Commercial message: The last month in the equity markets has brought some measure of calm despite the initial sell-off and equity indices have started to rise slightly, but we may not be out of the worst. In addition, Great Britain has a new Prime Minister (again). Rishi sunak, which must bring stability to this country after years.

Source: CBSnews

FED and news

We also heard from the Fed that interest rates are likely to be at higher levels for an extended period of time, which may have a negative impact on stocks. The saga around Elon Musk and Twitter was finally resolved by the fact that Musk finally bought Twitter and, of course, the problems in China do not end either.

So investing is really complicated these days, and that's why we decided to organize a big one Online Investment Conference, where several lecturers will present their views on the current situation, and in addition, individual lecturers will also discuss this topic together.

The past month has been relatively quiet for the stocks we have in our portfolio. The main topic was the Results Season. Within it, some companies mentioned similar things, for example, that they are bothered by the strong dollar or that they will start cutting costs. It didn't take long for the company Meta really laid off 11 people. There was also information that he had Apple problems with the production of iPhones in China due to local COVID restrictions and logistics. Company Intel did another IPO of its Mobileye division.

Walt Disney - a buying opportunity?

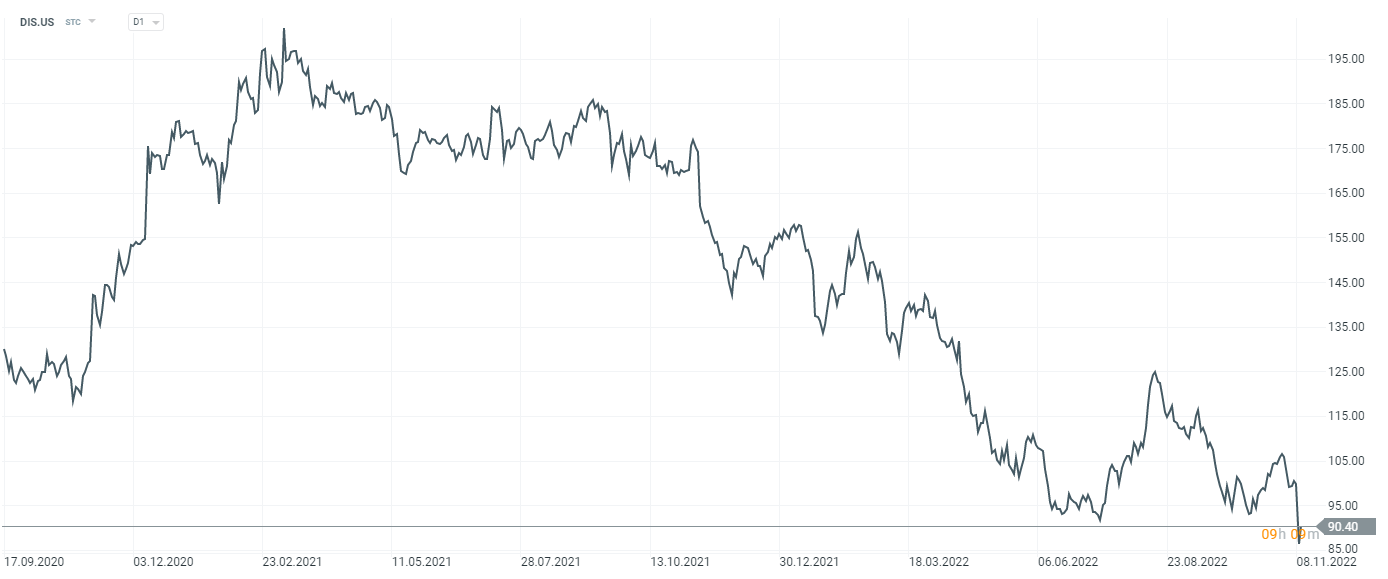

Of course, there are still opportunities in the market and we have bought shares in the company as part of our portfolio Walt Disney. This position is one of the oldest that we have in the portfolio and we last bought shares in April 2022. Since then nothing has fundamentally changed within the company except that the shares have fallen slightly. They fell from the top by about 50%, are around covid lows, despite the company being in a much better position than it was a few years ago, in my opinion.

Source: xStation, XTB

Walt Disney consists of two main divisions. The first are amusement parks, hotels, ships, sales of advertising items, etc. Understandably, this segment had big problems after the arrival of covid, because due to restrictions, theme parks, hotels or ships were either completely closed or operated in a significantly limited mode. However, these facilities are already largely open, the company has raised prices for almost all of its services and significantly increased sales and profits in this segment year-on-year. So it looks like everything is fine in this area.

The second part of the company is made up media segment. Here we can include film studios, intellectual property (rights to many fairy tales, Marvel films, Star Wars, National Geographic), TV stations and the like. This segment also faced problems after the arrival of covid as many shoots were interrupted and many films were released late. However, Covid also brought positives for this company, one of which was growth streaming as such. Disney launched its new streaming platform Disney+ a few years ago, and it was covid that caused the service to have a great start.

Every quarter since the launch, new subscribers have been added, but the company is still investing in the service and the first profits are expected only in 2024, until then it will be a loss-making project. It should help the company to turn a profit reducing marketing and content spending, an influx of new subscribers and a significant increase in subscription prices to come at the end of this year.

Disney's revenue is already significantly higher than it was before the arrival of Covid. However, profits are still insufficient for the above reasons, which is probably why the stock is at a significant discount. However, I do not see this as a problem, but rather the opposite, which is why I see the current situation as a good buying opportunity.

For more detailed information on the above topics, see this month's video: Stock portfolio of Tomáš Vranka.

Discussion of the article

Discussion is not open for this article.