The arrival of Apple Pay in the Czech Republic pleased a large number of Apple device owners and earned considerable media attention. Even the banks themselves, which offered it in the first wave, enthusiastically presented their support for the service to their clients. But while users won't pay a penny when using Apple Pay, it's the exact opposite for banking and non-banking institutions, and Californian companies will pay millions in fees.

For Apple, services play a premium, so it is not surprising that it also pays properly for Apple Pay. While rival Google Pay costs banks almost nothing, Apple charges hefty fees. For Google, mobile payments represent another supply of valuable information about users - how often they spend, for what and exactly how much - which they can then use for marketing purposes.

In contrast, Apple Pay brings completely anonymous payments, where the company, according to its own words, does not store any information about payments or payment cards - these are stored only on a specific device and a virtual card is used for payments. Thus, Apple compensates for the benefit of the service through fees, which it does not require from the users themselves, but from the banking houses.

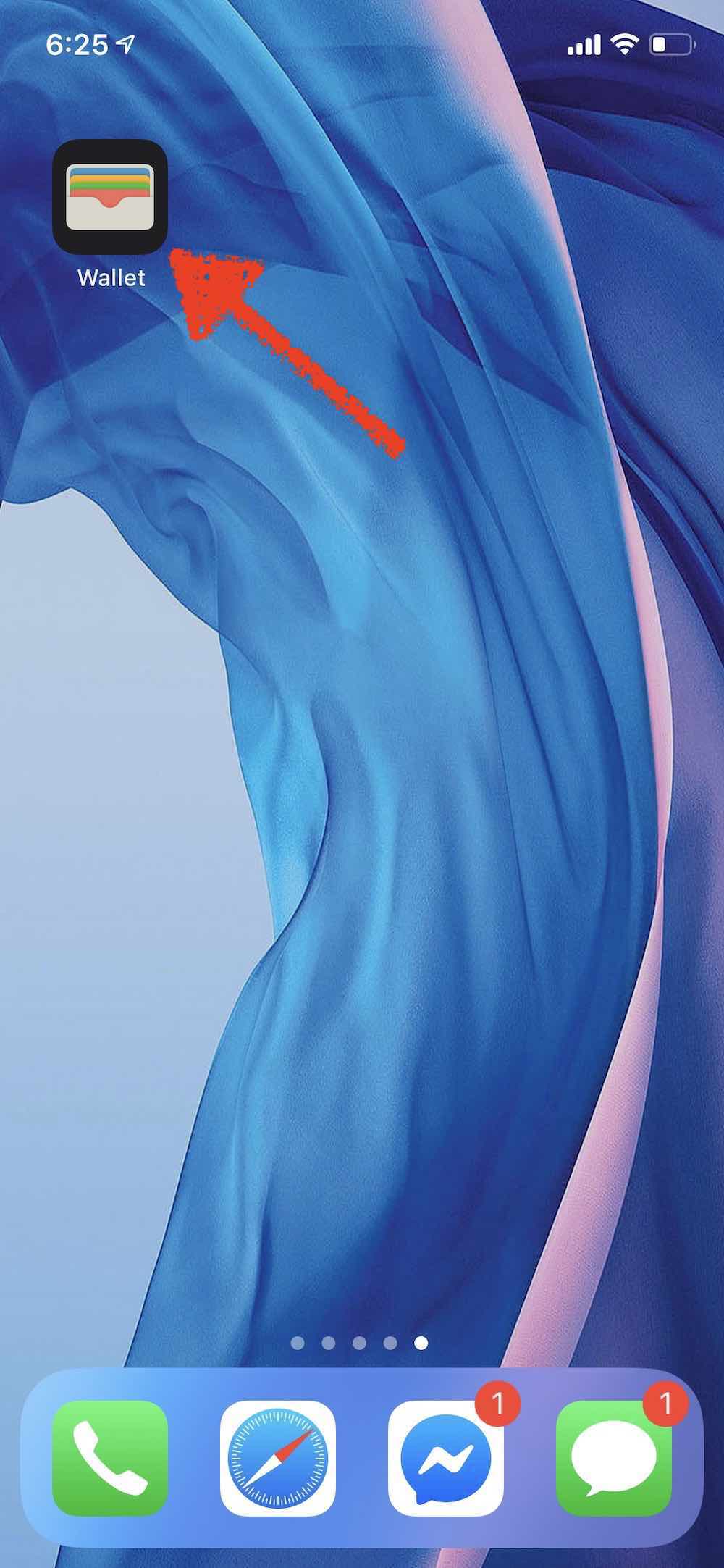

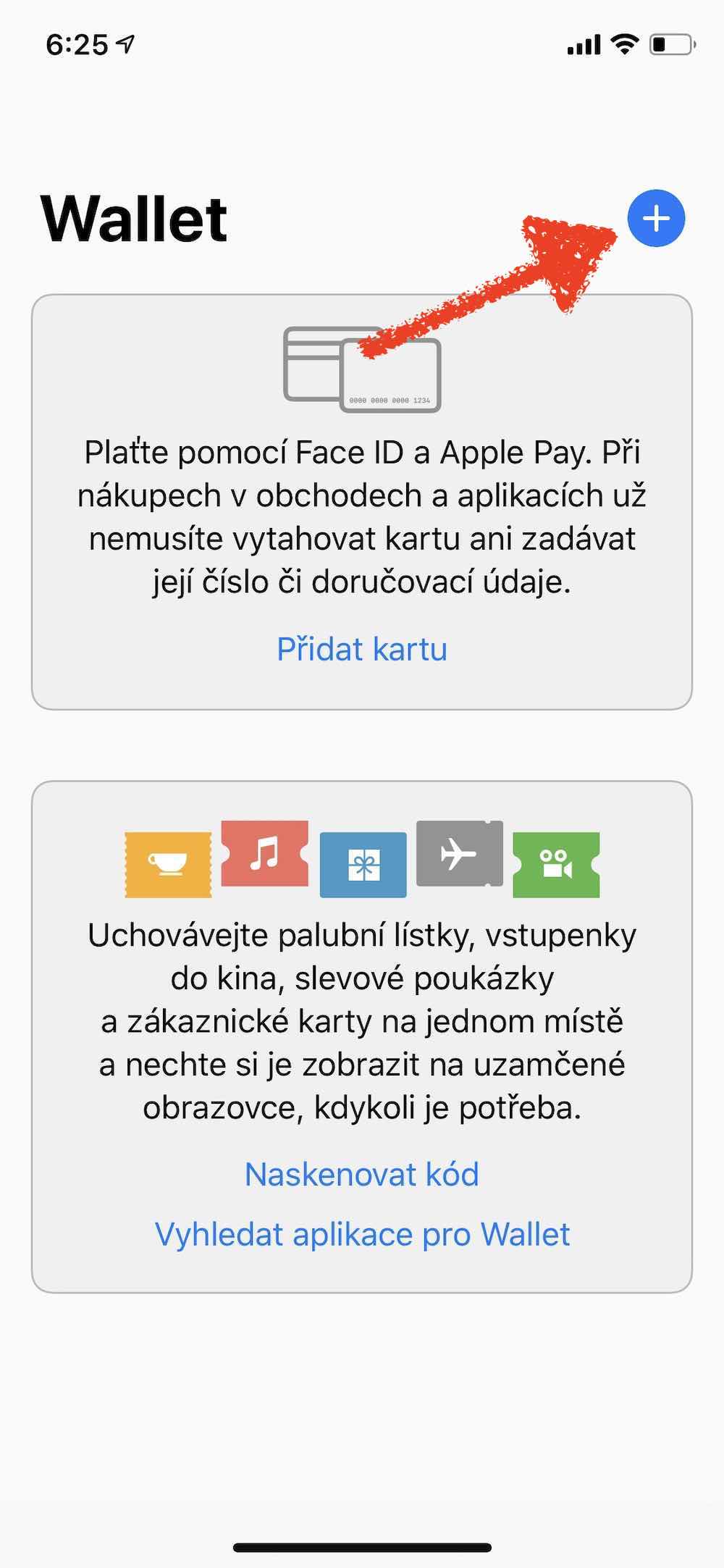

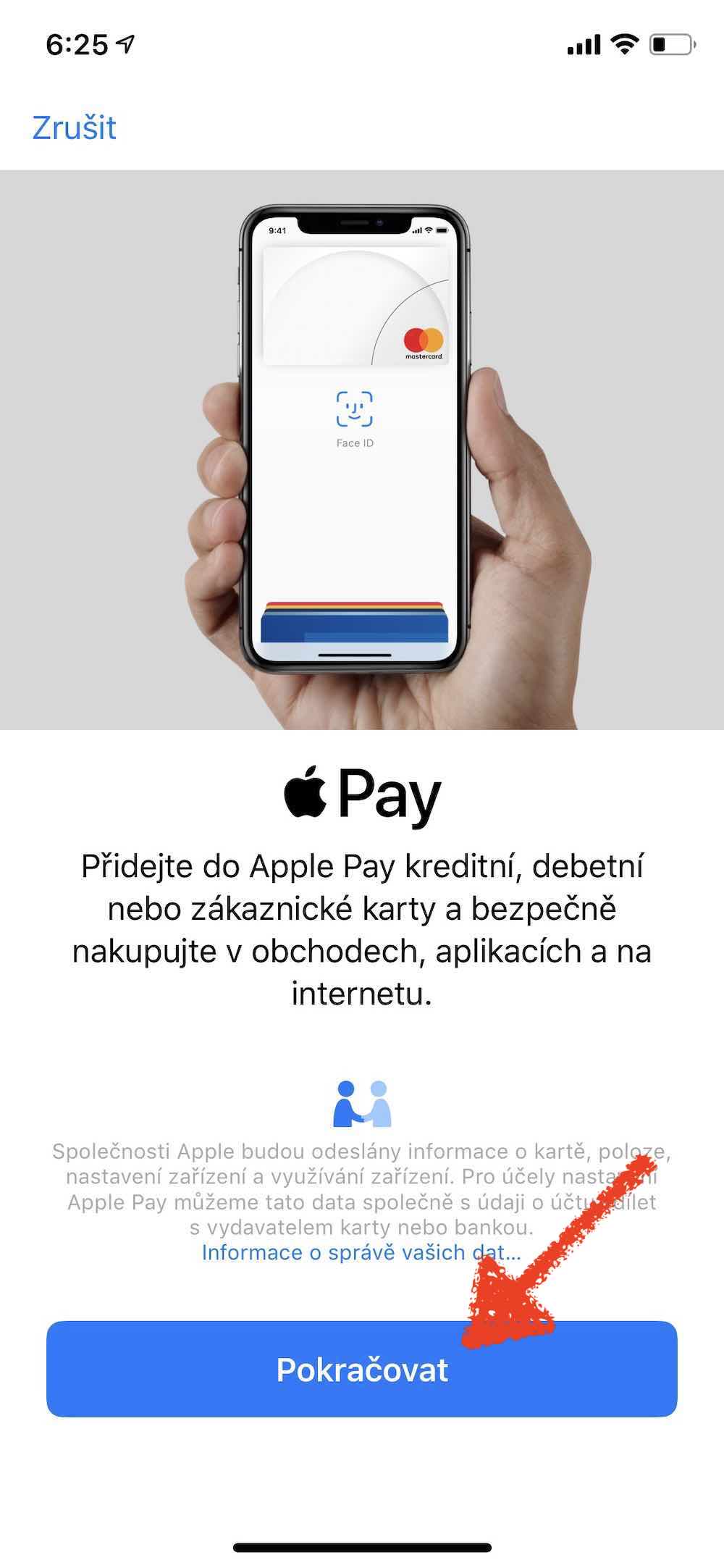

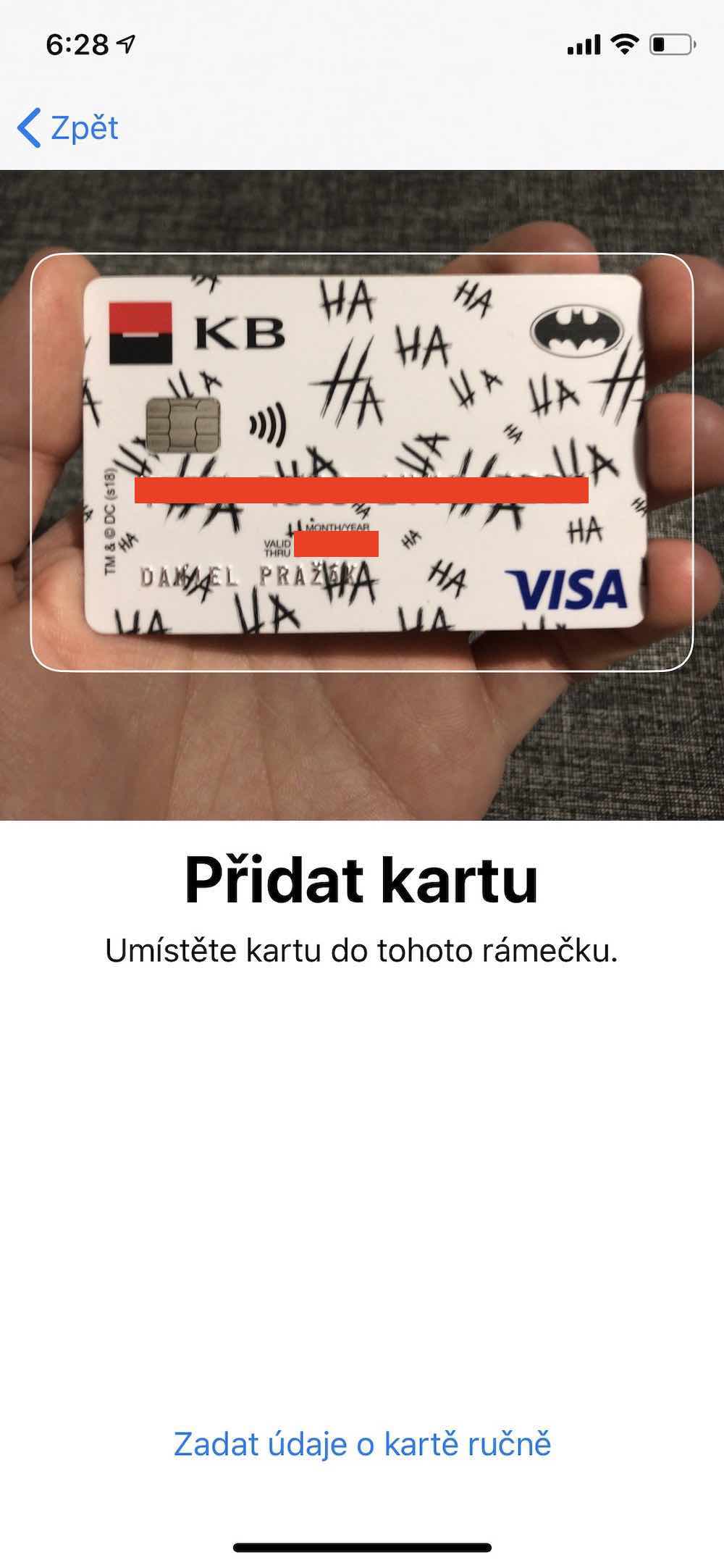

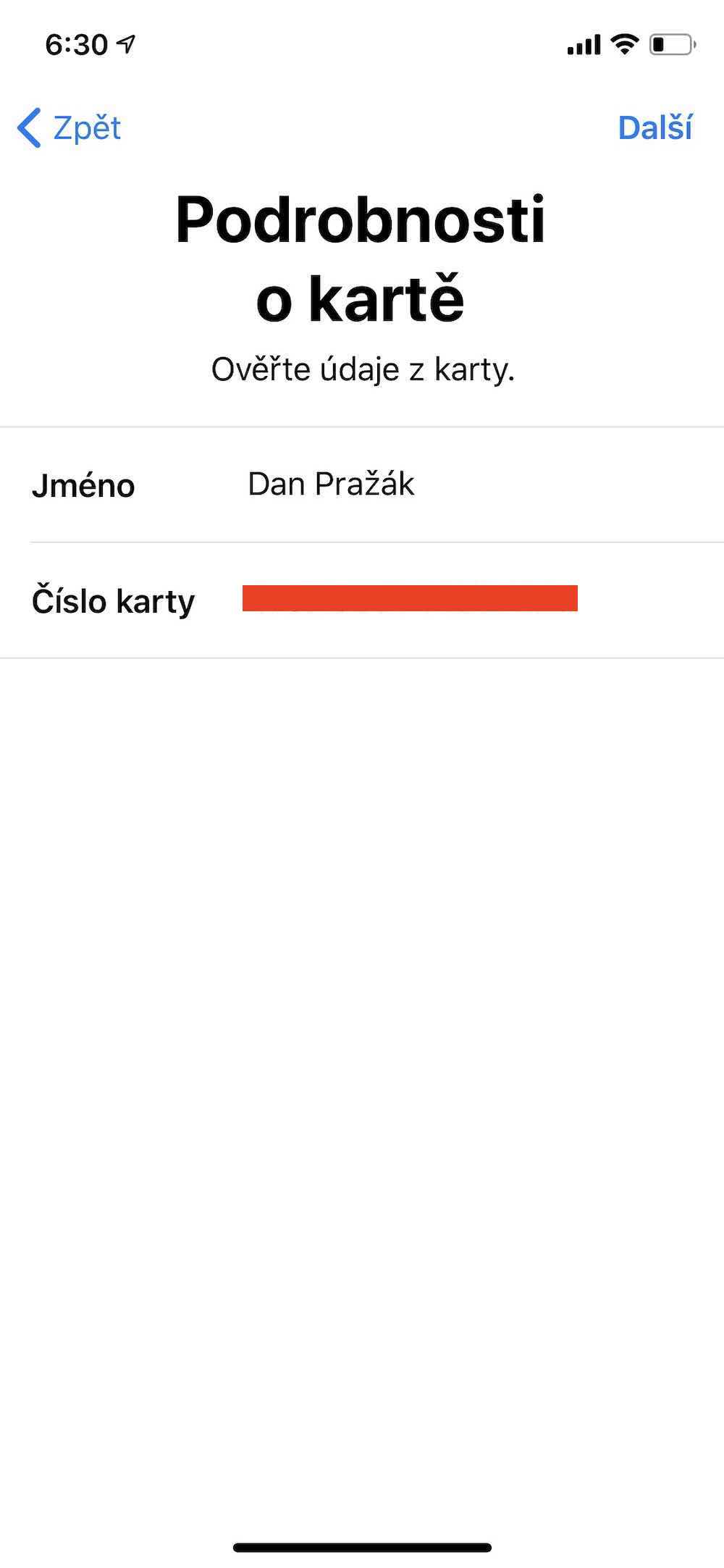

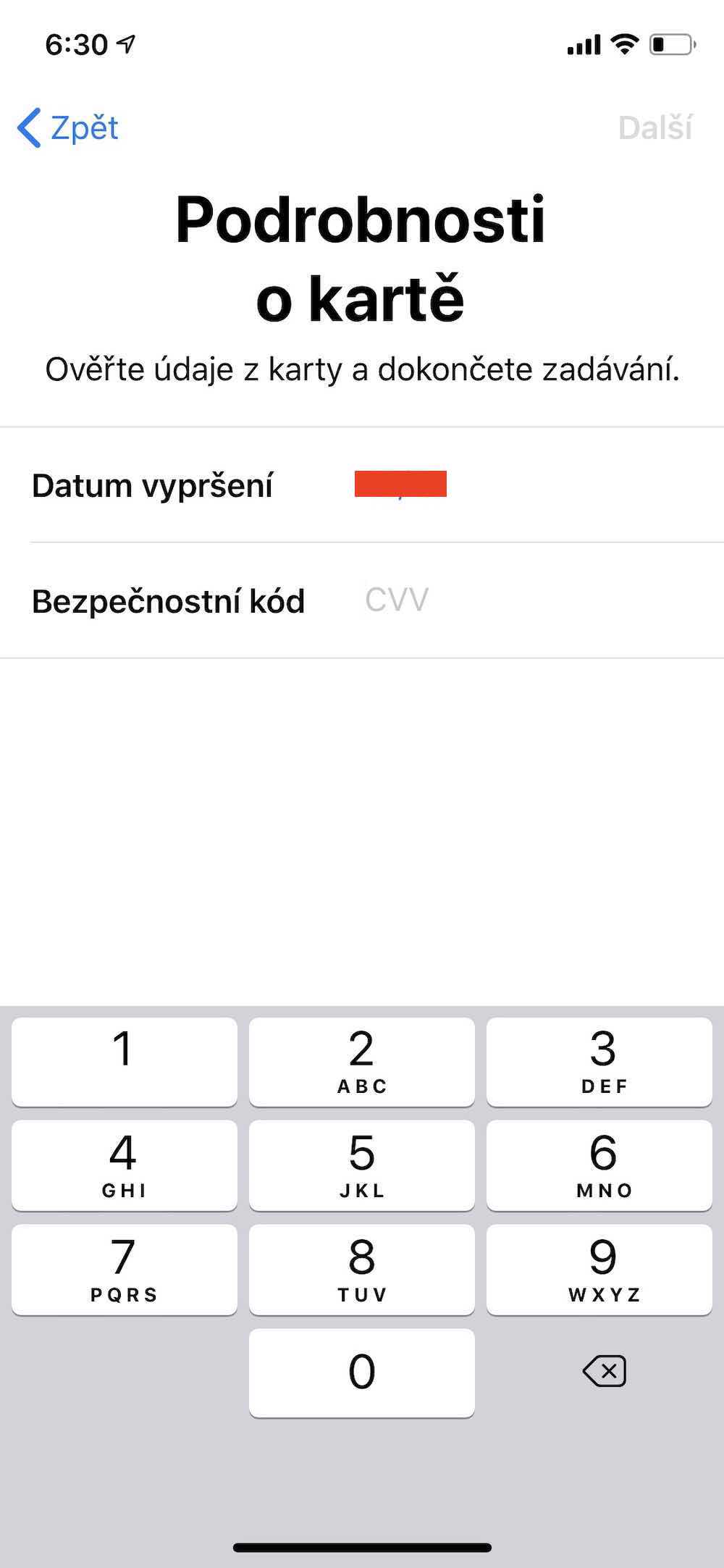

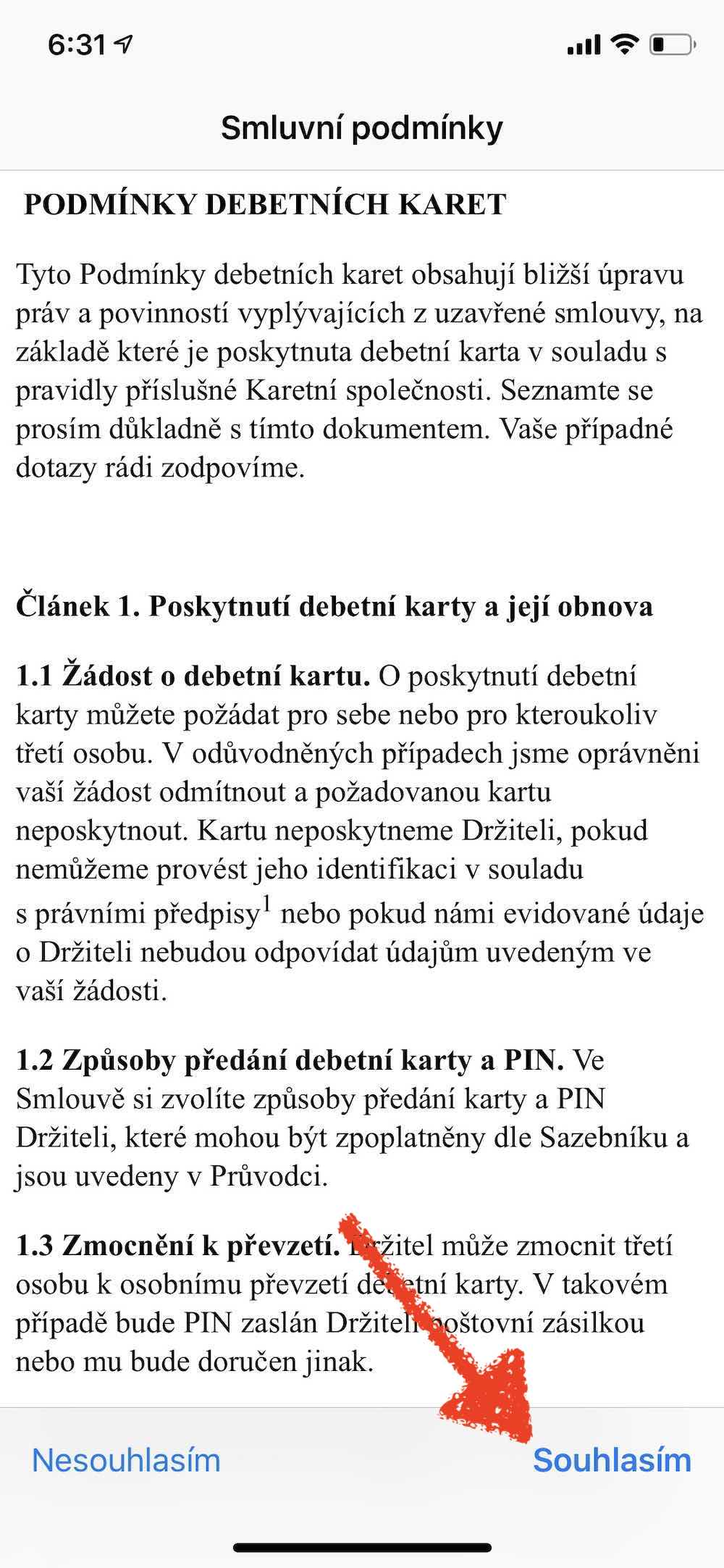

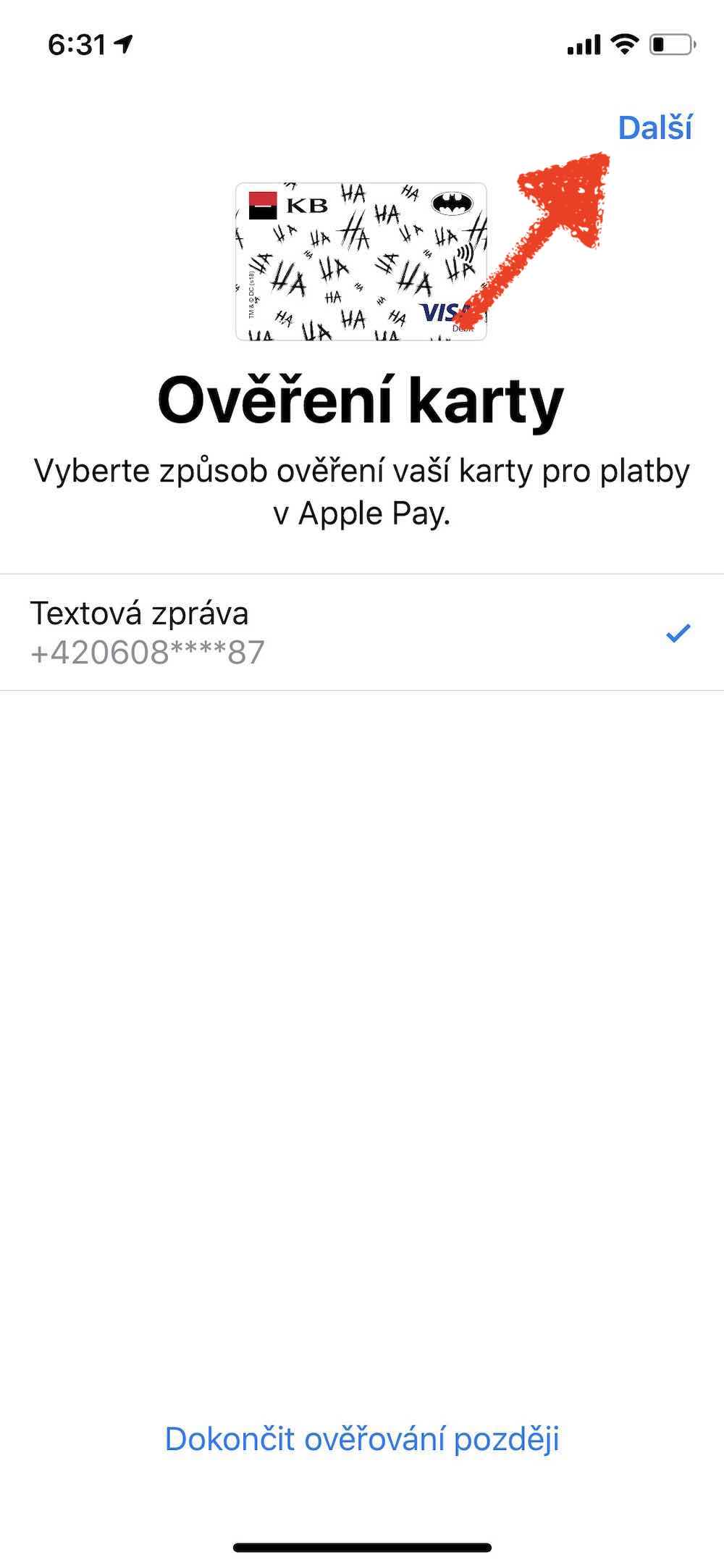

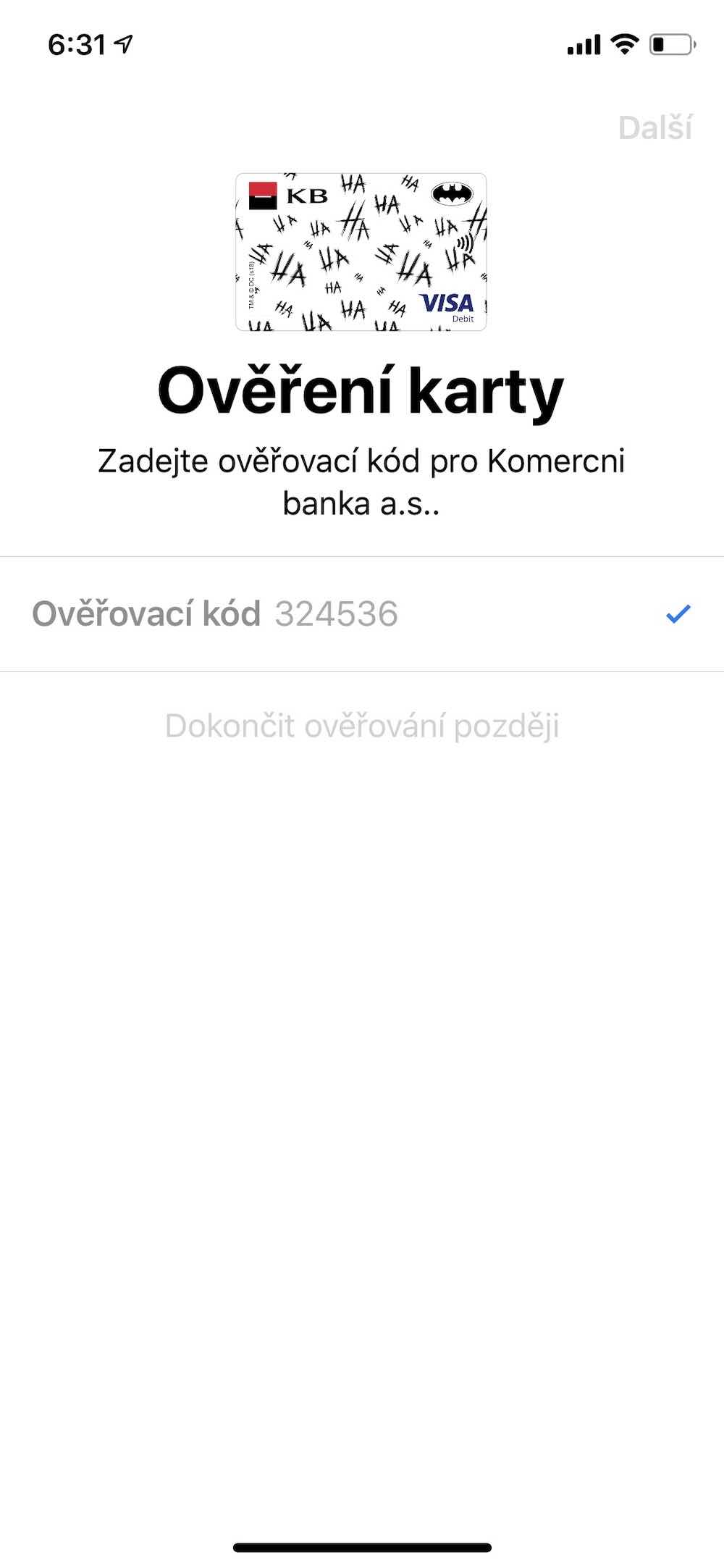

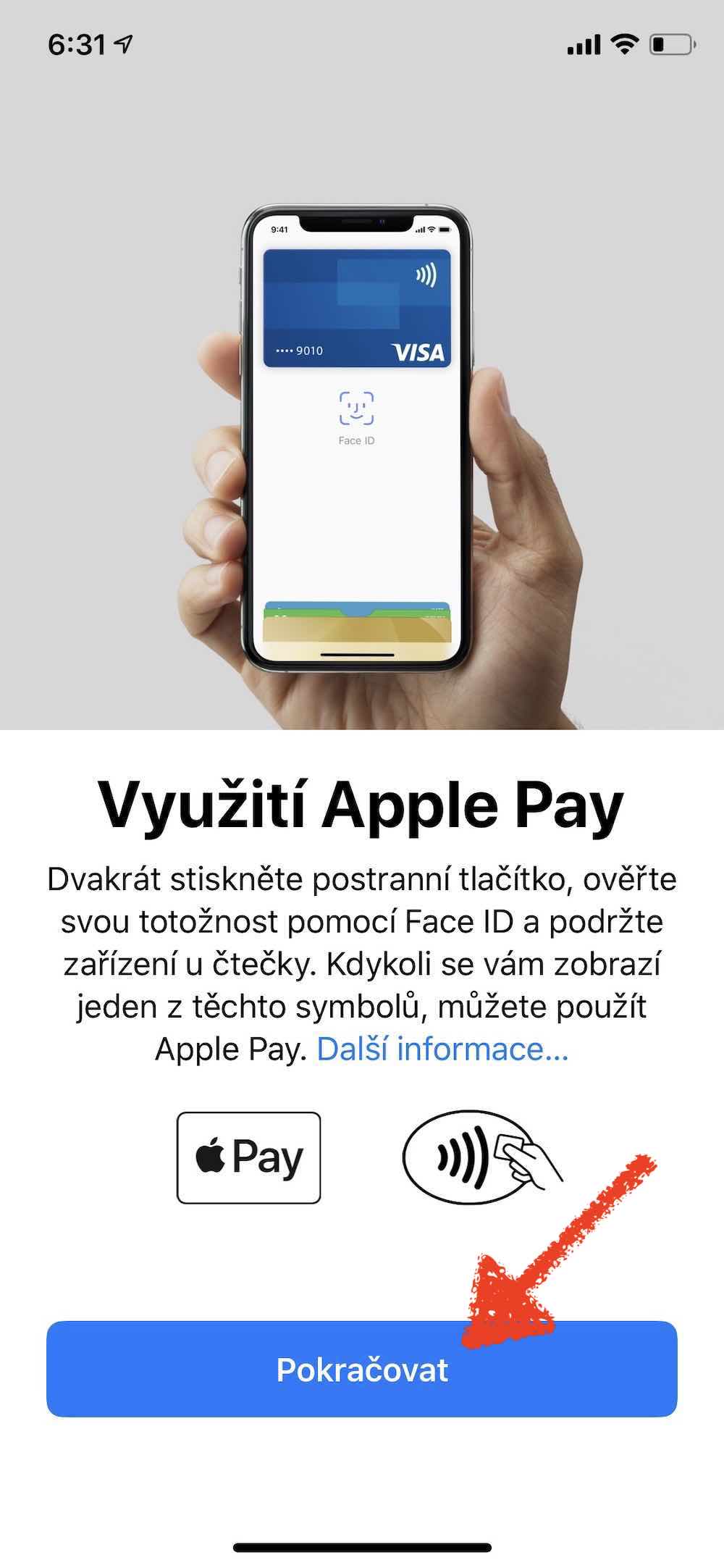

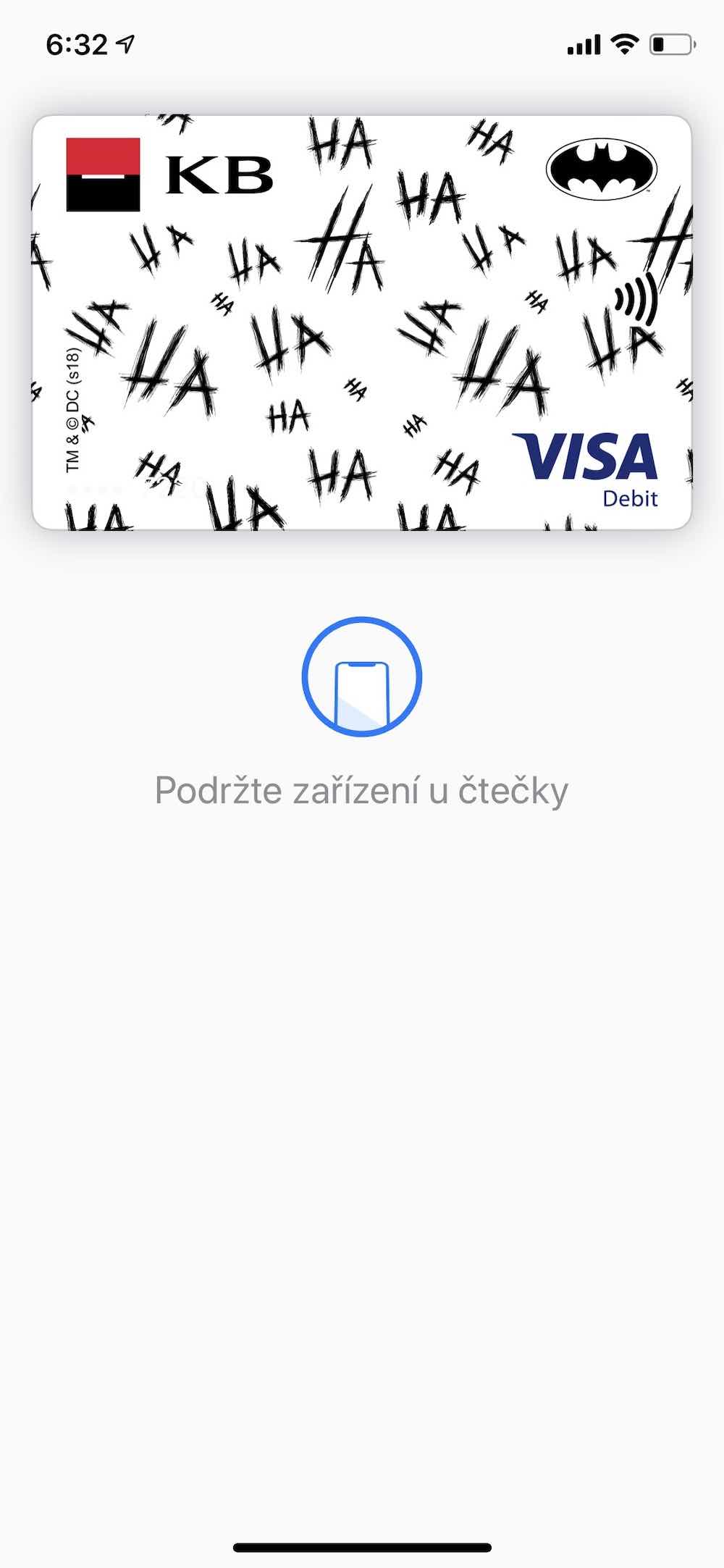

How to set up Apple Pay on iPhone:

According to sources newspaper E15.cz Apple Pay fees are split into two parts. First of all, banks must pay Apple 30 crowns per year for each newly added card to the service. In the second row, Tim Cook's company takes a bite of roughly 0,2% of each transaction.

In the week since the launch of the service, over 150 users have activated Apple Pay (the number of added cards is even higher), who have made around 350 transactions in a total volume of over 161 million crowns. Banking and non-banking institutions thus poured more than 5 million crowns into Apple's coffers in a single week.

It could be interest you

Despite this, the introduction of Apple Pay is paying off for banks. A key role is played by the great marketing potential of the service, thanks to which they were able to acquire clients of those banks that did not offer the service at the start. The introduction of Apple Pay does not represent an additional source of income for financial houses, but it does open up opportunities for them to create new products and services. In the long run, the introduction of a payment method from Apple may thus pay off.

"Because of the fees, this business model doesn't quite work for us. The probability that some clients would leave us if the service was not introduced was relatively high," an unnamed financier from a domestic bank told E15.cz.

“We're kind of bleeding on Apple Pay. While Google Pay costs us next to nothing, Apple charges hard money.” a source close to the management of one of the other banks told the newspaper.

Banks don't pay for it either, but every merchant with whom a card payment is made pays tithes to the operators of the payment terminals, which of course are owned by the banks. This fee is normally around 1,5-2% of each payment and you have to be really lucky and connected to get just under 1%! Banks will only see a slight reduction in profit when paying with Apple Pay.

Their profit will be reduced, so it is valid. Of your own. The profit is theirs, right? :D

Those banks that don't want Apple Pay will still lose, and over time even more, than the fee. The loss of a customer who pays at once with another card of another bank is -100% of the profit of the fee paid by the merchant. But they have calculated it well, so the percentage of switching to another card is still small, but there will be a time...

Banks are milking merchants, and only a tenth of the milk is milked, Apple will pay,,,,,, That's how it always is when the bank is milking, there is silence, when someone starts to milk the bank only slightly and indirectly, the bank is on fire,,,