The Apple Card credit card, developed by Apple in collaboration with Goldman Sachs, attracted mostly positive reactions at the time of its launch. The card is intended for owners of Apple devices and can be used to pay both separately and via Apple Pay. Apple Card offers an interesting and tempting cashback system, and until recently it seemed to have virtually no flaws.

It could be interest you

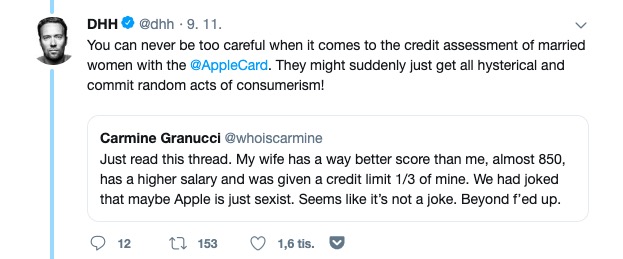

However, businessman David Heinemeier Hansson drew attention to one peculiarity at the weekend, connected with requests for the issuance of a card, or the granting of a credit limit. Hansson's wife got a much lower credit limit than Hansson himself. This was not the only case of this kind - the same thing happened to Apple co-founder Steve Wozniak, or his wife. Other users with similar experiences began to respond to Hansson's tweet. Hansson called the algorithm used to set credit limits "sexist and discriminatory". Goldman Sachs responded to this allegation on its Twitter account.

In a statement, Goldman Sachs said credit limit decisions are made on an individual basis. Each application is assessed independently, according to the company, and factors such as credit score, income level or debt level play a role in determining the amount of the credit limit. "Based on these factors, it is possible that two family members may receive significantly different loan amounts. But in no case have we made and will not make these decisions based on factors such as gender.” it says in the said statement. The Apple Card is issued individually, the system does not offer support for family sharing of cards or joint accounts.

Apple has not yet officially commented on the matter. However, the Apple Card is promoted as a card "created by Apple, not a bank", therefore a large part of the responsibility also rests on the shoulders of the Cupertino giant. But it is possible that Apple's official statement about this problem will come later this week.

Source: 9to5Mac

If there is no error, we will invent it :-) Let us be interesting... :-)