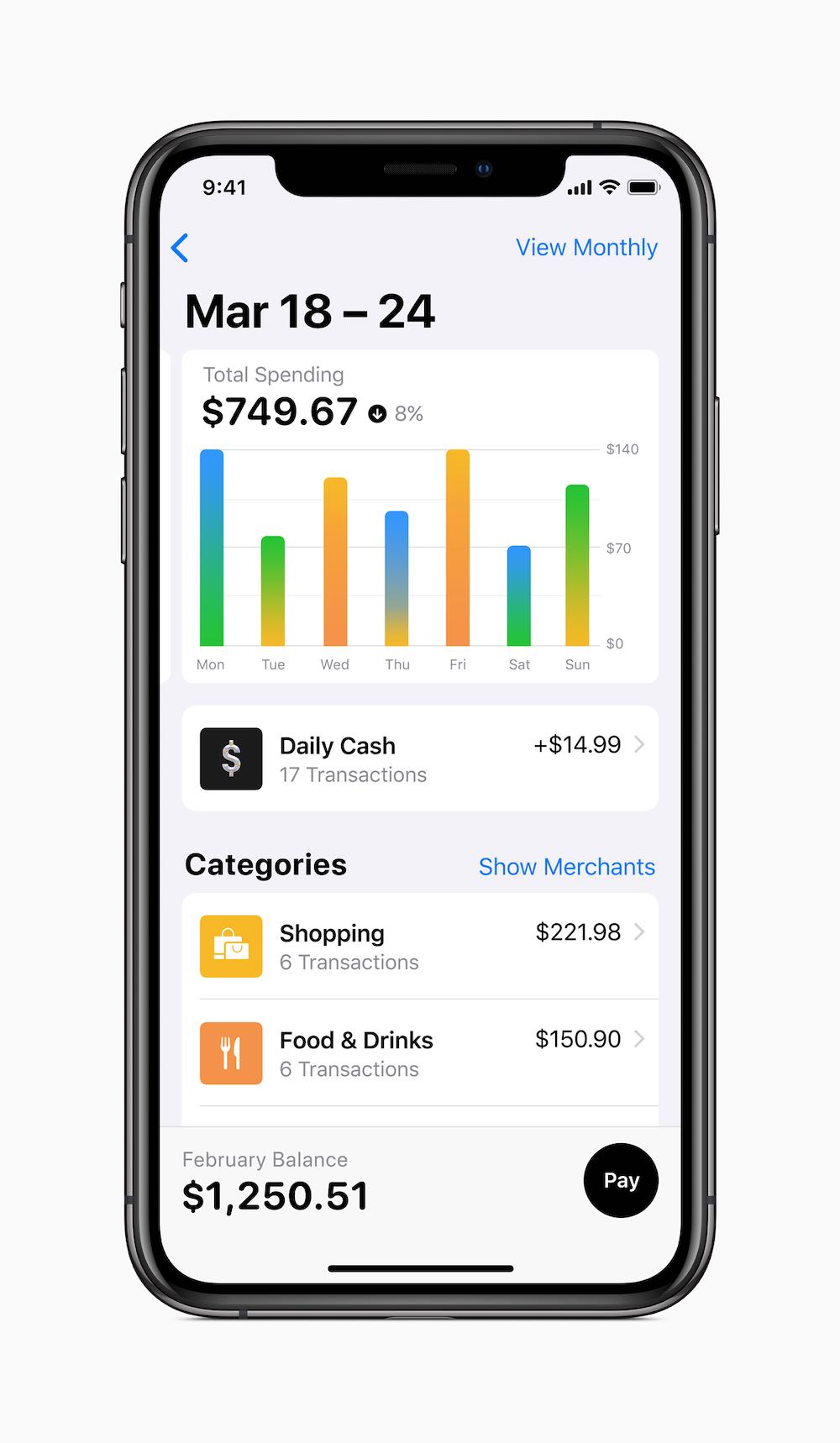

When Apple introduced the Apple Card at the beginning of the week, one of the main attractions was the announced complete absence of fees. In addition, under certain conditions, cardholders receive a cashback option of 1% to 3%. So how does Apple Card generate revenue for a business?

Of course, there is some interest associated with the use of the card in case its owner does not pay the relevant installments on time - but this alone, according to banking industry experts, is not enough to make the card profitable for Apple. Several of them gave an interview to Business Insider magazine, in which they said, for example, that while Apple talks about low interest rates, their range is actually not that unusual.

The fine print at the bottom of the Apple Card notice talks about variable interest rates ranging from 13,24% to 24,24%, a wide but not unusual range. Even if the company charged lower interest rates, the proceeds from them could generate a decent income for him.

"Credit card interest rates are very high, so there's room to make money at lower rates," Jim Miller, vice president of banking and credit cards at JD Power, told Business Insider.

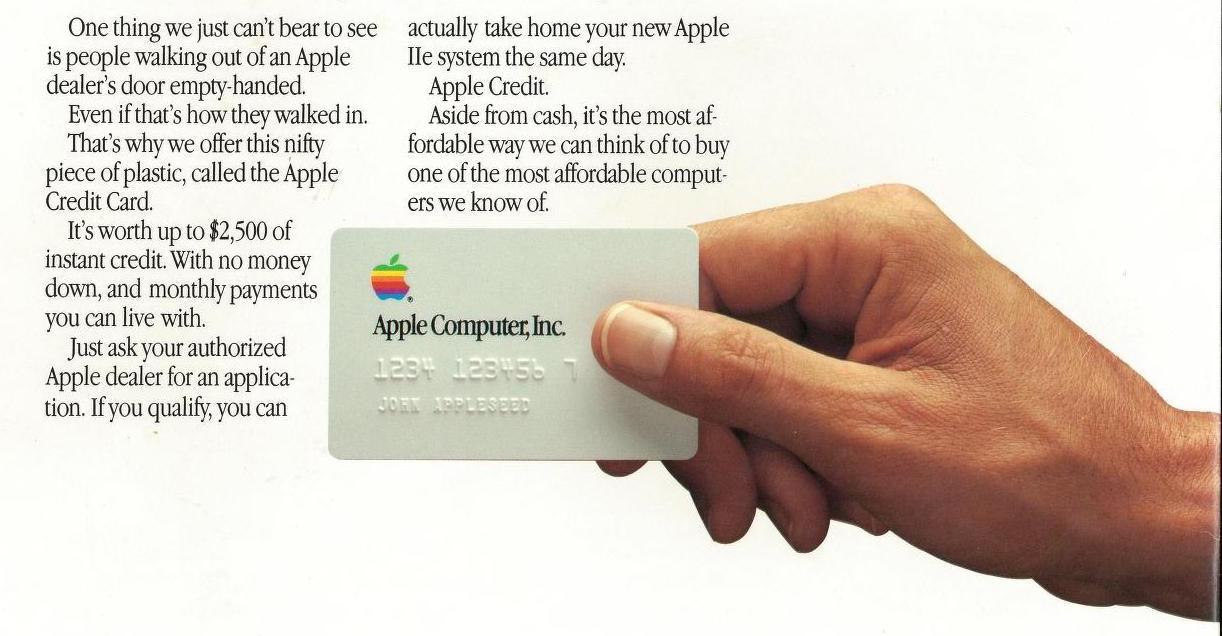

While Apple doesn't charge its credit card holders any fees, it can charge merchants, in large rather than small amounts. Merchants typically pay card issuers around 2% for payment processing.

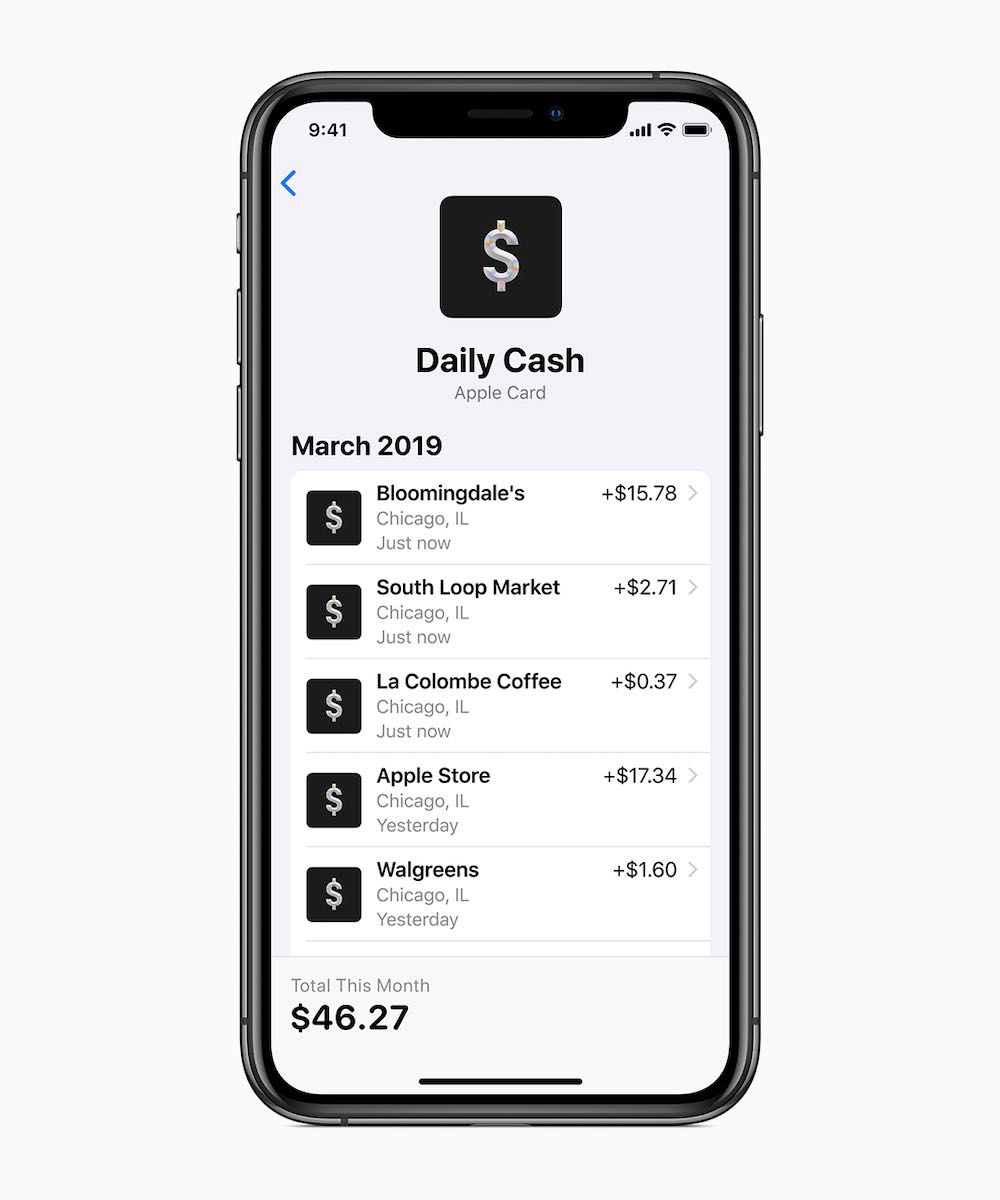

According to experts, Apple can also keep more of the interest paid by customers, thanks to four key savings. Credit card companies usually spend a portion of their funds on acquiring new customers. These expenses include investments in advertising and marketing, or bonuses, with the task of attracting new clients. However, Apple already has relatively fertile ground prepared in this direction, so these investments do not have to bother him.

The second point is the lower probability of fraud related to the Apple Card, which is really secured to the maximum in this regard. Transactions will be authenticated using Face ID and Touch ID. Thanks to the clarity of movements on the Apple Card, a significant number of customers investigating unrecognized payments, and thus also the costs related to the detection of these payments, will be eliminated. Additionally, the one percent that Apple gives back to customers for purchases of its own products could ultimately prove to be an expense that is negligible compared to current interchange fees.

It could be interest you

Source: 9to5Mac