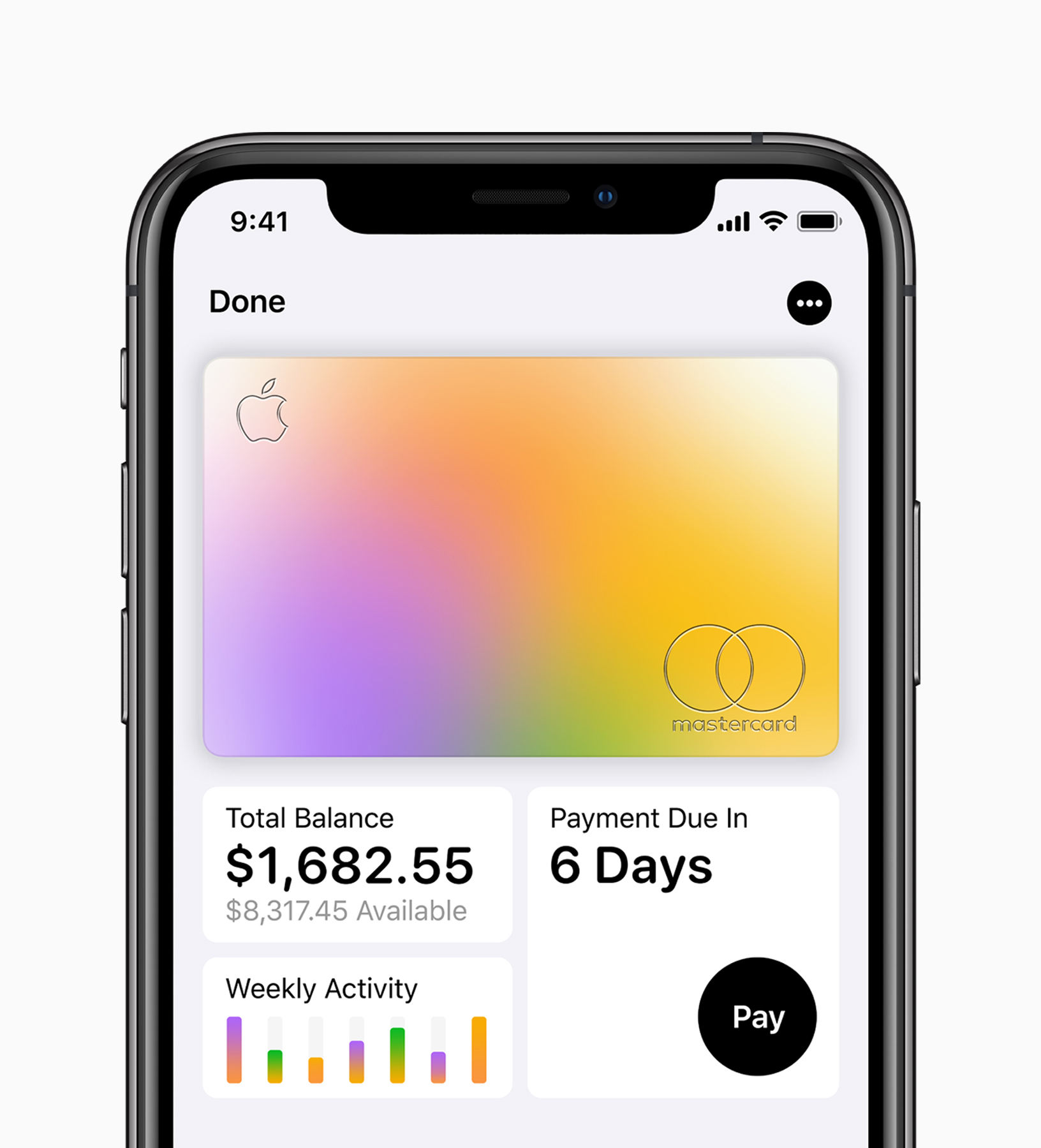

The wait is over. At least for some. As of today, the official process of launching the Apple Card program is underway, when the first users received invitations to sign up for the new service.

Invitations are sent to US users who have expressed interest in pre-registration on Apple's official website. The first wave of invitations was sent out this afternoon and more can be expected to follow.

In conjunction with the launch of Apple Card, the company has released three new videos on its YouTube channel describing how to apply for an Apple Card through the Wallet app and how the card is activated after it arrives at the owner's home. The full launch of the service should take place by the end of August.

It could be interest you

On the contrary, one of the advantages is a high degree of privacy. Apple has no transaction data, Goldman Sachs logically does, but they are contractually bound not to share any user data for marketing purposes.