The American stock market has been experiencing an unusual slide downwards in recent weeks, and this fall is mainly dominated by losses in the share values of large technology giants, which are referred to as Faang – Facebook, Apple, Amazon, Netflix and Google. The entire NASDAQ stock exchange has fallen by more than 15% over the past twelve months.

It could be interest you

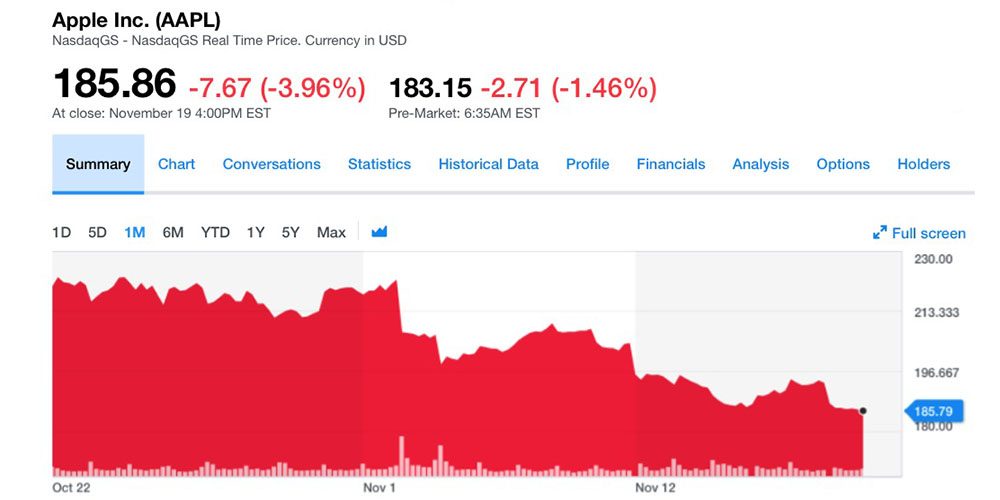

As for Apple itself, stock values are on a swing here. Shareholders could rejoice at the recent high AAPL reached on Oct. 3, when the value of one share crossed the $233 mark. Now, a month and a half after that high, the value is more than 20% lower, specifically at $177,4. This represents a loss of roughly 24% of the value of one share, as well as an overall decline in the value of the company, which is now around $842 billion (trillion cloud so it went down very quickly).

However, Apple is not the only company whose results on the stock exchange are reveling in red numbers. Alphabet (Google's parent company) also lost roughly 20% of its stock value. Amazon has even lost over 26% over the past few months. Notably worse is Netflix, with a drop of just over 36%, and even more miserable is Facebook, whose shares have lost almost 40% of their value in less than four months.

At first glance, the disastrous numbers (at least for Apple) are not such a big problem. In the year-on-year comparison, it is on point stock value the Californian company is still some 15% better than last year. The question remains how the value of the company's stock will react to the upcoming Christmas season, which is not expected to be as rich as Apple experienced last year. If you've been itching to buy AAPL stock for the past few months, now is probably the best time.

It could be interest you