Press Release: Natural gas is currently a hot topic, mainly due to the current situation in Ukraine and the approaching winter. Although this topic is very current, it is quite difficult to get your bearings in the whole matter.

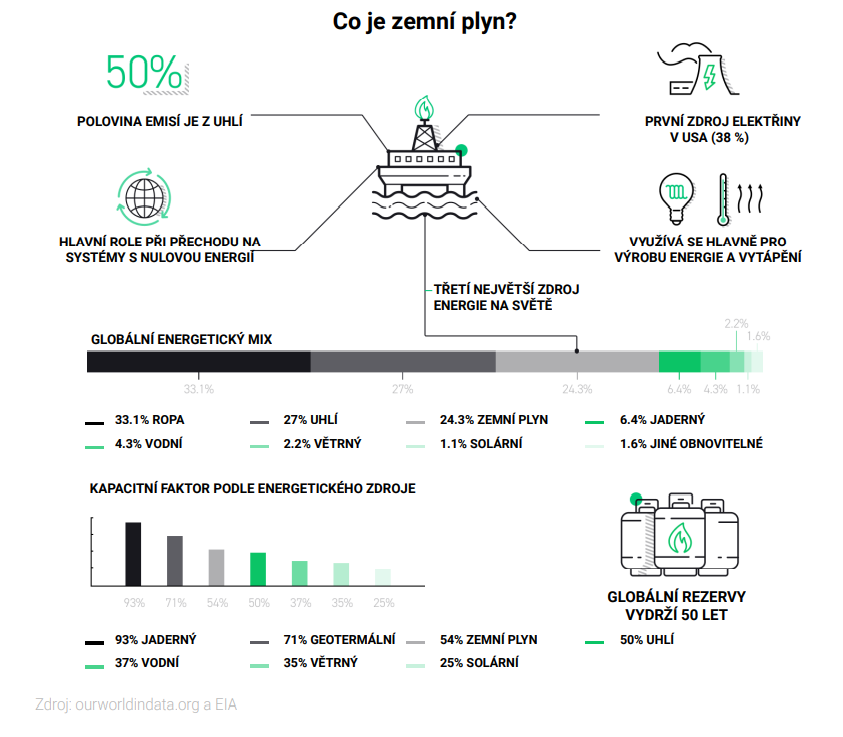

Natural gas (NATGAS) is considered to be the fossil fuel with the lowest carbon footprint in the world, so it has little impact on the environment, as emissions from its combustion are twice as low as coal. Unlike coal or nuclear plants, gas plants can be turned on and off very quickly, providing great flexibility in terms of the country's energy mix. This is why gas-fired power plants have become very popular in both Europe and the United States, while coal-fired power plants are slowly being phased out. Gas is one of the most popular heating commodities in average households.

Thus, the total dependence on natural gas was considered a relatively positive thing until recently. However, due to the fact that a large part of European consumption comes from Russia, the prices de facto "shot up" immediately after the outbreak of the conflict, because the support of Ukraine in this conflict could end up "closing the faucet", which basically happened in the end.

However, the roots of the story go much deeper. Germany's decision to build the Nord Stream gas pipeline led to a significant drop in gas production throughout the European Union. Production has been cut by as much as half compared to peak levels seen just before the 2008-2009 financial crisis.

The next phase of the story was the COVID-19 pandemic and a reduction in gas imports due to low economic activity in Europe and very difficult winter conditions that pushed natural gas stocks to record lows. At the same time, Russia stopped the sale of gas on the spot market in Europe and limited the filling of its own reservoirs in Germany, which was probably a preparation for blackmailing Europe at the time of its aggression against Ukraine. So when the invasion really started, everything was ready for a rocket growth in the prices of natural gas (NATGAS), but also of other commodities.

Russia initially honored the long-term supply contracts, but at some point mandated payments in rubles. Russia suspended gas transfers to countries that did not agree to these terms (including Poland, the Netherlands, Denmark and Bulgaria). It subsequently reduced and eventually suspended gas transfers to Germany due to technical problems, and at the beginning of the final quarter of 2022 continued to transport only via Ukrainian and Turkish pipelines. The latest culmination of this situation is the sabotage of the Nord Stream pipeline system. At the end of September 2022, 3 lines of the system were damaged, which is most likely not related to a force majeure, but a deliberate act aimed at further destabilizing the EU energy market. As a result of these actions, 3 lines of the Nord Stream system could be shut down for up to several years. Heavy dependence on Russian gas and other commodities such as oil and coal has led Europe to the biggest energy crisis in history, coupled with high prices and shortages of raw materials.

With winter coming, it is likely that the current natural gas situation will not be resolved anytime soon. However, even this generally unfavorable situation can be a potential opportunity for individual investors and traders. If you are interested in this issue, XTB has prepared a new e-book focused on this topic.

In an e-book NATURAL GAS SUMMARY AND OUTLOOK you will learn:

- Why does the topic of natural gas arouse such interest?

- How does the global gas market work?

- How to analyze the gas market and how to trade gas?