Yesterday, Apple announced financial results for the fourth quarter of fiscal year 2021 covering the months of July, August and September. Despite continued supply chain delays, the company still reported record revenue of $83,4 billion, up 29% year over year. The profit is 20,5 billion dollars.

Total numbers

Analysts had high expectations for the numbers. They predicted sales of $84,85 billion, which was more or less confirmed - the almost one and a half billion may seem rather insignificant in this regard. After all, in the same quarter last year, Apple reported revenue of "only" $64,7 billion, with a profit of $12,67 billion. Now the profit is even higher by 7,83 billion. But it's the first time since April 2016 that Apple failed to beat revenue estimates and the first time since May 2017 that Apple's revenue fell short of estimates.

Figures for the sale of equipment and services

For a long time now, Apple has not disclosed the sales of any of its products, instead reporting a breakdown of revenue by product category. iPhones shot up by almost half, while Macs may be lagging behind expectations, even though their sales are at their highest ever. In a pandemic situation, people were more likely to buy iPads to communicate with each other.

- iPhone: $38,87 billion (47% YoY growth)

- Mac: $9,18 billion (up 1,6% year-over-year)

- iPad: $8,25 billion (21,4% YoY growth)

- Wearables, home and accessories: $8,79 billion (up 11,5% year-over-year)

- Services: $18,28 billion (up 25,6% year-on-year)

Comments

Within the published Press Releases Apple CEO Tim Cook said of the results:

“This year, we launched our most powerful products ever, from Macs with the M1 to the iPhone 13 line, which sets a new standard for performance and enables our customers to create and connect with each other in new ways. We put our values into everything we do – we are getting closer to our goal of being carbon neutral by 2030 in our supply chain and throughout the entire life cycle of our products, and we are constantly advancing the mission of building a fairer future.”

When it comes to the "most powerful products of all time", it's pretty much a given that every year there will be a device more powerful than the one that's already a year old. This is therefore rather misguided information that proves practically nothing. Sure, Macs are switching to its new chip architecture, but year-over-year growth of 1,6% isn't all that convincing. It is then a question whether every year until the one leaked at the end of the decade, Apple will constantly repeat how it wants to be carbon neutral. Sure, it's nice, but is there any point in touting it over and over again?

Luca Maestri, Apple's CFO, said:

“Our record results for September capped off a remarkable fiscal year of strong double-digit growth, during which we set new revenue records across all of our geographies and product categories, despite continued uncertainty in the macro environment. The combination of our record sales performance, unmatched customer loyalty and the strength of our ecosystem drove the numbers to a new all-time high.”

It could be interest you

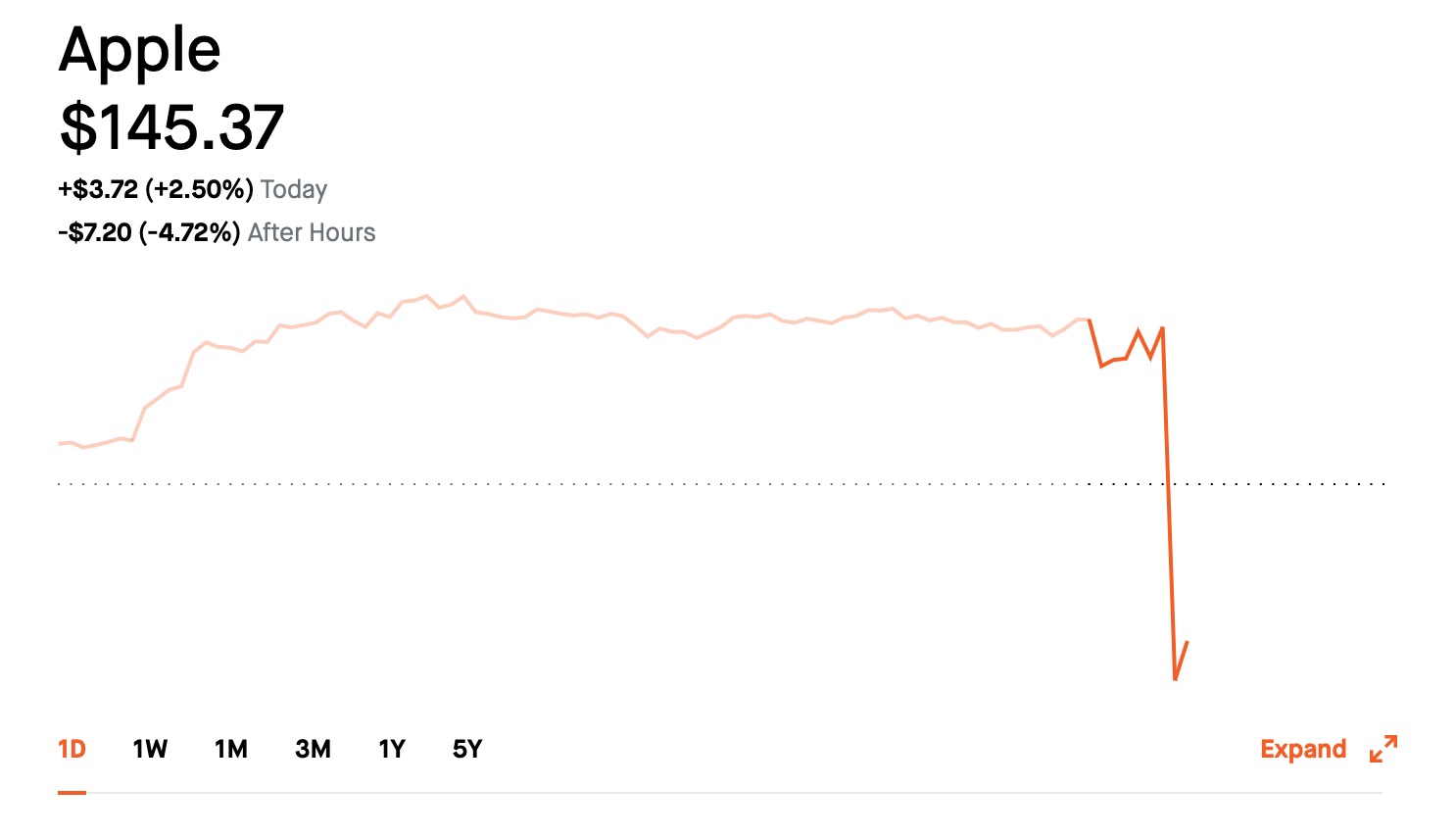

Falling stocks

In other words: Everything looks great. The money is pouring in, we are selling like on a conveyor belt and the pandemic is actually not hindering us in any way in terms of profit. We are getting greener for that. These three sentences practically sum up the entire results announcement. But nothing has to be as green as it seems. Apple's shares subsequently fell by 4%, which slowed down their gradual growth since the fall that occurred on September 7 and stabilized only at the beginning of October. The current value of the stock is $152,57, which is a good result in the final as it is a monthly growth of 6,82%.

Losses

Subsequently, in an interview for CNBC Apple CEO Tim Cook said supply chain problems cost Apple around $6 billion in the quarter ended. He said that while Apple expected various delays, the supply cuts ended up being greater than he had anticipated. Specifically, he mentioned that he lost these funds due to the lack of chips and the interruption of production in Southeast Asia, which was related to the COVID-19 pandemic. But now the company is waiting for its strongest period, i.e. the first fiscal year 2022, and of course this should not slow down the breaking of financial records.

It could be interest you

Subscription

There is a lot of speculation about the number of subscribers the company's services have. Although Cook did not give specific numbers, he added that Apple now has 745 million paying subscribers, which is a year-on-year increase of 160 million. However, this number includes not only its own services, but also subscriptions made through the App Store. After the results are published, there is usually a call with the shareholders. You can have that one to obey even by yourself, it should be available for at least the next 14 days.

Adam Kos

Adam Kos